Crypto is maturing. Memes and hype are receding, and in their place comes real value. Tokenization of real assets is not a theory, but an active trend that is changing the rules of the game.

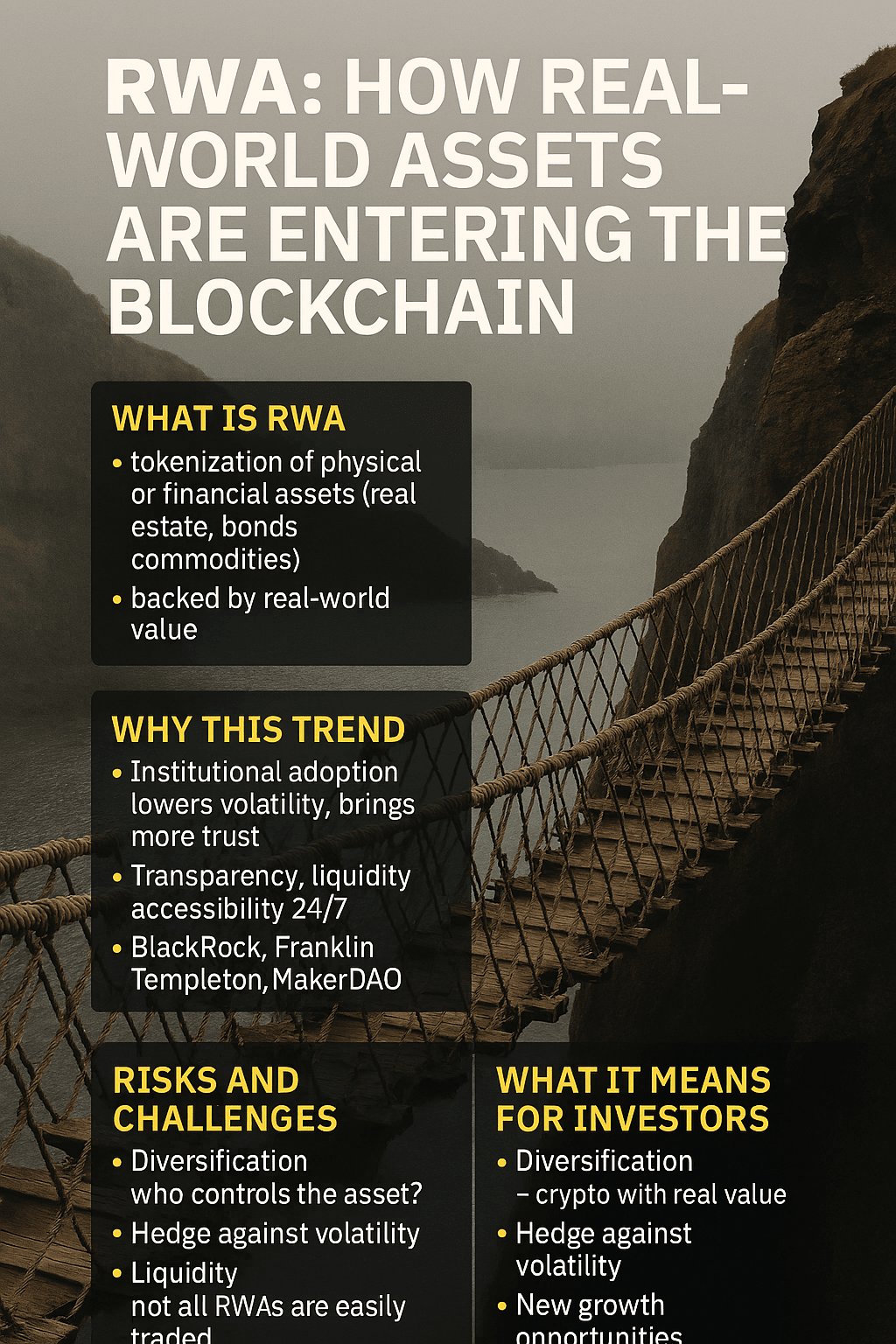

🔍 What is RWA

Tokenization of physical and financial assets: real estate, bonds, gold.

These are not just tokens — they are backed by real value outside the blockchain.

RWA — this is a bridge between traditional markets and crypto infrastructure.

📈 Why is this a trend

- Institutions are entering through RWA: less volatility, more trust

- Transparency, liquidity, availability 24/7

- BlackRock, Franklin Templeton, MakerDAO — already in the game

⚖️ Risks and challenges

- Who controls the asset? Regulation has not yet caught up with technology

- How to confirm the cost? Reliable oracles and audit are needed

- Liquidity: not all RWA can be sold quickly

🚀 What does this mean for the investor

- Diversification: crypto with real profitability

- Protection against volatility

- Growth potential: if RWA becomes the standard — this is a market in trillions

📌 RWA — this is the transition of crypto from speculation to infrastructure.

Those who enter now may find themselves at the dawn of a new financial era.

#RWA #Tokenization #RealWorldAssets #CryptoInfrastructure #DeFi #BlockchainAdoption #Ethereum #OnChainFinance #BinanceSquare #CryptoTrends #Write2Earn