Thinking that the shape of a single candle or an isolated pattern is enough to trade is one of the most common and costly mistakes.

Let's expand on that very important idea:

The Japanese Candle: Just the "Tip of the Iceberg"

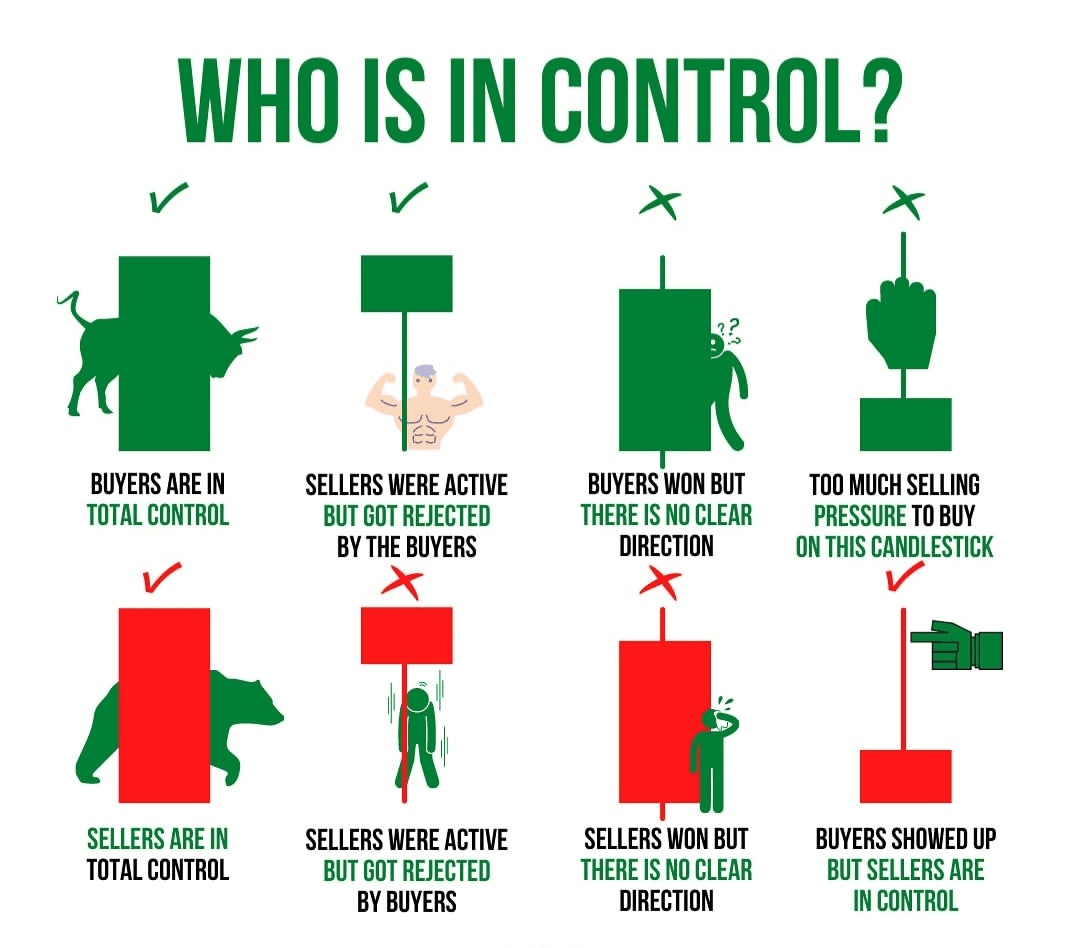

The candle tells you WHAT is happening (compression, indecision, buying/selling strength), but it doesn't tell you WHY it is important or if it is reliable. For that, you need the context.

---

The "Complete Panorama" You Should Combine

Here are the key elements that a successful trader always analyzes BEFORE looking at the entry signal of a candle:

1. Main Trend (The Higher Time Frame)

· Are you in a bullish, bearish, or sideways market? A "hammer candle" (bullish reversal signal) in a strong downtrend carries much more weight than the same candle in the middle of a sideways trend. The trend is your friend. It is more likely that a correction in a strong trend is an entry point in favor of the trend than a total reversal.

2. Key Support and Resistance Levels

· Has the candle formed at an important level? An exhaustion or reversal candle is much more significant if it appears:

· At a strong support (previous lows, important moving averages, demand zones).

· At a strong resistance (previous highs, supply zones).

· This gives you a "why" for the price reaction.

3. Volume

· Did the reversal or continuation candle have high volume? Volume is the "fuel" of the movement.

· A bullish candle with high volume confirms buying strength.

· A reversal candle with low volume is suspicious and likely won't last.

4. Multiple Candle Patterns (Sets)

· A single candle can be noise. Two or three candles forming a pattern are more reliable.

· Examples: Three white soldiers (bullish), Three black crows (bearish), Harami, Engulfing, Dark cloud, etc. These patterns show a more sustained momentum change.

5. Confirmation (The Golden Rule)

· NEVER trade solely on the signal of a candle. Wait for the next candle to confirm the direction.

· If you see a bullish hammer, wait for the next candle to close above the body of the hammer before buying.

· This avoids "false signals" and "whipsaws" (when the price takes you out of the trade just before moving in the right direction).

📍Final Summary

You have a trader's mindset. Remember this analogy:

· The Japanese candle is like a word in a sentence.

· The candlestick pattern is like a complete sentence.

· The context (support/resistance, volume, trend) is the complete story.

Do not trade solely on words. Always read the complete story.

#LibertadFinanciera #InvestSmart #BinanceSquareFamily #VelasJaponesas #Write2Earn