In a new X post, Max Keiser, renowned Bitcoin evangelist, has placedStrategy (MSTR) and its chairman, Michael Saylor, in the same category as Elon Musk and Tesla. The essence of Keiser's message is that the premium on MSTR stock reflects more than just theBitcoin holdings of the company, but investor confidence in Saylor.

Through the unconventional analogy, Keiser argues that investors are buying the "jockey, not the horse," in a similar way to how Tesla once traded at extreme multiples based on belief in Elon Musk’s ability to deliver.

card

The numbers lend weight to that framing.Strategy is by far the largest public holder of Bitcoin, with 636,505 BTC — worth around $70.6 billion at today’s price — on its books. The company’s average purchase cost is $73,765, meaning it is sitting on a 50.5% return on investment, but its stock market value goes much further.

$MSTR mNAV premium reflects @saylor’s 𝙐𝙉𝙄𝙌𝙐𝙀 ability an a financial engineering genius. Same as $TSLA trading at 200x earnings reflecting @elonmusk’s genius. You’re buying the jockey, not the horse. With all other Bitcoin Treasury Companies you’re buying the horse.

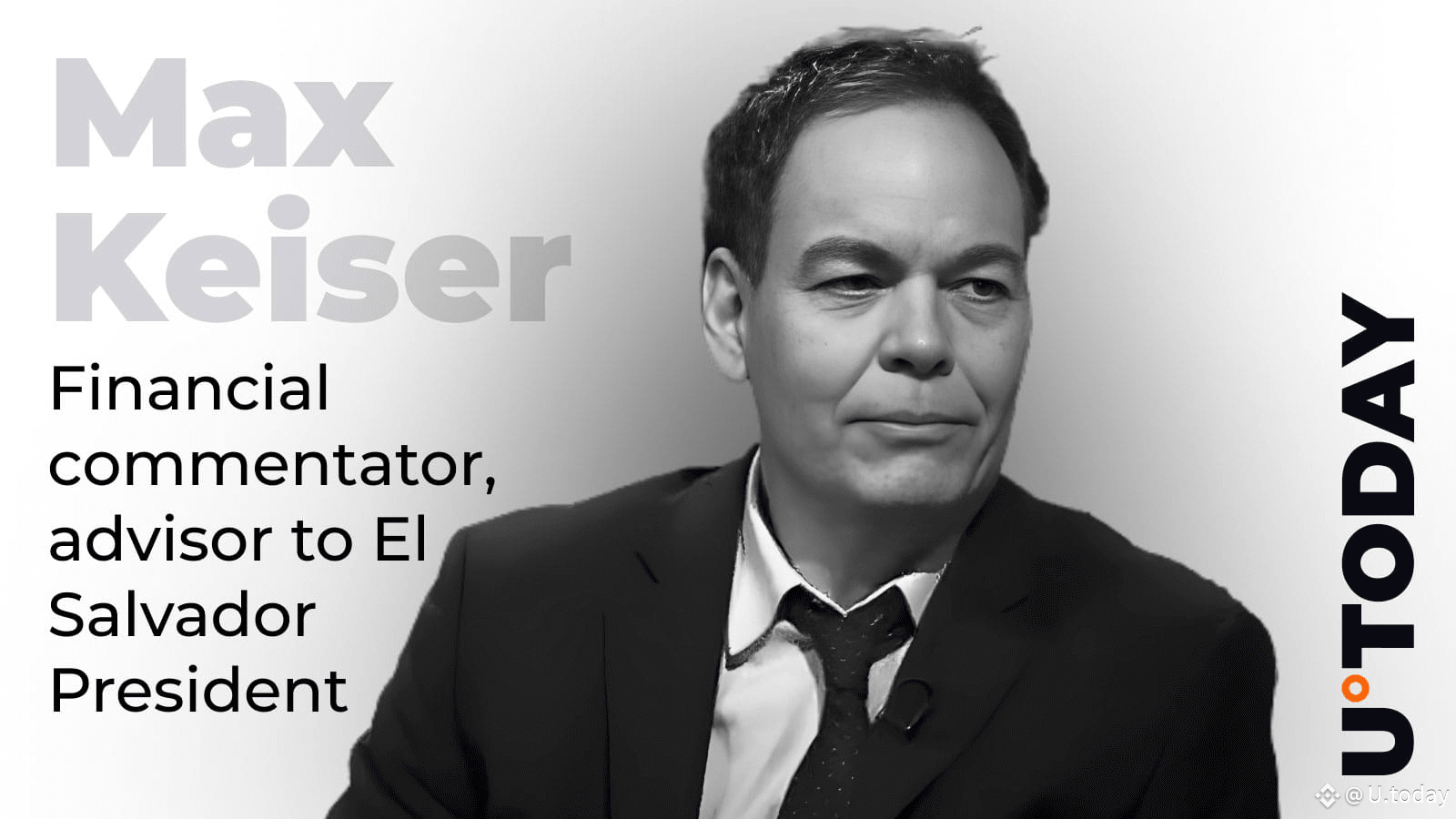

— Max Bitcoin (@maxkeiser) September 4, 2025

MSTR’s diluted market capitalization has reached $105 billion. When compared with its net Bitcoin value, it trades at an mNAV ratio of 1.48; enterprise value stretches this to 1.53.

Why Strategy?

This is what sets Strategy apart from the rest of the list.BitcoinTreasuriesNet numbers highlight the gap: MARA Holdings, second on the list with 50,639 BTC, trades at a diluted mNAV of only 1.04.

card

Keiser's comparison shows why Saylor's company is unique in the world of Bitcoin treasuries. Investors are now looking for more than just exposure to BTC — they want to know that someone with the expertise to manage the biggest corporate Bitcoin collection in history will continue to generate more value.