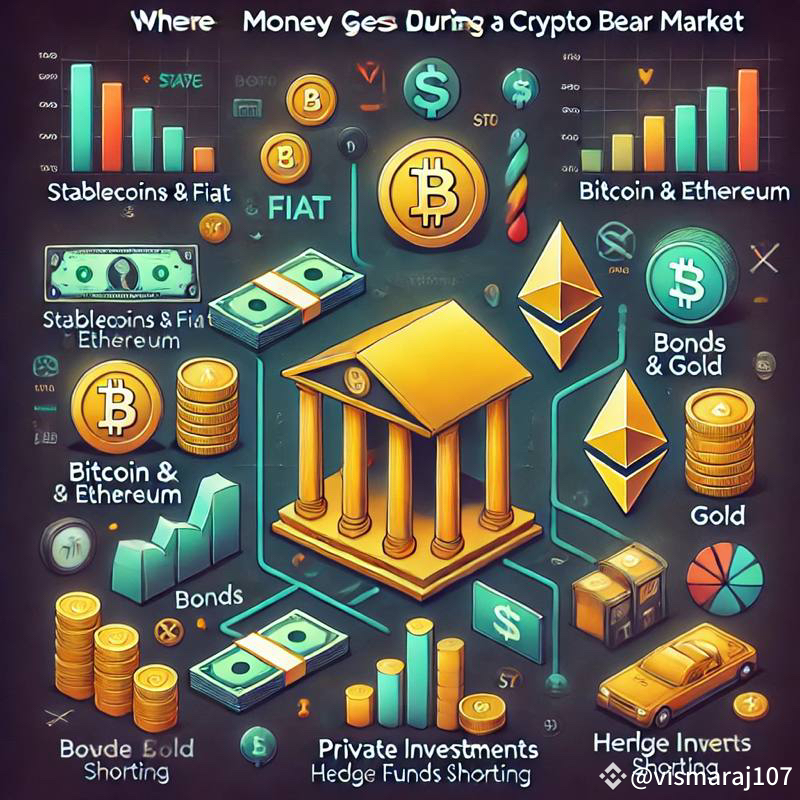

The crypto market is known for its extreme ups and downs. During bull runs, money floods into altcoins, DeFi projects, and NFTs. But when a bear market hits, where does all that money actually go? Does it just disappear? The answer is no—it simply moves elsewhere as investors look for safer options.

Let’s break down where crypto money flows during a market downturn and how investors reposition their funds.

1. Stablecoins & Fiat – The Safe Haven

When prices start falling, many investors convert their crypto into stablecoins like USDT, USDC, or DAI to protect their capital while staying in the market. This allows them to buy back assets at lower prices when confidence returns.

Others exit crypto completely by cashing out into fiat currencies like USD or EUR, keeping funds in traditional banks or money market funds for stability.

➡️ Recent Data: In the latest downturn, Bitcoin saw its biggest weekly drop in over two years, with outflows hitting $876 million as investors moved funds into safer assets.

2. Bitcoin & Ethereum – The “Safe” Crypto Assets

Not all investors leave crypto entirely. Instead, many rotate their holdings into Bitcoin and Ethereum, which are seen as more stable than small-cap altcoins. During bear markets, Bitcoin dominance increases as it holds value better than most other tokens.

3. Institutional Investors Move to Bonds & Gold

Large hedge funds and institutional investors diversify into traditional safe-haven assets during crypto downturns. These include:

• Government bonds (U.S. Treasuries)

• Gold & precious metals

• Money market funds

➡️ Example: Crypto investment funds have seen over $600 billion in outflows during recent bear markets, with major players shifting to traditional finance.

4. Smart Money Moves into Private Investments

Some experienced investors take advantage of bear markets by shifting funds into:

✅ Early-stage crypto projects (venture capital)

✅ Real estate & private equity

✅ Startup investments

This strategy allows them to accumulate assets at lower valuations before the next bull cycle.

5. Hedge Funds Profit by Shorting the Market

While retail traders panic sell, institutional hedge funds and market makers find ways to profit from the crash by:

• Short selling cryptocurrencies

• Using derivatives & options to hedge losses

• Providing liquidity to earn fees in volatile markets

Final Thoughts – What Should You Do?

During a bear market, money doesn’t disappear—it just moves into different assets. Whether you choose to hold, rotate into stablecoins, or invest in new opportunities, your strategy should match your risk tolerance.

🚀 What’s your plan for this bear market? Let us know in the comments!