Historically, it's the weakest months for crypto

Most think rate cuts will pump the market, wrong

☞1 Here's my SECRET plan how to make 6 figs in 30 days

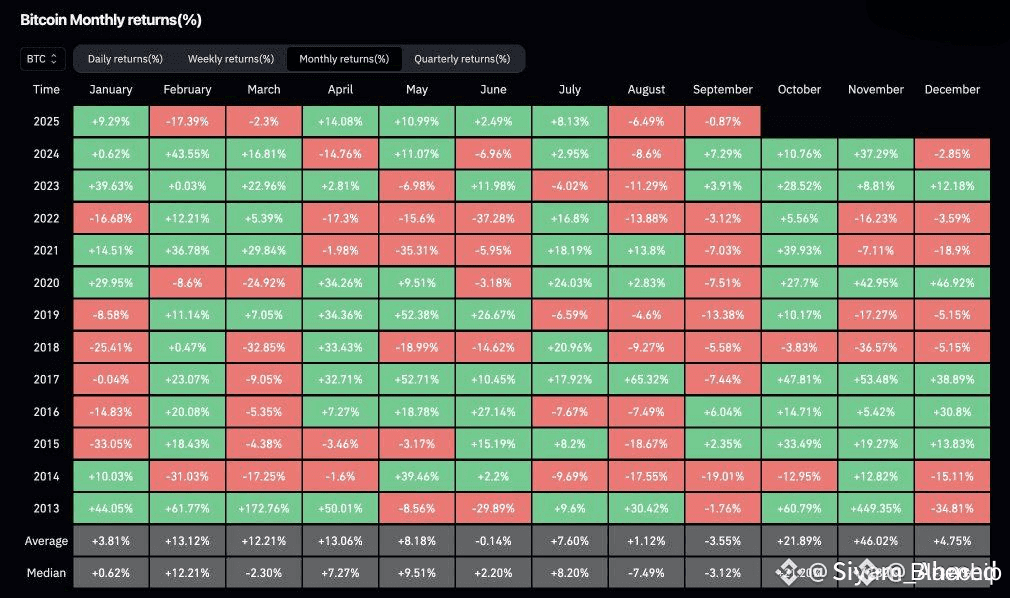

☞ 2 Curse of Red September

𓁼 Historically September is considered the weakest month for crypto markets

𓁼 Bitcoin and Ethereum often show sideways movement with sharp flash crashes

𓁼 Even during bull cycles the probability of local drops remains very high

☞ 3 Crowd expectations

𓁼 The crowd believes that once the Fed cuts rates, moon starts immediately

𓁼 Social media paints a clear scenario: September 17 triggers altseason rally

𓁼 But such strong expectations often fuel sharp dumps directly on the news

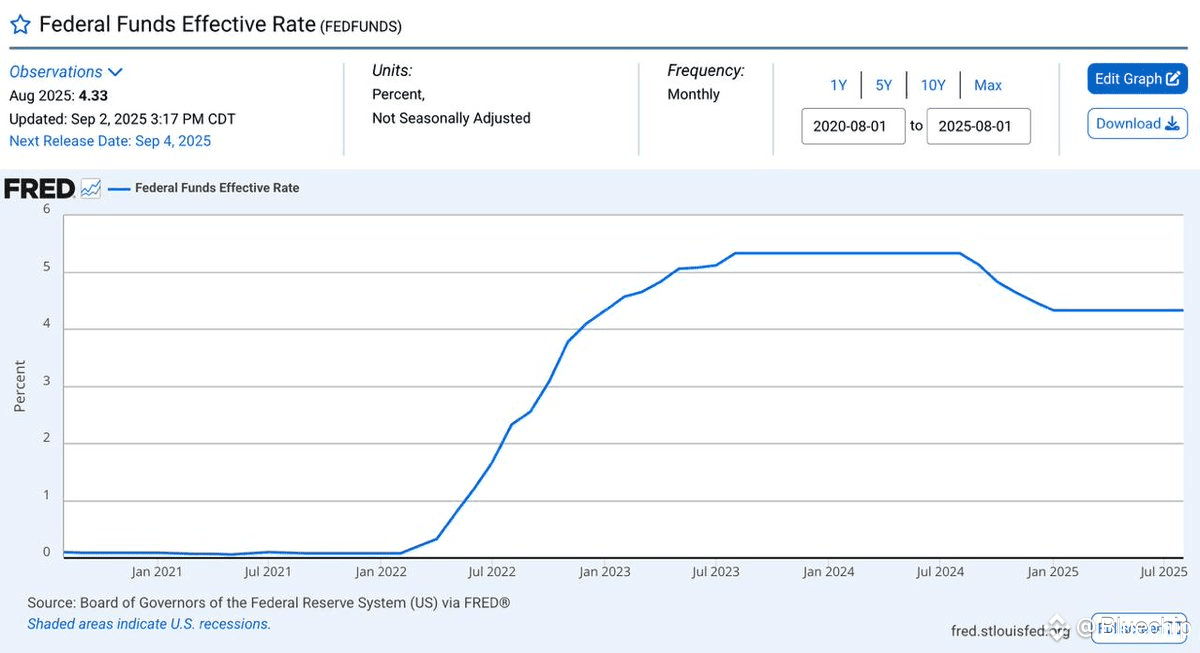

☞ 4 Last year’s experience

𓁼 In 2024 after the Fed cut rates, markets unexpectedly turned lower instead

𓁼 The main reason was that prices had rallied strongly on prior expectations

𓁼 The actual decision simply triggered profit taking and further corrections

☞ 5 Seasonal statistics

𓁼 The first half of September is weak historically, but relatively manageable

𓁼 The worst performance comes later - the second half shows deepest declines

𓁼 This pattern is confirmed across both stock markets and crypto markets

☞ 6 Practical conclusions

𓁼 Expecting instant altseason right after the Fed’s cut is simply unrealistic

𓁼 More likely is a trap - rally on rumors, then strong selloff on the facts

𓁼 Smarter strategy is keeping extra liquidity ready for later entry points

☞ 7 For active traders

𓁼 Watch closely the Fed meeting dates and market reaction around key events

𓁼 Sharpest moves usually happen right during or after official announcements

𓁼 Always use stop losses and hedging tools to survive heavy volatility safely

☞ 8 For long term investors

𓁼 These corrections create opportunities to average positions in BTC and ETH

𓁼 The key is avoiding all-in entries during moments of euphoric optimism

𓁼 Historically the best buys happen during panic in late September crashes

---

☞ 9 Impact on altcoins

𓁼 Altcoins typically react stronger than BTC - their drops are much deeper

𓁼 Trying to catch absolute bottoms is dangerous, patience works much better

𓁼 Risk is highest in alts, but long-term upside potential remains significant

---

☞ 10 Final takeaway

𓁼 Red September is not a myth, but a data-supported recurring market pattern

𓁼 Crowd expectations usually lead to the exact opposite short-term outcomes

𓁼 Calm strategy and discipline deliver more profit than panic or blind euphoria

Always DYOR and size accordingly. NFA!

📌 Follow @Bluechip for unfiltered crypto intelligence, feel free to bookmark & share.