Looking back, I made mistakes during this wave of the bear market that brought down myself

Firstly, being overly blindly confident and not respecting the market. When I avoided the 1011 Black Swan event, I was actually in position, and I was long, but I was trading BTC and ETH with a leverage of <2 times, and even after I bottomed out in my spot account, I added some positions in this account's contract as well, pulling my average price extremely low.

I thought... it was just my assumption... I thought this time would be the same because every support level and resistance level has failed... and it is in a large cycle (as we all know, the larger the cycle level, the more effective the support and resistance levels are)

My trades: Bollinger: Over-sold! The 'bat' and 'head and shoulders' patterns have emerged! MA200 has broken down; the major cycle support and resistance swap position has arrived! I have detected smart money with a 100% win rate going long, consistent with my directional judgment!

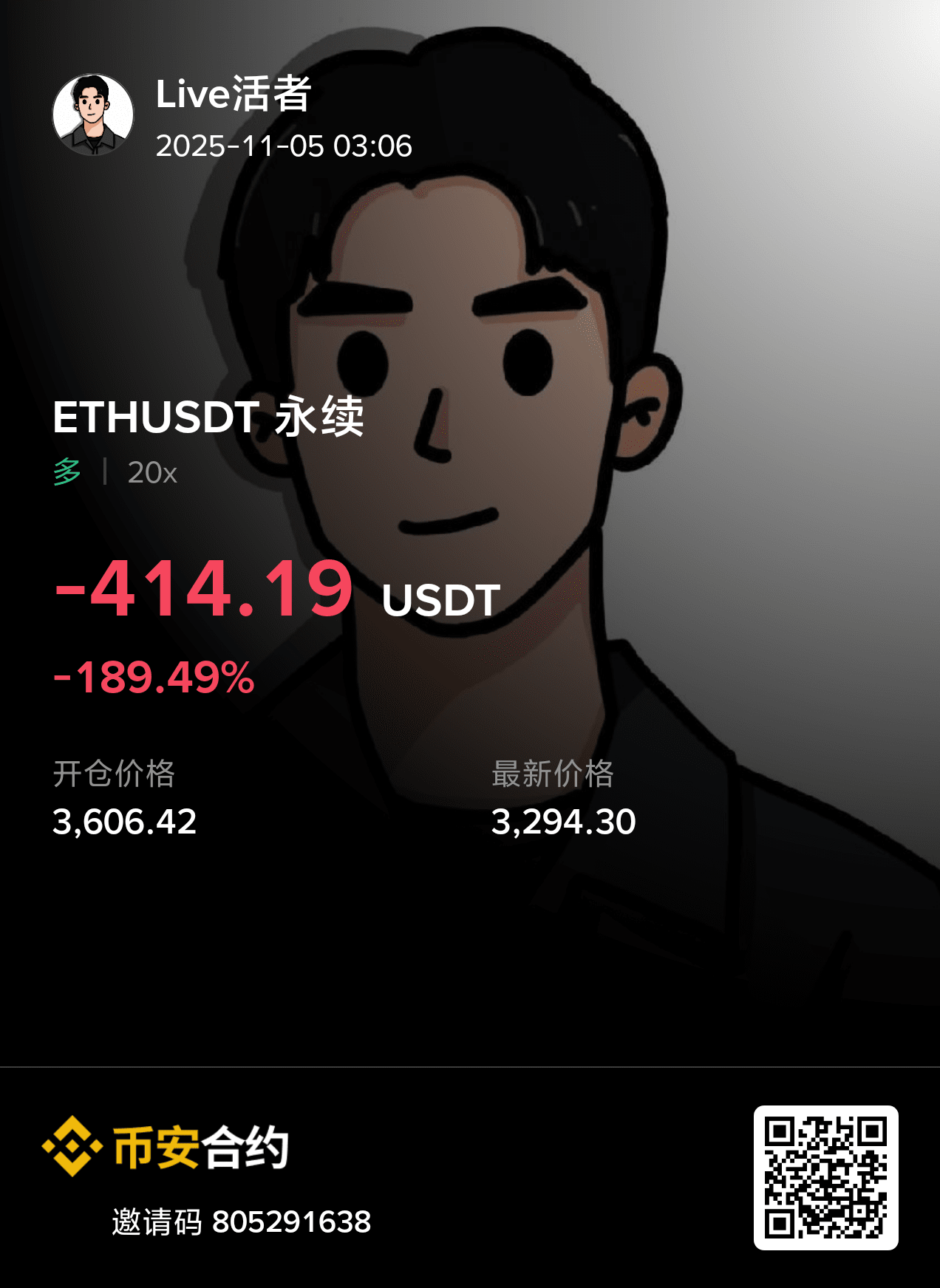

Multiple indicators are urging me to increase my position, I strictly adhere to my rules, my average purchase price after adding to my position will always be controlled within 200 of the current price. Even if I only need one oversold rebound, I will exit at breakeven; not losing is considered a profit. Currently, my cost price is fixed at 3600, and I will not add to my position until Bitcoin has not broken 98000 and Ethereum has not broken 2800. Now I can only wait for the trend market, waiting for a direction after consolidation.

(PS: The scholarship only has the 'award' left, the 'money' has been handed over to Crypto.)

Secondly, opening positions, adding to positions, and making chaotic hedges during work hours. My personal habit is to open positions and add to positions, always using multiple indicators (MACD, Bollinger, resistance levels, patterns) for comprehensive comparison and research. Only when multiple indicators meet the buy/sell criteria will I trade. During work, my left hand is focused on work, while my right hand is checking X, causing my mindset to be influenced by some KOLs, disrupting my plan to add to positions. The bullets could not strike precisely; the plan was to add to my 6th level position at 3360, but I added around 3500, resulting in poor control of the risk-reward ratio.

Moreover, I mostly engage in left-side trading, going against the trend, and I have not strictly set stop losses. In fact, this trade was obviously a bear market downtrend; even I posted a month ago saying the bear market has arrived, and I should focus on shorting. However, just for a 100-200 point rebound, I initiated my first bear-to-bull holding position. Once again, I did not set a stop loss for my order; what I think in my mind and what I say out loud differ greatly from my actual actions.

Just to add: impatience leads to frequently watching the market and making frequent trades. I am still too anxious and didn't wait for the right levels. In my left-side trading system, setting limit orders with stop losses should be my strong suit trading strategy. It really reflects the saying that '90% of losing traders are trading, only 10% are waiting, while 90% of profitable traders are waiting, and only 10% trading can earn a fortune.' However, every time I check the 5-minute and 15-minute K-line and see a rapid decline, I think about urgently hedging for a rebound, resulting in high-frequency orders bringing extremely high transaction fees. It seems that I have already hedged my breakeven position, but I am still losing on paper, losing on fees.

👉 Current optimal strategy for getting out of a position:

1. Wait for the market to rebound to 3600-3650, I will take a breakeven loss (the probability is still quite high), and then conduct right-side trading with higher-level K-lines.

2. Open short at 3600-3650, take profit at 2800; stop loss if the two 4-hour/2-hour level lines stand above 3650 without showing a downward trend.

3. Extreme stop loss at 3750

I hope to remember my erroneous operations through this article; the tuition must be meaningful to be called a trader.

Understanding and sharing failure experiences is what makes a good KOL, whether he makes money or loses money. If he only shows off his profitable trades, how can he gain the trust of the audience? #币安合约实盘 #ETH $ETH

——Live (The senior scholarship has been fully lost version)