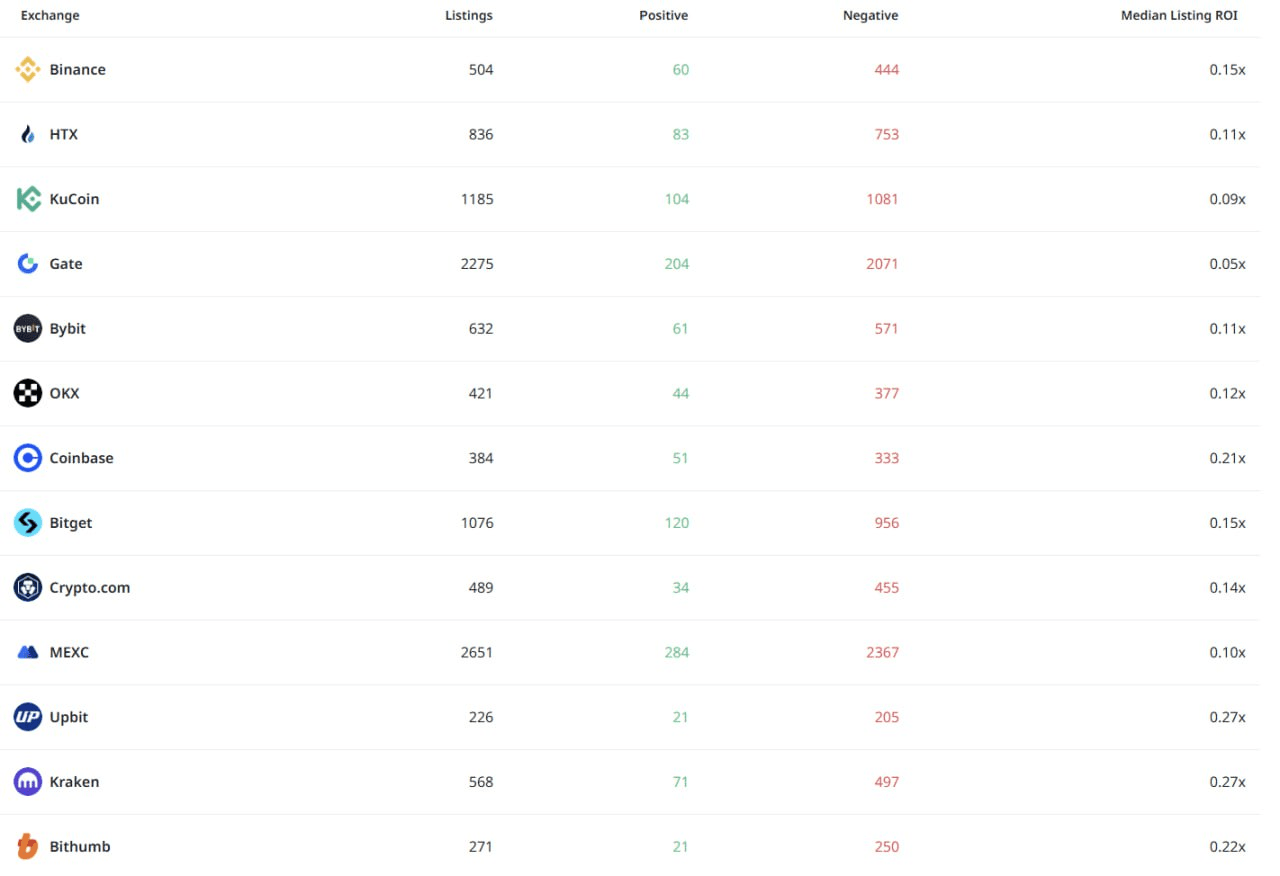

Recently, there has been a lot of discussion about the significant declines of tokens listed on @binance. Let's gain a broader perspective by looking at data from all exchanges:

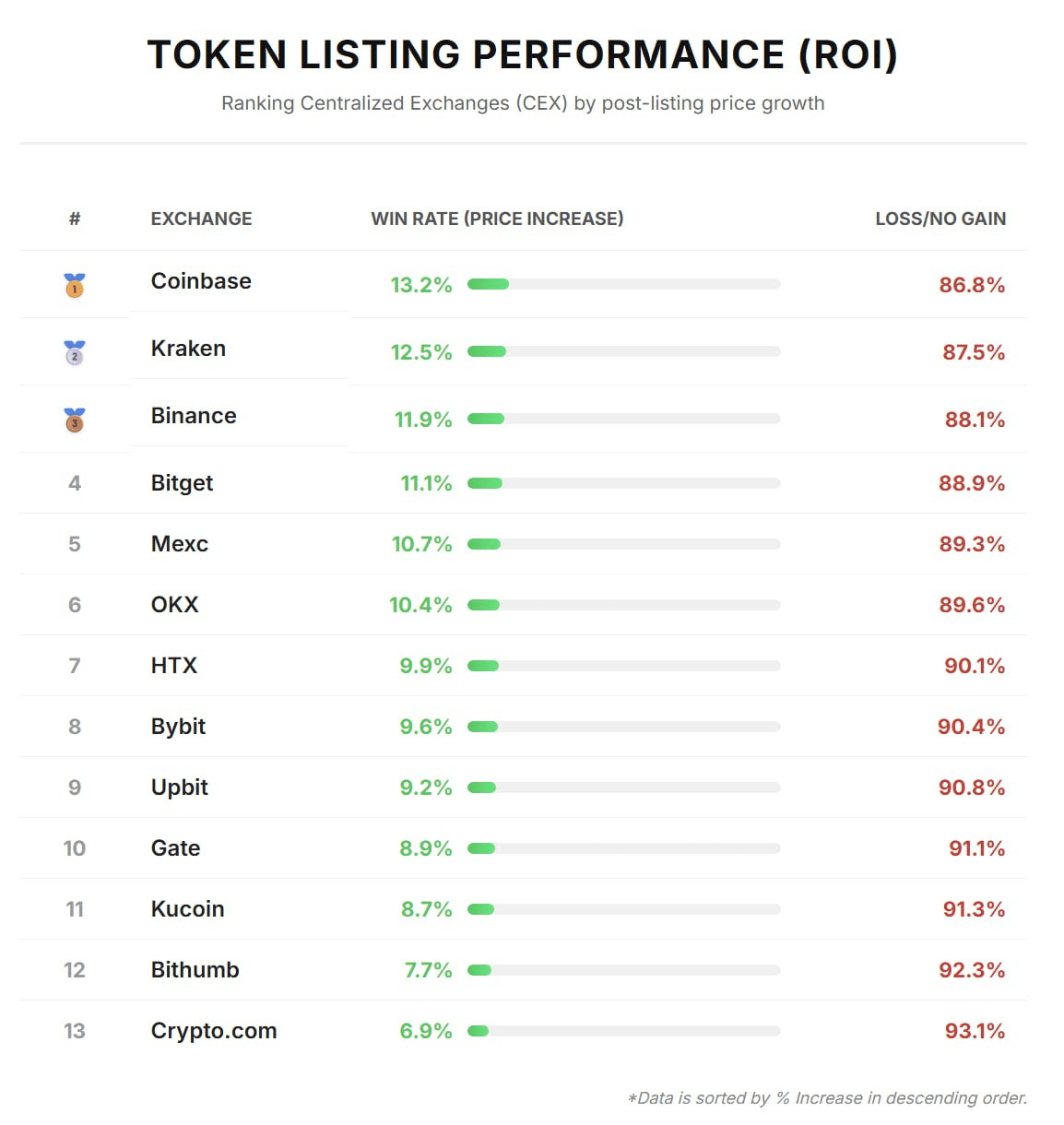

❌ General Situation: The market is bleak. The loss rate for buying new coins across the market is as high as 87-93%.

✅ Performance Ranking (Increase Rate):

🥇 Coinbase: 13.2%

🥈 Kraken: 12.5%

🥉 Binance: 11.9% ...

🔻 Worst Performers: Cryptocom (6.9%), Bithumb (7.7%), Kucoin (8.7%).

Three key lessons from this period:

1️⃣ Listing coins is no longer a 'money printing machine': Unlike in 2021, the ROI is mostly negative on any exchange now. Market Makers (MM) and VCs have changed the game.

2️⃣ The FUD about Binance is emotional: Actual data shows that in terms of project quality, Binance still ranks Tier 1 (top three).

3️⃣ New Strategy: At this time, one should not blindly chase high prices (FOMO) with opening candles, but should instead:

▪️ Carefully examine FDV (avoid overvaluation).

▪️ Monitor the order book and real trading volume.

▪️ Patiently wait for the price to stabilize.