In the early hours of July 15, a long-dormant Bitcoin BTC $116 748 24h volatility: 4.6% Market cap: $2.32 T Vol. 24h: $70.83 B whale believed to have acquired coins in the early days of the network reemerged and transferred 9,000 BTC worth over $1 billion to Galaxy Digital, a prominent digital asset management firm.

The move triggered a brief price dip, with Bitcoin falling from above $123,000 to around $116,900, according to CoinMarketCap data.

Chaos Amid a 9,000 BTC Transfer

The transaction was first flagged by blockchain analytics platform Spot On Chain and is believed to be part of an over-the-counter (OTC) deal.

🚨The whale just moved 8.5K $BTC (~$1B) to Galaxy Digital 15 minutes ago. It is likely an OTC deal.

This is his first cash-out in 14.3 years.

Wallet Link: https://t.co/7ZhXS8WXu8 https://t.co/UyEH6eMJxq pic.twitter.com/Mf3jfeQdUj

— Spot On Chain (@spotonchain) July 15, 2025

Despite the significant outflow, the wallet still held around 11,000 BTC, worth roughly $1.3 billion, as investors speculated that this may not be a full exit and more could follow in the coming days.

Earlier in the day, the wallet moved 20,000 BTC, worth a staggering $2.4 billion, to a new address. These coins were bought at $2 per BTC, an unbelievable return on investment.

The wallet first resurfaced on July 4 after 14 years of inactivity, initiating the transfer of 80,000 BTC across several transactions. Coinbase’s head of product, Conor Grogan, has floated the theory that some of these reactivated funds could be linked to compromised private keys.

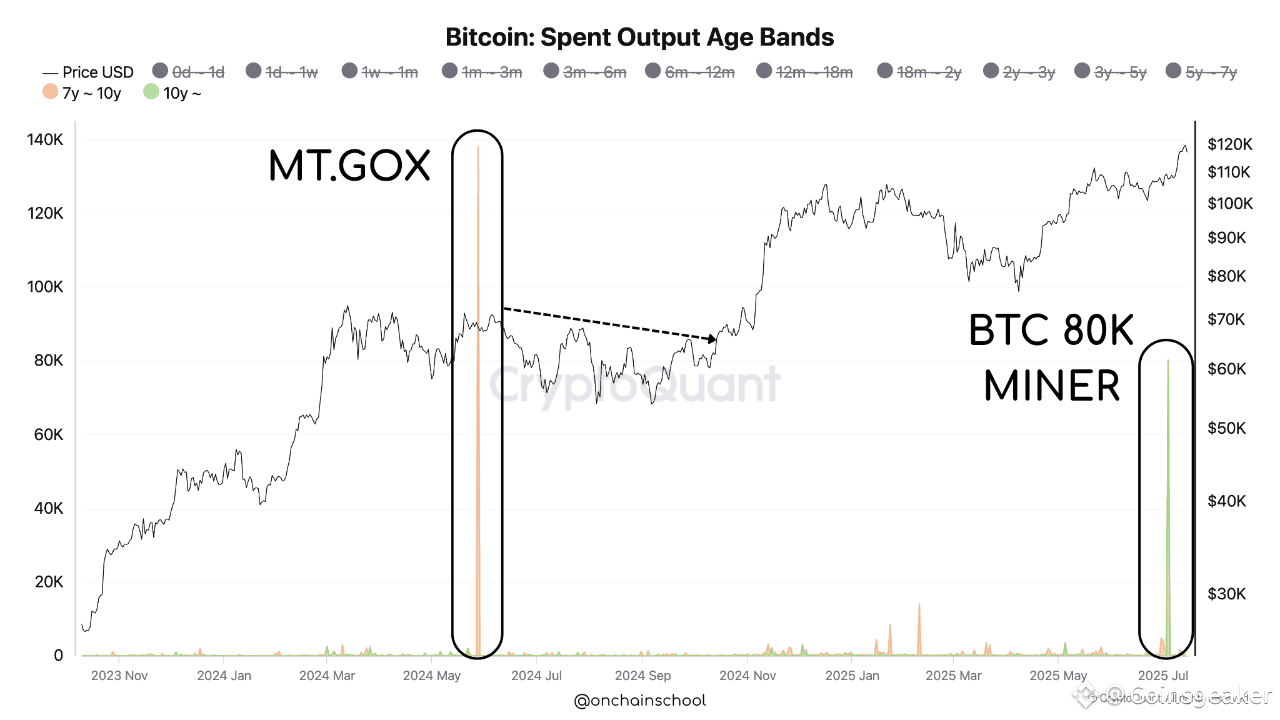

Interestingly, in an update, OnChainSchool revealed that of the 80,000 BTC that this wallet had held for the past years, it sold 20,000 BTC worth $2.33 billion. It is clear that the transfers are not strategic repositioning but more of a “strategic liquidation.”

Bitcoin Whale Wallet Sells 20K BTC | Source: CryptoQuant

So far, only a portion of the total 80,000 BTC has been sold. As Bitcoin hovers below the $117K price level, investors question if more pain is to follow.

Should Bulls Be Worried?

According to Bitfinex analysts, new Bitcoin buyers, particularly in the so-called “Shrimp,” “Crab,” and “Fish” (those holding less than 100 BTC), are accumulating Bitcoin at a rapid pace, far outpacing the post-halving supply rate.

“Demand from this segment alone is more than enough to absorb all new supply,” Bitfinex stated in a recent market report, adding:

“This cohort-level accumulation trend supports the broader bullish narrative that new buyers entering the Bitcoin market are price-agnostic buyers and are relentlessly accumulating with limited intervals.”

The small buyers are adding approximately 19,300 BTC per month, while monthly issuance stands at just 13,400 BTC following the April 2024 halving.

next

The post Satoshi-Era Whale Offloads 9,000 BTC, Is Bitcoin Rally Over? appeared first on Coinspeaker.