LONG OR SHORT?

87% of traders lose money, but not me

But all you need is $50 and my secret straegy

my ultimate trading guide is here 👇🧵

(People charge $1,000+ for such info)

Before we begin, please click on Follow and Repost 🔄

Also, I’d like to share $2,000with my most active followers

Click and follow to participate

Intro

𓁼 Long or short is the core decision every trader makes

𓁼 Long = profit from price going up, short = profit from price going down

𓁼 But the real edge is knowing when to use each, with proper tools and signals

𓁼 Let’s break down practical strategies 👇

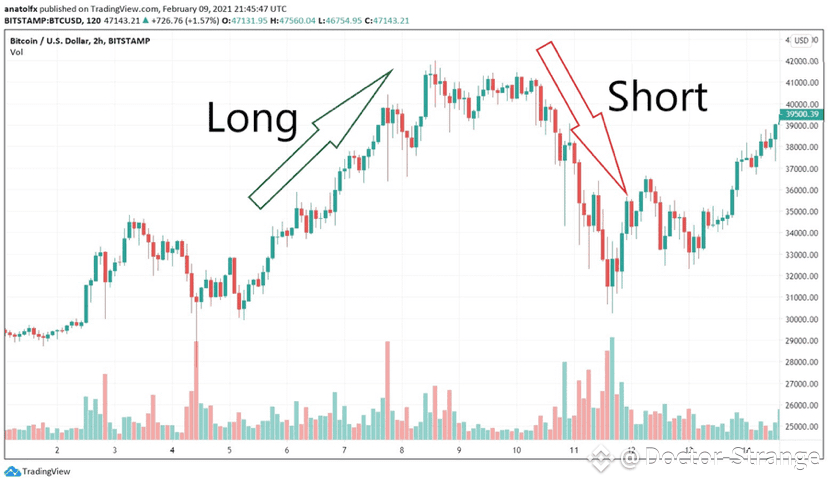

Long explained

𓁼 A long is a simple bet on growth - buy at lower price, sell higher

𓁼 Works best in uptrends or after healthy pullbacks to support

𓁼 Confirmation comes from volume spikes, positive sentiment, and trend indicators

𓁼 Safer for beginners since logic is intuitive and closer to investing

Short explained

𓁼 A short is betting on price falling - sell now, buy back cheaper later

𓁼 Ideal during market downtrends, overbought conditions, or hype-driven rallies

𓁼 Short moves are faster and sharper than longs, so risk is higher

𓁼 Always use stop-loss, since liquidation risk is bigger here

Hedging basics

𓁼 Hedging reduces risk by opening opposite positions to balance outcomes

𓁼 Example: long 2 BTC, short 1 BTC → you still profit if market rises but losses are smaller if it falls

𓁼 This cuts both profits and losses in half - like paying for insurance

𓁼 Best used when you expect volatility but don’t know the direction

Hedging in practice

𓁼 BTC rises $30k → $40k, formula (2-1)*10k = +$10k profit

𓁼 If BTC falls $30k → $25k, result (2-1)*-5k = -$5k loss instead of -$10k

𓁼 Hedging saves capital but caps upside, so use it smartly

𓁼 Don’t hedge with equal long and short size - that only burns fees with no gain

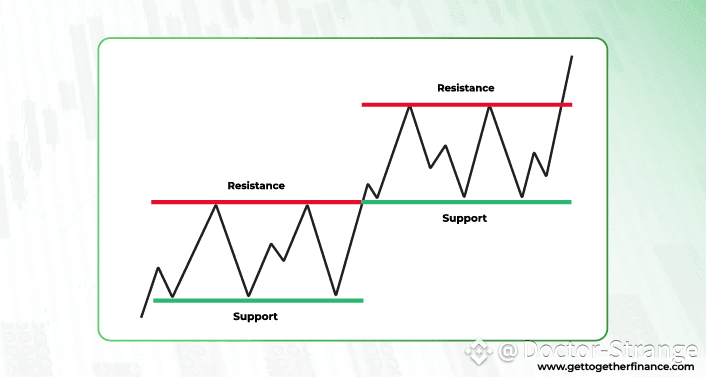

Support & Resistance

𓁼 Support = buyers protect price, Resistance = sellers push it down

𓁼 Strong levels form after multiple tests without breaking

𓁼 Trade setups: buy confirmed support bounces, sell at resistance rejections

𓁼 Break and retest of resistance flipping to support is one of the most reliable long entries

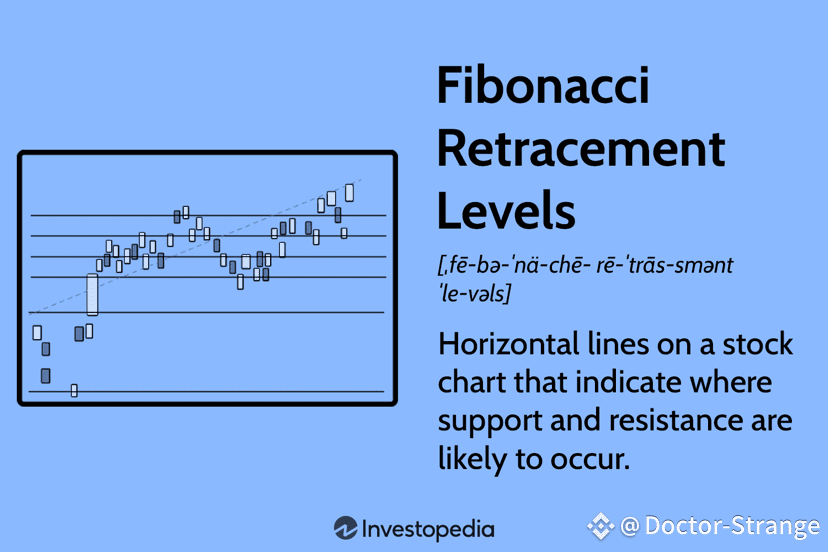

7 Fibonacci retracements

𓁼 Use Fib levels to catch pullbacks and reversal zones

𓁼 0.382 = shallow dip, 0.5 = psychological zone, 0.618/0.786 = strongest reversal areas

𓁼 Always combine Fib with volume, trend, and confluence

𓁼 Best setups happen at 0.618/0.786 with whale accumulation and high volume

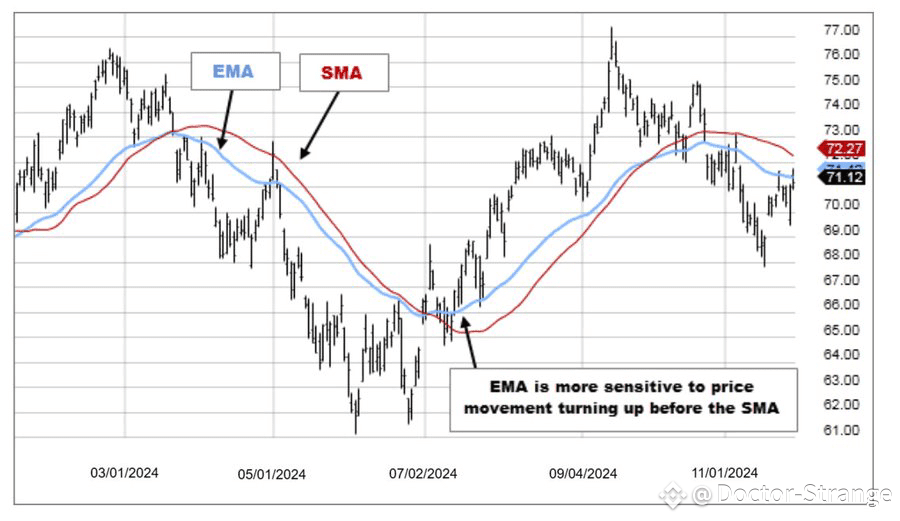

Moving Averages (EMA/SMA)

𓁼 SMA 50/200 → Golden Cross (bullish), Death Cross (bearish)

𓁼 EMA 21/50 → track short-term momentum and intraday trends

𓁼 EMA 200 → one of the strongest support/resistance levels in crypto

𓁼 Combine MA signals with volume to avoid fake crossovers

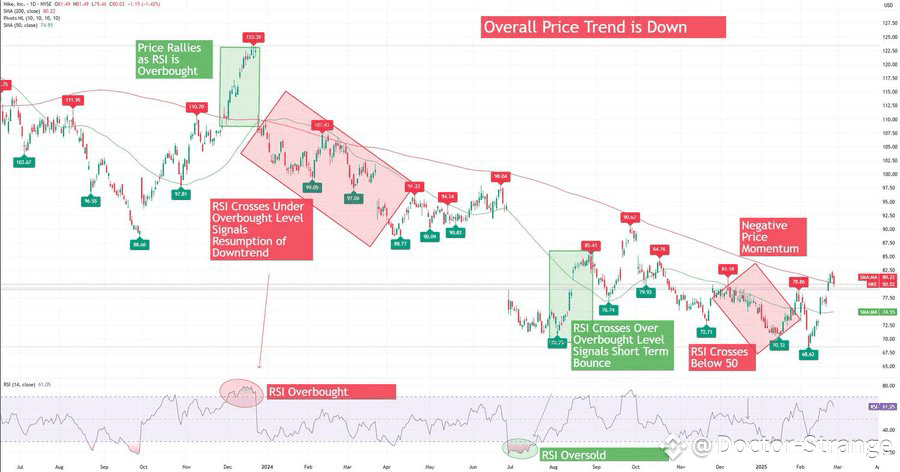

RSI

𓁼 RSI >70 = overbought (sell zone), RSI <30 = oversold (buy zone)

𓁼 Divergences give strong signals: bullish = RSI rises while price falls, bearish = RSI drops while price rises

𓁼 RSI works best on 4H and 1D charts for crypto volatility

𓁼 Don’t counter-trade strong trends only on RSI, always wait for confirmation

Comment to continue for more info on this