Weakness in the world’s reserve currency never ends quietly

Credit, commodities, equities, crypto, all feel the shockwaves

I mapped 55 years of data to see what happens next

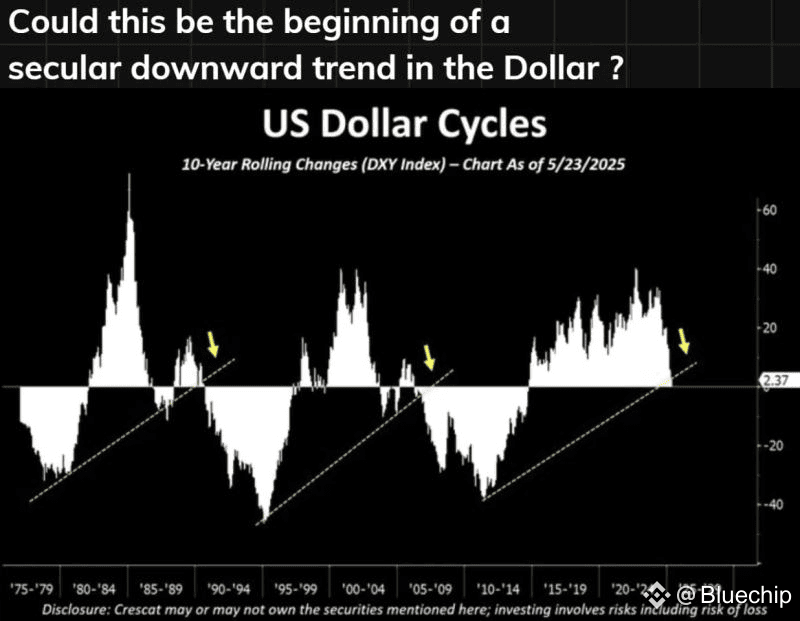

The dollar index is sitting on a 14-year support zone

It has already lost more than 10% since January and trades near 2022 lows

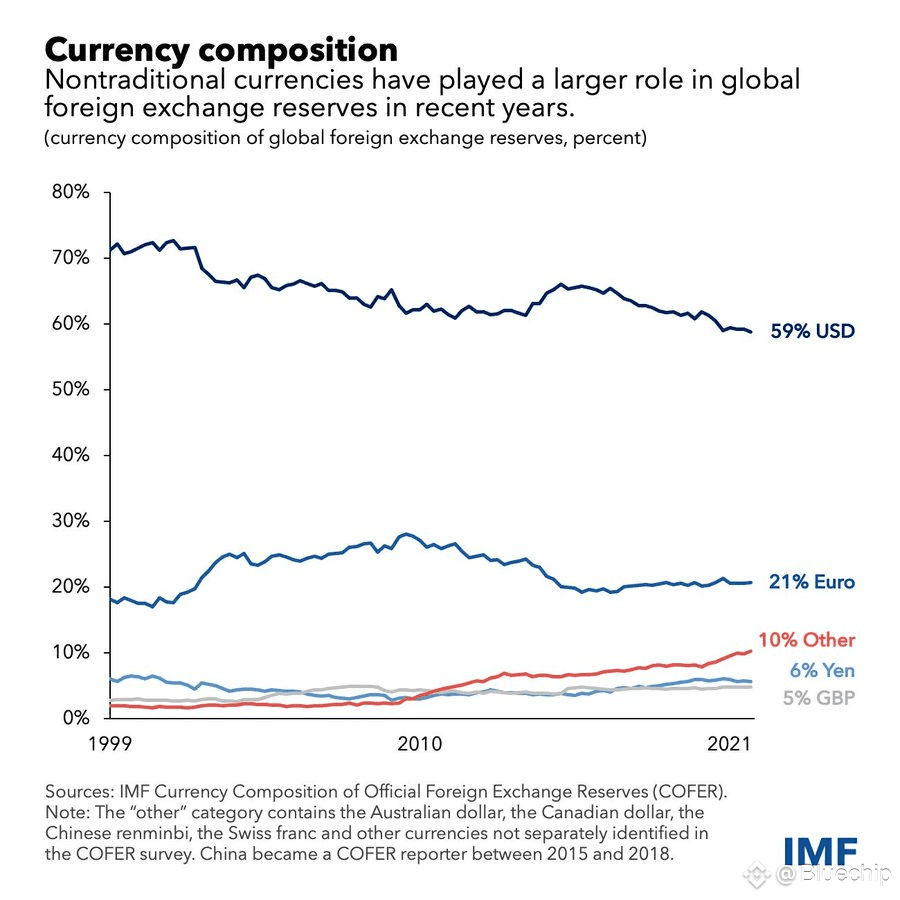

This weakness in the global reserve currency raises the risk of systemic stress

Markets are beginning to price that in

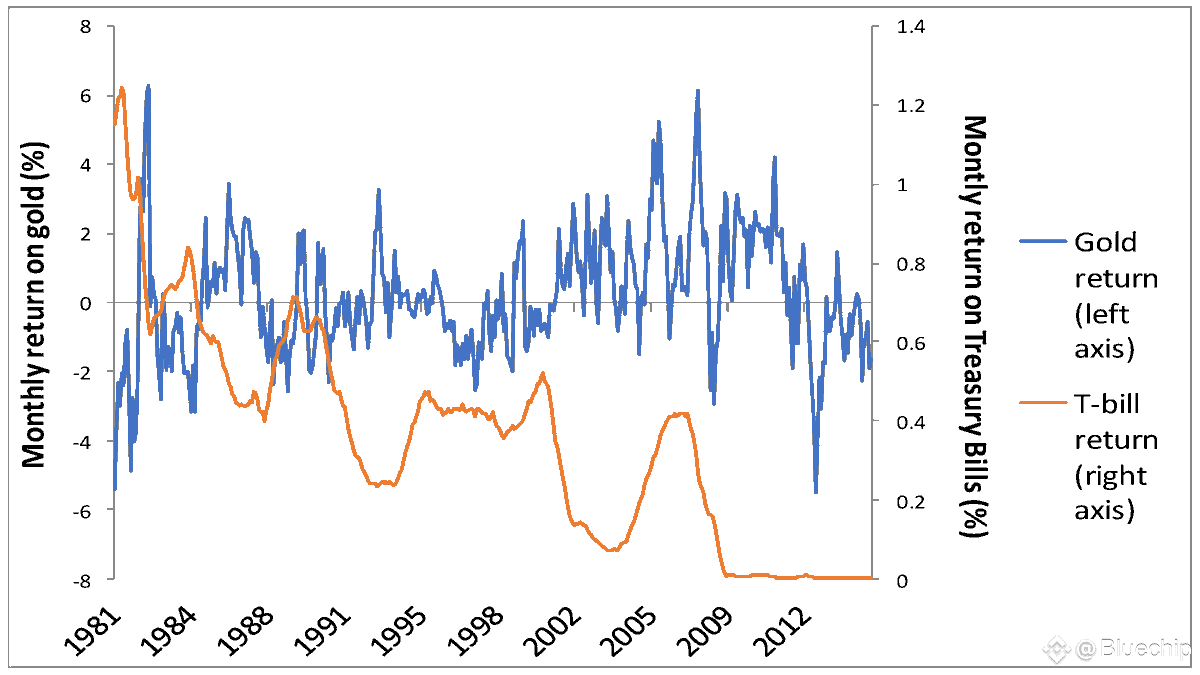

When the dollar weakens, capital rotates out of USD assets

Flows shift into gold, commodities, and equities, while crypto reacts with a higher beta

That transition phase is usually volatile, especially for BTC and alts

Short-term stability is not guaranteed

If the slide deepens, confidence in credit markets and reserves can break down

That is when liquidity crunches and sudden selloffs appear

BTC has shown it is not immune to such shocks

Temporary downside becomes part of the reset

Longer term the picture flips entirely

A weaker dollar makes alternative assets more attractive

Bitcoin benefits as a neutral, decentralized hedge against a fragile reserve system

That is why conviction investors watch DXY as closely as price charts

History is full of these moments

Gold multiplied after the 2001 dollar collapse

Bitcoin surged post-2015 during another wave of dollar weakness

The pattern is repeating and crypto stands to gain as the cycle unfolds

The key is to ignore the noise and focus on flows

Dollar weakness is not a headline, it is a structural shift

It is the backdrop for the next wave of global adoption

$BTC is positioned at the center of that transition

Always DYOR and size accordingly. NFA!

📌 Follow @Bluechip for unfiltered crypto intelligence, feel free to bookmark & share.