On October 18, No Kings Protests stirred waves in the United States: the organizers claimed that over 7 million people took to the streets, with 2,700+ events across 50 states. The protest slogan was very straightforward: 'No Kings', directly targeting the 'concentration of power', 'executive overreach', and 'imbalance of democratic mechanisms' represented by Donald Trump.

As a cryptocurrency analyst, I want to discuss the significance of this protest for the crypto world from three dimensions. This is not just political news, but a red light + alert sound for the work we do.

1. Democracy vs Authoritarianism: The crypto world is also a battlefield

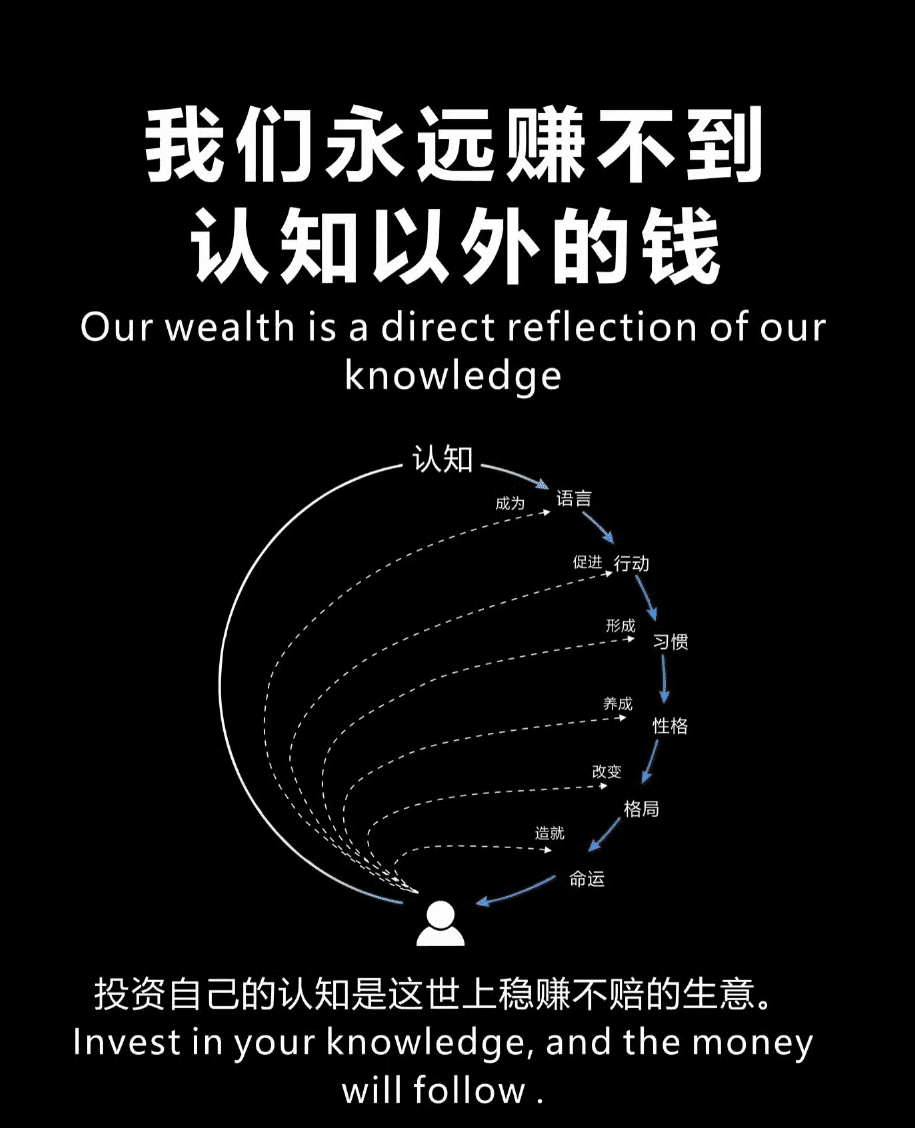

The core of the protest is: people are unwilling to see 'one person decides, one person determines the fate of the country.' This aligns with the concept of 'decentralization' in the crypto world.

Under a democratic system, power is divided, and there are supervision mechanisms; however, if a 'king' model appears, the system is prone to abuse.

In the crypto space, if a project party, a KOL, or an exchange holds too much control, it may 'concentrate' and become a new 'king.'

This protest scenario tells us: the public is sensitive to 'who holds power' and 'who calls the shots.' As analysts, we should ask: which projects truly achieve power decentralization? Which projects operate under a 'king' model?

A universal statement: the crypto space should not have a king model; we want democratic governance. If project governance cannot achieve transparency, openness, and community empowerment, it will be a passive 'dominated' model on the chain in the future.

2. Capital flow and trust gaps: when the system is unbalanced, decentralized assets benefit.

7 million people took to the streets, indicating that trust in the system is fractured—this affects the financial market and capital flows.

If traditional institutions/regimes become unstable, 'centralized assets' (traditional finance, fiat currency systems) are likely to become carriers of risk.

Decentralized assets (such as Bitcoin or trusted public chain tokens) may become a safe haven for capital.

For the crypto space: this protest itself is a signal, the public shows strong aversion to models that are 'not controlled by themselves.' This means that future chains and projects that can truly empower users with 'sovereignty' and genuinely detach from centralized control may gain stronger structural advantages.

In other words: this is not about 'simply looking at halving' or the 'hype of trading coins,' but an opportunity for structural change.

3. Our window of opportunity: community, governance, and resistance to censorship

Seeing 7 million people take to the streets shouting 'no kings' gives us a wake-up call in the crypto space:

If a project lacks community participation rights, and governance is merely 'decided by the interests,' then it is a 'small kingdom.'

If the on-chain system can still be controlled by a single node or entity, then under this theme, it is the target.

On the contrary, truly scalable projects are: users can propose, vote, verify, have multiple autonomous nodes, and strong resistance to censorship.

Therefore, Brother Yuan suggests that you focus on the following in crypto analysis:

The project's governance structure: do tokens have voting rights? Can the community change direction?

Node distribution: is it centralized? Is it easy to be 'blocked' or 'controlled'?

The project's resistance to censorship: whether it has the ability to continue operating under institutional/policy oppression.

'No kings, we want democracy'—this phrase is not only a political slogan but more like a mirror for the crypto space. You may not pay attention to street protests, but the 'power structure doubts,' 'trust crisis,' and 'institutional changes' behind the protests will never bypass the crypto world.

My view is: the next round of true opportunities lies not in 'who is promoting' a certain coin, but in 'who gives you real sovereignty.' We must grasp this point in the crypto space: decentralization ≠ just a slogan, but a structured advantage.$BTC $ETH $BNB #美财政部比特币战略储备激增 #加密市场反弹 #美国政府停摆 #BTC走势分析