"Never add to a losing position." (Averaging down often exacerbates losses.)

Daily news

1. Trump announces 'strategic crypto reserve.'

2. CZ: YZi Labs opens project application entry for long-term builders.

3. Mining machines Antminer S19, Shama M33S+, etc., reach breakeven coin prices.

4. A giant whale 'sets 10 big goals' BTC long position has an unrealized profit of $8.35 million.

5. The total market capitalization of cryptocurrencies has surpassed $3 trillion, with a 24-hour increase of 8.4%.

6. The ETH stolen by the Bybit hacker may be completely laundered in the next day or two.

7. Data: A giant whale cleared out its PEPE and BEAM for 6.25 million DAI, losing $14.14 million.

Market observation

Analyze and simplify. For more specific indicator learning and exchange, feel free to DM X: @djoer2049

(PS: For short-term operations, set good position protection for profit; position management is the holy grail of trading‼️)

Chart structure | Chip distribution | Main force tracking | Volume price theory | Market psychology | Macroeconomic analysis | Microeconomic analysis

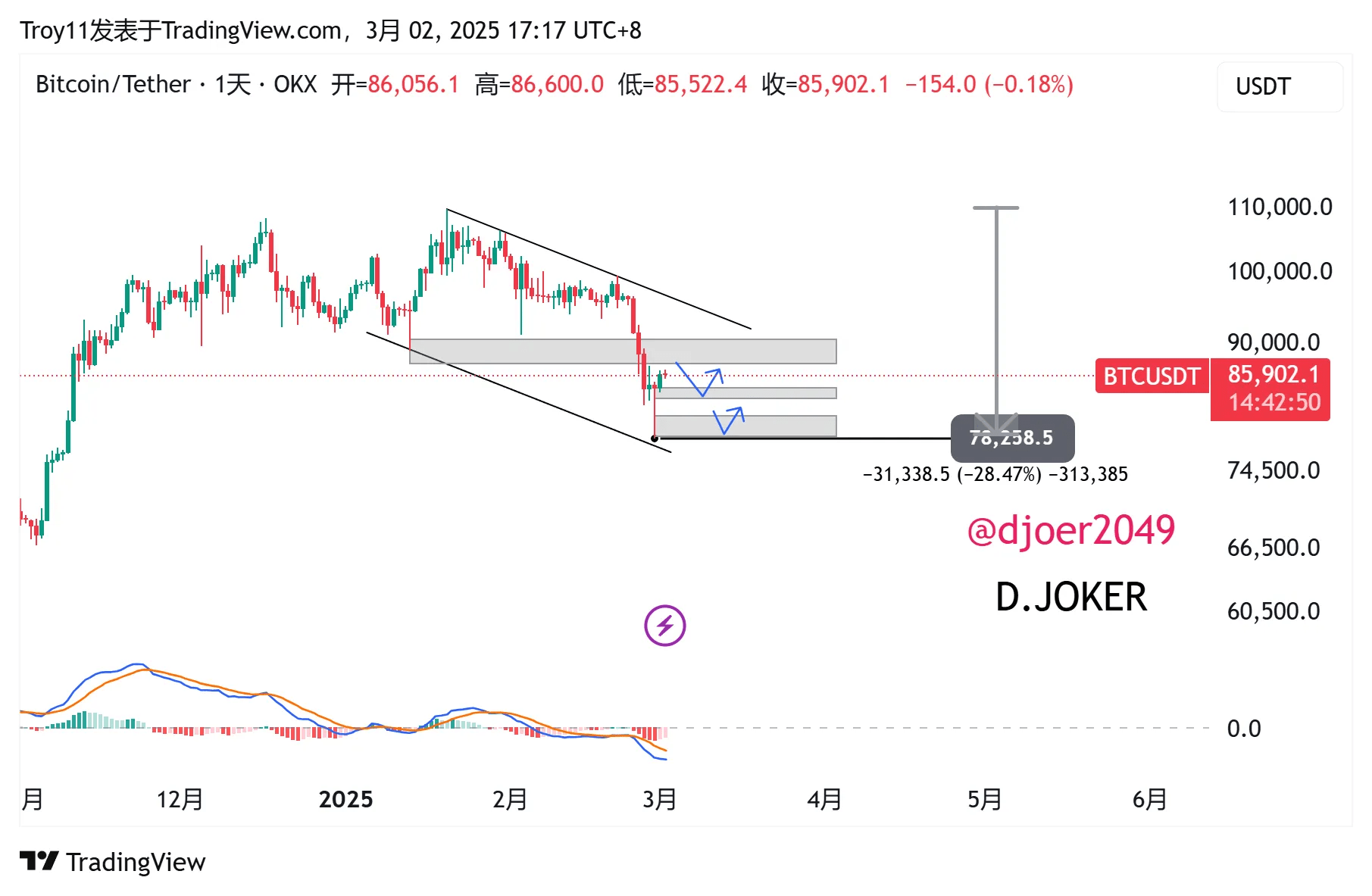

$BTC

Daily level:

Short-term 86000-87000 breakthrough stop loss ❌

(In the face of trends, the importance of stop loss is evident.)

Yesterday there was no second dip, thanks to Trump's announcement of 'crypto reserves.'

A direct wave of good news pushed it to over $90,000.

After breaking through the key support level, the market basically reversed.

Classic bull market technical short squeeze washout.

(Basic pullback logic reference tweet: https://x.com/djoer2049/status/1895387548786335825)

Currently oscillating and consolidating at a high position, large levels are returning to an upward cycle.

The upper resistance range is 96500-99500; a breakthrough will likely revisit ATH for testing and start a new round of bullish market.

Lower support range 88500-90500.

Operation reference:

Observe the upper selling pressure range.

A pullback to 88500-90500 can try to go long.

Stop loss.

$ETH

3-day level:

Testing the low support range from last August again, 2000-2100

The last two days mainly observed the V reversal situation in the overall market without action.

The Bitcoin price is almost back to the previous high.

Meanwhile, the price of ETH is still at a 40% cut from its high.

The market is too weak, and FUD voices keep appearing.

A hopeless case.

Mainly focus on two upper ranges: 2700-2800 and 3200-3400.

These are also two important market cost ranges during this recent downturn.

The lower support range is still around 2000-2100.

Operation reference:

Waiting for the price to further pull back to 2700-2800.

Or temporarily rebuild a bottom between 2100-2500 and then look for entry opportunities.

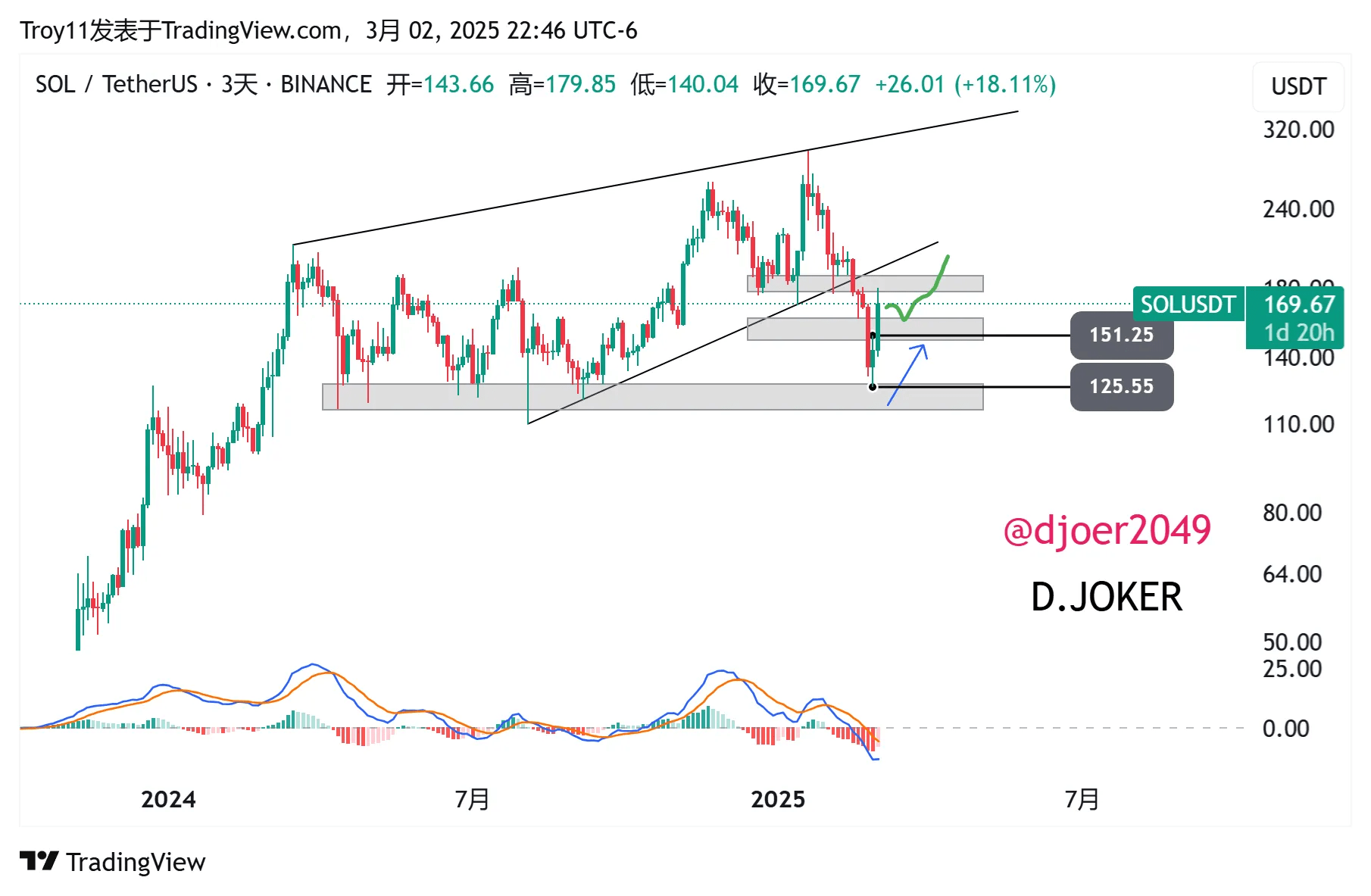

$SOL

3-day level:

Affected by news, followed the Bitcoin for a strong reversal.

Currently testing the upper resistance level of 175-190 again.

Lower support range 150-160.

Last night's stretch was quite large, currently likely to oscillate between 160-180 before choosing a new direction.

Operation reference:

Short-term:

At the upper resistance range of 175-190, a short can be attempted; if broken, stop loss.

A pullback to the lower support range of 150-160 can try to go long; if it breaks, stop loss.

Medium term:

Positions bought around the bottom of 130 can continue to hold.

As long as the price stays above 150, there are no major issues.

Opportunity hotspot

#Short term

$BERA $S (Review)

$BERA surged sharply yesterday to near the previous high, continuously increasing positions raised the cost, and then was stopped out ❌

Currently, the daily structure still shows significant opportunities.

Continue to pay attention and wait for opportunities.

$S saw a strong reversal in the market yesterday.

After a false breakout down, the best position was protected; continue to observe.

$FET

Daily level:

#AI's leading targets have been washing out for almost a year.

After several days of doji stars, a short-term opportunity for a right-side ambush.

There are still a few bottoms in the short term that can be focused on:

$AVAAI $SWARM $GRIFFAIN

$ZEROBRO (Bottom trading volume can still be good.)

#Medium to long term

$KOMA (Review)

Medium to long-term strategy stop loss ❌

$ZEN

Daily level:

Currently, the bottom is performing well; $ZEC has already made a move.

Can take a position.

Operation reference:

Can build a position around 12.5-13.5.

Stop loss: 11.9

TP1: 18-20

TP2: 28-30

Review

$BTC technical short squeeze washout ✔️

$BTC short-term 86000-87000 breakthrough stop loss ❌

$ETH tests last August's low support range of 2000-2100 ✔️

$BERA short-term unrealized profit increased, stop loss ❌

$KOMA medium to long-term strategy stop loss ❌

PS: The above analysis interpretation is merely personal opinion and does not constitute investment advice.