The brief optimism brought about by the end of the U.S. government shutdown quickly evaporated, with market focus shifting to a large amount of delayed economic data, uncertainty regarding the Federal Reserve's interest rate cuts, and concerns over overvalued tech stocks, leading to widespread selling of overvalued tech stocks and risk assets.

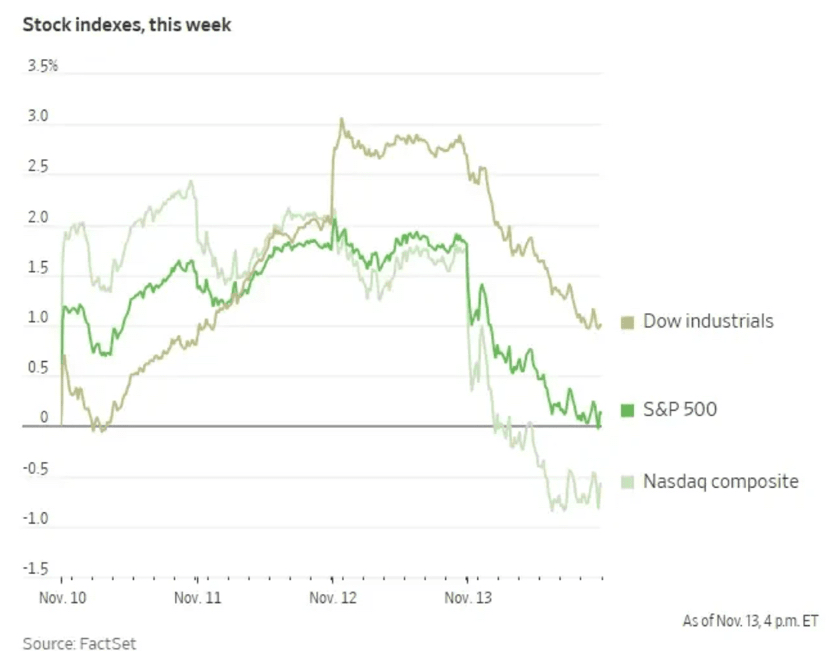

On Thursday, October 13, the three major U.S. stock indexes collectively fell during the day's trading, with the tech-heavy Nasdaq Composite Index closing down 2.29%.

The deterioration of risk sentiment also spread to the cryptocurrency market, with Bitcoin falling below the $100,000 mark and Ethereum briefly dropping over 10%.

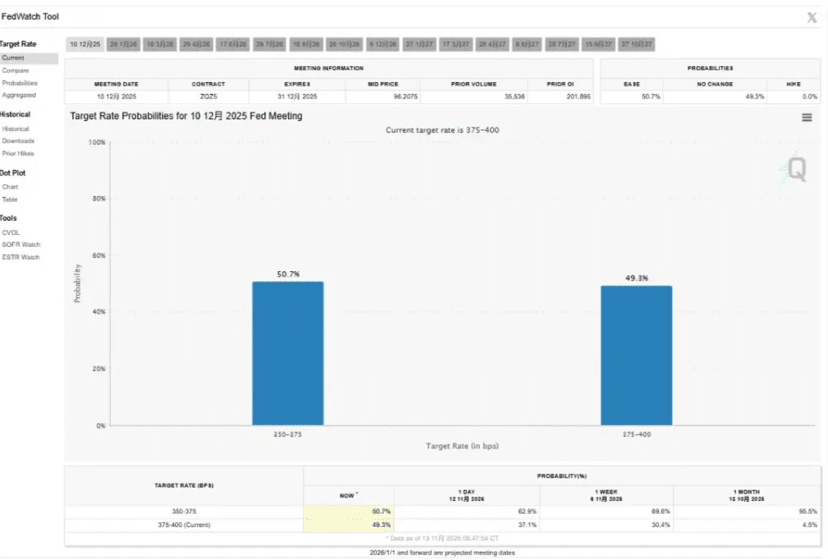

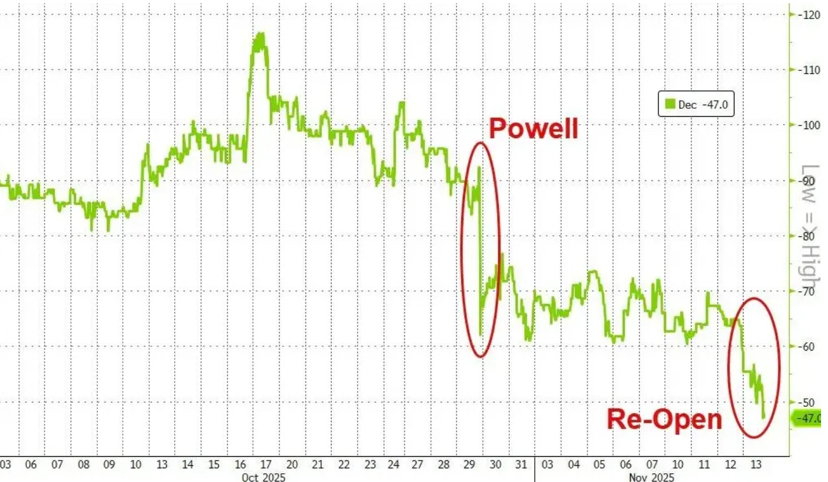

The direct catalyst for this sell-off was the cautious remarks made by multiple Fed officials, suggesting that rate cuts should be approached with caution. According to CME data, the interest rate futures market shows that the probability of a rate cut has dropped sharply from over 70% a week ago to around 50%.

This shift has intensified the market rotation that has been occurring this month. Reports indicate that investors are taking profits from the hottest stocks of the year and shifting into lower-valued, more defensive sectors, a 'risk-off mode' that was vividly demonstrated in Thursday's trading.

U.S. stocks recorded the largest single-day drop in a month.

The U.S. government shutdown has ended, the release of economic data has been postponed, and investors are reassessing the prospects for a Fed rate cut in December, with U.S. stocks recording the largest single-day drop in a month on Thursday.

U.S. stock benchmark indices:

The S&P 500 index closed down 113.43 points, a decrease of 1.66%, at 6737.49 points.

The Dow Jones Industrial Average closed down 797.60 points, a decrease of 1.65%, at 47457.22 points, moving away from its historical closing high.

The Nasdaq closed down 536.102 points, a decrease of 2.29%, at 22870.355 points. The Nasdaq 100 index closed down 536.102 points, a decrease of 2.05%, at 24993.463 points.

The Russell 2000 Index closed down 2.77%, at 2382.984 points.

The VIX index closed up 14.33%, at 20.02, having risen to 21.31 at 04:23 Beijing time, before retracting some of its gains.

The seven tech giants:

The Magnificent 7 index of U.S. tech stocks fell 2.26%, closing at 203.76 points.

Tesla closed down 6.64%, Nvidia down 3.58%, Google A down 2.84%, Amazon down 2.71%, Microsoft down 1.54%, and Meta closed up 0.14%.

Chip stocks:

The Philadelphia Semiconductor Index closed down 3.72%, at 6818.736 points.

AMD fell 4.22%, TSMC down 2.90%.

Oracle closed down 4.15%, Broadcom down 4.29%, Qualcomm down 1.23%.

Multiple Fed officials made hawkish statements, and the 'moderates' began to waver.

Multiple Fed officials made hawkish statements, expressing concerns about inflation and taking a cautious stance on future rate cuts.

Among them, Cleveland Fed President Hammack (2026 FOMC voter) stated that inflation is expected to remain above the 2% target for the next 2-3 years. With a weak labor market, the Fed's employment goal (the employment aspect of its dual mandate) is facing challenges. Tariffs are expected to push inflation higher and continue into early next year. The Fed needs to maintain a certain level of policy restrictiveness to cool inflation.

Minneapolis Fed President Neel Kashkari stated on Thursday that due to the resilience of the economy, he opposed last month's rate cut and is taking a wait-and-see approach to the December decision. St. Louis Fed President Alberto Musalem also reiterated that he believes monetary policy needs to 'hold up' against inflation.

Due to concerns about inflation and some officials believing the labor market remains robust, an increasing number of policymakers are showing hesitation about further easing monetary policy, including some previously strong supporters.

The latest development is that Boston Fed President Susan Collins and San Francisco Fed President Mary Daly—two officials who voted for rate cuts this year—issued the clearest cautious signal to date. Collins specifically stated that the 'threshold for further easing policy in the near term is relatively high,' while Daly said it is too early to draw conclusions about the December decision and she maintains an 'open mindset.'

The upcoming massive data release (which may bring more rather than less uncertainty), combined with the recent intense hawkish statements from officials, has pushed market bets on a December rate cut back below 50%.

Two possibilities for the December meeting

Looking ahead to the December meeting, the outcome seems to tilt towards 'two options': either maintain the interest rate or cut it again by 25 basis points. According to Wall Street Journal reporter Nick Timiraos, another possibility is that the Fed may cut rates in December while setting a higher threshold for future easing policies through guidance.

Regardless of the final decision, Powell may face more dissenting votes than during the October meeting (where there were two dissenters). Evercore ISI Vice Chairman Krishna Guha wrote in a report on Thursday that Collins' clear opposition to a December rate cut 'intensified our concerns about Powell's ability to manage internal divisions within the FOMC.'

Guha analyzes that if the Fed decides to cut rates, Kansas City Fed President Jeffrey Schmid may receive endorsements from Collins and Musalem; if the Fed decides to hold steady, then board member Stephen Miran, who previously advocated for larger rate cuts, may vote against alongside fellow board members Christopher Waller and Michelle Bowman, who also support easing policy.

This further highlights the profound rift within the committee, making the December decision full of uncertainties.