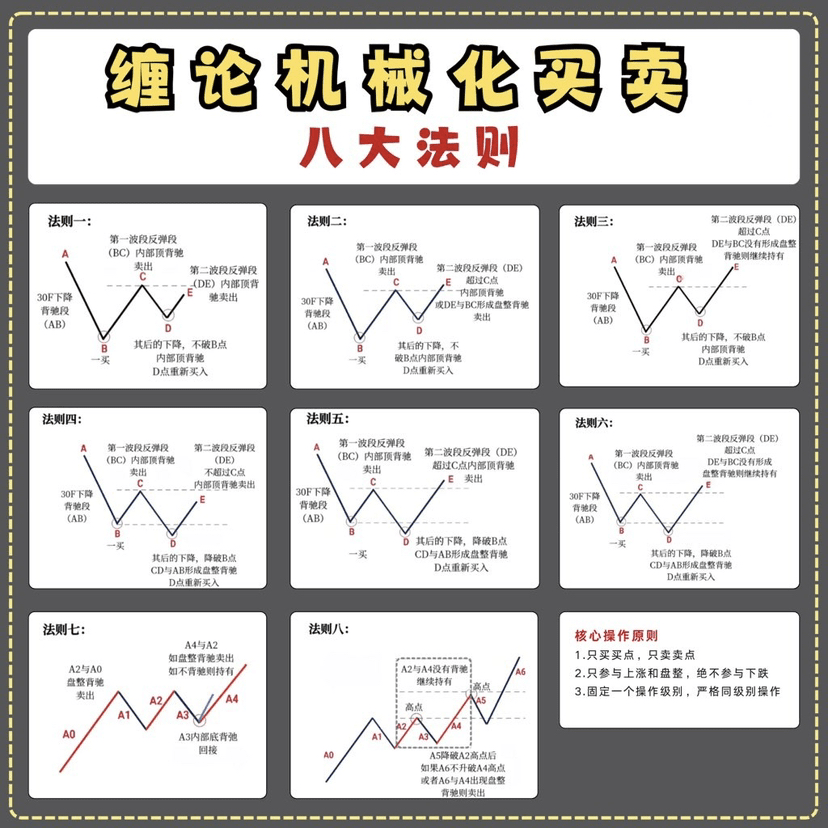

The Ceiling of Practical Chande: 8 Major Mechanized Trading Rules, from "Relying on Feelings" to "Stable Profits" Transformation

In the unpredictable trading market, the reason why Chande can become a "Guiding Light" for countless traders lies in its ability to break down complex market trends into quantifiable and replicable operational logic. The domestic Chande practical circle has undergone practical accumulation from 2018 to 2025, extracting 8 highly stable and high-winning-rate mechanized trading models, completely breaking the dilemma of "being able to see but not able to act," ensuring that each trade has a clear basis, allowing beginners to quickly improve their trading win rate.

One, daily one buy lurking: the "safest king" of big-level bottom fishing.

The bottom divergence on the daily level is a strong signal for a medium-term rebound. The operational logic is simple and direct: when the daily MACD shows a "new price low but indicator not a new low" divergence, and subsequent pullbacks do not break the lower edge of the central line (ZD), directly enter with full positions. Once a three-buy signal appears on the 30-minute level, increase positions to 100%, with the stop loss firmly set below ZD, using big-level certainty to avoid small-level volatility risks.

Two, 30-minute level operations: the "golden model" highly recommended by Master Chan.

This is the most suitable trading level for ordinary investors, balancing win rate and efficiency. There are only three core rules: only make 30-minute one buys, initial position 50%-80%; decisively add positions when a 30-minute three buy occurs; once a 30-minute three sell is triggered, immediately liquidate all positions. Operate at the same level to avoid multi-level chaotic decision-making, which is the optimal path for small funds to quickly snowball.

Three, 5-minute cheetah three buys: the "profit tool" for short-term quick battles.

Designed specifically for short-term traders, focusing on "leveraging + precision." When the 30-minute level is clearly in an upward trend, closely monitor the 5-minute central structure — once the 5-minute three buys break through the upper edge of the central line (ZG), immediately enter quickly. Set the stop loss directly at ZG, with strong explosiveness and short cycles, akin to a cheetah hunting, precisely and swiftly capturing short-term high risk-reward scenarios.

Four, consolidation divergence bottom: the "low buy high sell code" of a choppy market.

No need to panic in a choppy market, consolidation divergence helps. The core is to capture the conversion of long and short within the central line: when the yellow and white lines within the center show a new low but the price does not create a new low, a bottom divergence forms, buy decisively; conversely, if the yellow and white lines show a new high but the price does not create a new high, a top divergence appears, sell immediately. There is no need to wait for a breakthrough; wave operations can be completed within the central line, perfectly adapting to the choppy market.

Five, small to big one buy: the "early warning" of trend initiation.

Small-level signals hide big-level opportunities. When a buy signal first appears on the 1-minute chart, closely track the 5-minute trend — if the 5-minute subsequently forms a buy signal, it indicates the big-level trend has officially started. At this time, entering is equivalent to seizing the golden point in the early stage of the trend. Set the stop loss based on the low point of the 1-minute buy signal, with small risk and large potential, accurately capturing the turning point of the trend's initiation.

Six, central extension nine segments to add positions: the "position wisdom" of a choppy market.

Central oscillation exceeds 9 segments, the trend breakthrough is imminent. Operational strategy: each time there is a new low in the pullback but does not break ZD, add positions once, with a maximum of 3 additions. Gradually build positions to dilute costs, avoiding the risk of being fully loaded too early, while holding sufficient positions when the trend breaks, using time to exchange for space, patiently waiting for the big market after the oscillation.

Seven, three buys without breaking ZG dead long: the "iron rule of holding positions" in a main upward wave.

Three buys are the core signal for trend acceleration. Once established, the holding logic is extremely firm: as long as the price does not break the corresponding ZG of the three buys, continue to hold or even add positions; once it effectively breaks ZG, immediately liquidate, never linger. Lock in risks with ZG, firmly grasp the main upward wave, and not be washed out by short-term fluctuations.

Eight, the divergence strength comparison method: the "quantitative scale" for buying and selling.

Say goodbye to subjective judgment, use data to determine buying and selling. Quantify the strength of trends through MACD: compare the area or height of the bars of the same direction in the adjacent two segments; if the strength of the current segment is less than 70% of the previous segment, it is determined that a divergence exists, and buying and selling operations must be strictly executed. This is the core support of all mechanical operations, greatly reducing the probability of misjudgment.

Core mindset: the underlying logic of mechanical operations.

The essence of these 8 rules is "central positioning + divergence confirmation + disciplined execution." In practice, just remember three points: multi-level confirmation signals, do not rely solely on one time frame; strictly execute stop losses, do not harbor lucky thoughts; match patterns with market types, use consolidation divergence in a choppy market, and use three buys without breaking ZG in a trending market.

Chan theory is not difficult; the difficulty lies in "knowing and acting as one." Master these 8 major mechanical buying and selling rules, free from emotional interference, so that each trade has a set of principles to follow, to achieve continuous and stable profits in the unpredictable market.