The engulfing bar candlestick pattern

The Engulfing bar as it states in its title is formed when it fully engulfs the previous candle. The engulfing bar can engulf more than one previous candle, but to be considered an engulfing bar, at least one candle must be fully consumed.

The bearish engulfing is one of the most important candlestick patterns.

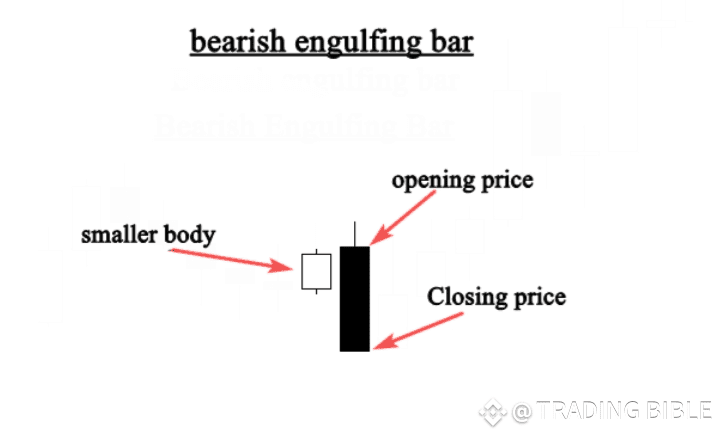

This candlestick pattern consists of two bodies:

The first body is smaller than the second one, in other words, the second body engulfs the previous one. See the illustration below:

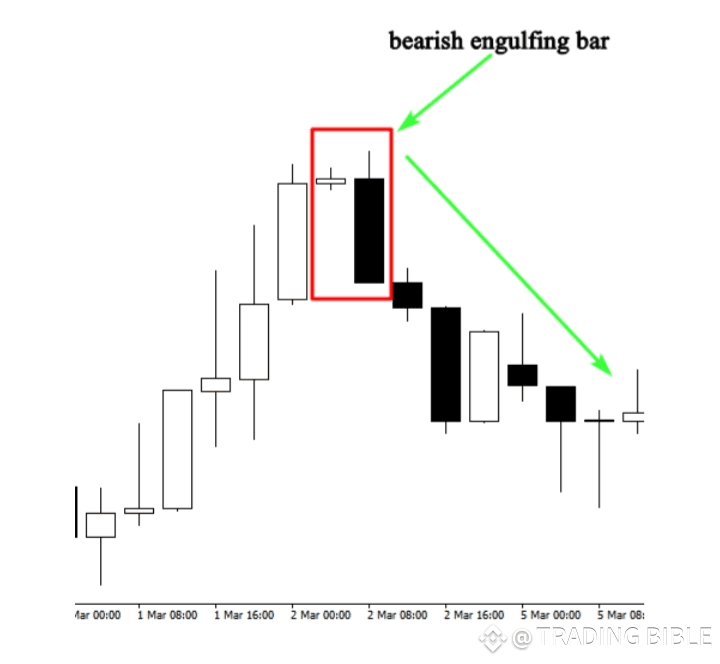

This is how a bearish engulfing bar pattern looks like on your charts, this candlestick pattern gives us valuable information about bulls and bears in the market.

In case of a bearish engulfing bar, this pattern tells us that sellers are in control of the market.

When this pattern occurs at the end of an uptrend, this indicates that buyers are engulfed by sellers which signals a trend reversal.

See the example below:

As you can see when this price action pattern occurs in an uptrend, we can anticipate a trend reversal because buyers are not still in control of the market, and sellers are trying to push the market to go down.

You can’t trade any bearish candlestick pattern you find on your chart; you will need other technical tools to confirm your entries.

We will talk about this in details in the next chapters. Right now, i just want you to open your charts and try to identify all bearish candlestick patterns that you find.$BTC

#USBitcoinReserveDiscussion #BinanceHODLerAVNT #GoldHitsRecordHigh $BNB

#FedRateCut25bps #BNBBreaks1000