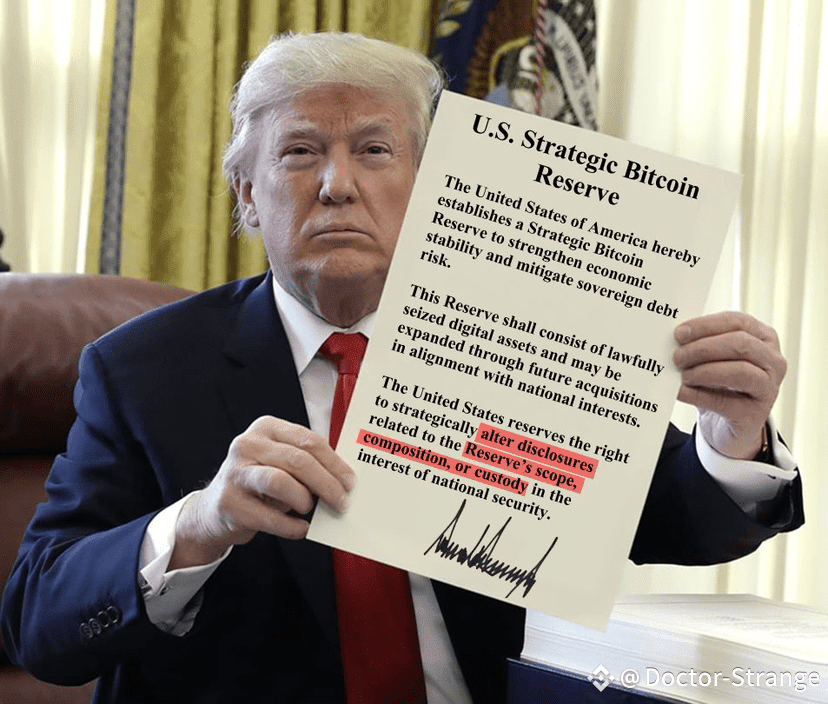

The US Bitcoin Reserve is FAKE

They only hold 29,000 BTC, not 200,000

I'm risking by revealing their real plan, but...

Here's the TRUTH Trump don't want you to know👇

Please take a moment to vote for me in the Binance Blockchain 100

✯ Trump never intended to build a Bitcoin Reserve in the first place

✯ The audit was a smokescreen - a cover operation for internal shuffling

✯ 172 days without a report is not delay - it’s intentional silence

✯ Something happened behind the scenes that they don’t want traced

✯ The April 5 audit deadline passed with zero federal acknowledgment

✯ The Treasury claimed to “forward the request” - then went dark

✯ All crypto inquiries now lead to IRS-CI, HSI, or the Secret Service

✯ Agencies known for asset seizures - not transparent reporting

✯ Trump’s team used the reserve announcement to trigger market euphoria

✯ Price surged, inflows returned, and insiders began unloading BTC

✯ Wallets tied to campaign donors moved coins before and after the news

✯ The “Bitcoin Shield” was narrative warfare - not economic strategy

✯ Why fake a reserve? Because it’s a perfect pump weapon

✯ A sovereign buy narrative signals safety, protection, inevitability

✯ Retail thinks: “The U.S. will never let Bitcoin fail”

✯ Meanwhile, the real actors were quietly exiting the top

✯ The Treasury never intended to hold BTC - only to freeze it

✯ Most “confiscated” assets are technically unconfirmed and reversible

✯ Court battles over private keys are ongoing across federal circuits

✯ There is no unified Bitcoin wallet under government custody

✯ 200K BTC was always a myth - it came from Arkham assumptions

✯ The actual controlled amount is closer to 29K, and fragmented

✯ Some sits in Marshals, some in IRS vaults, some in active litigation

✯ There is no single balance sheet, no cold wallet, no real reserve

✯ The refusal to publish audit data signals fear, not incompetence

✯ If they disclose the real BTC count - panic might follow

✯ It breaks the illusion of strength behind the U.S. crypto stance

✯ And exposes the market to a confidence-driven correction

✯ Trump’s silence is also strategic - he needs BTC alive, not strong

✯ A weak Bitcoin allows reentry at lower levels for future moves

✯ The goal is to buy later - after others capitulate and sell cheap

✯ The reserve was always meant for post-crash accumulation

✯ Meanwhile, Trump blames China, the Fed, and inflation for delays

✯ But insiders know: the real reason is unfinished accumulation

✯ Leaks suggest Patriot Act loopholes are used to seize without reporting

✯ The Bitcoin Reserve may exist - but hidden, off-books, untracked

✯ Don’t wait for a press release - the truth is in the flows

✯ Watch for stealth cold wallet mints and off-market seizures

✯ If the reserve is real, it will appear when they need control

✯ Until then, this was the biggest narrative rug of 2025 so far

✯ Please continue to read

How WCT’s Connectivity Backbone Stacks Up Against Chainlink’s Data Oracle Empire in the 2025 Web3 Landscape

In the ever-expanding universe of blockchain infrastructure, where tokens aren’t just speculative assets but the gears grinding the machine of decentralized finance, few projects embody the quiet power of foundational layers like WalletConnect Token (WCT) and Chainlink (LINK). As we hit September 25, 2025, with multi-chain ecosystems fracturing further under the weight of L2 explosions and RWA tokenizations, these two stand as pillars: Chainlink as the unyielding oracle feeding real-world truths into smart contracts, and WCT as the seamless conduit linking users’ wallets to the dApp sprawl. They’re not direct rivals—Chainlink whispers data from the ether, while WCT orchestrates human-to-protocol handshakes—but their roles intersect in profound ways, powering the same interoperable future. This comparison isn’t about crowning a winner; it’s a dissection of their synergies, divergences, and trajectories, revealing why both could supercharge portfolios in an era where Web3’s “plumbing” tokens are outpacing the flashier narratives. #WalletConnect

At their cores, WCT and Chainlink tackle Web3’s fragmentation from orthogonal angles, each addressing a pain point that’s as existential as it is technical. Chainlink, the elder statesman launched in 2017, reigns as the decentralized oracle network, solving the “oracle problem” by piping tamper-proof off-chain data—think stock prices, weather feeds, or election results—directly into on-chain logic. Without it, smart contracts would be blindfolded, unable to react to the world’s chaos. By mid-2025, Chainlink secures over $93 billion in value across blockchains, acting as Web3’s orchestration layer that not only delivers data but also enables cross-chain messaging via its CCIP (Cross-Chain Interoperability Protocol). This evolution positions it as a linchpin for institutional plays, like tokenized treasuries or automated trade finance, where data integrity isn’t optional—it’s the moat against exploits that have drained billions from DeFi.

Pyth’s Silent Coup: How This Oracle Is About to Eclipse Bloomberg and Rewrite Global Finance Forever

Imagine a world where the invisible threads of finance—those fleeting price whispers that dictate fortunes in milliseconds—aren’t hoarded by shadowy data barons but democratized, accelerated, and etched into the immutable ledger of blockchain. No more gated terminals costing fortunes, no more delays that turn trades into tragedies. This isn’t some utopian dream; it’s the quiet revolution brewing in the veins of Pyth Network, a force so understated yet so potent that it’s poised to unseat the titans of traditional market intelligence. As we stand on the cusp of 2026, with DeFi’s tentacles wrapping around real-world assets and governments dipping toes into on-chain waters, Pyth isn’t just an oracle—it’s the unseen architect of tomorrow’s economy. Buckle up, because this isn’t your average crypto tale; it’s the chronicle of a network that’s engineering the greatest data heist in financial history, and PYTH holders might just be the silent beneficiaries of a multi-trillion-dollar windfall.

Let’s rewind the clock, not to the dusty origins of blockchain, but to a moment in early 2023 when a cadre of Solana loyalists, weary of clunky data pipelines plaguing decentralized exchanges, decided enough was enough. Born from the fertile chaos of high-frequency trading minds at firms like Jane Street and Jump Trading, Pyth emerged not as a flashy newcomer but as a surgical strike against the oracle oligarchy. Traditional setups? They aggregate scraps from public APIs, layering on delays and doubts like sediment in a murky river. Pyth flips the script with a pull-based symphony: over 120 first-party publishers—think behemoths like Binance, OKX, and Virtu Financial—streaming proprietary intel straight to the chain. Prices refresh every 400 milliseconds, confidence intervals baked in like cryptographic alibis, ensuring that when a smart contract queries the ether, it gets truth, not echoes. #PythRoadmap

Dolomite’s DOLO: The Shadow Weaver of DeFi – Silently Spinning a Web That Could Trap the Titans

Imagine a vast, echoing cavern deep beneath the digital mountains of blockchain, where forgotten treasures glint in the half-light, untouched by the spotlights of hype machines. This isn’t some mythical lair from a forgotten fable; it’s the underbelly of DeFi, where protocols like Dolomite have been quietly chiseling away at the stone walls of inefficiency for years. Now, as the echoes of September 2025’s market tremors fade, Dolomite’s native token, DOLO, emerges not as a roaring beast but as a sly artisan, threading invisible filaments across chains and assets that could ensnare even the lumbering giants of lending and trading. But in a landscape scarred by post-listing bloodbaths and fleeting bull runs, is this weaver crafting a masterpiece or just another fragile tapestry destined to unravel? Buckle in, because we’re descending into the depths to unearth the threads that bind Dolomite’s ascent—and the knots that might yet trip it up.

Our tale begins not with fanfare or venture-backed fanfare, but in the pragmatic forge of Leavitt Innovations, a Delaware-based outfit more accustomed to engineering resilient systems than chasing viral memes. Launched in the frothy haze of 2022’s bear market, Dolomite wasn’t born from the ashes of Terra’s collapse or the euphoria of Solana’s speed demons. No, it slithered into existence on Arbitrum, that oft-overlooked Layer 2 oasis where gas fees whisper rather than scream. Picture the founders—visionaries who’d seen enough protocol implosions to know that true durability demands immutability. They etched Dolomite’s core contracts in stone: non-upgradable, unyielding code audited four times over by heavyweights like Zeppelin Solutions and Cyfrin, with test coverage hitting a pristine 100%. This wasn’t bravado; it was battle-hardened wisdom, a shield against the exploits that have felled flashier foes.