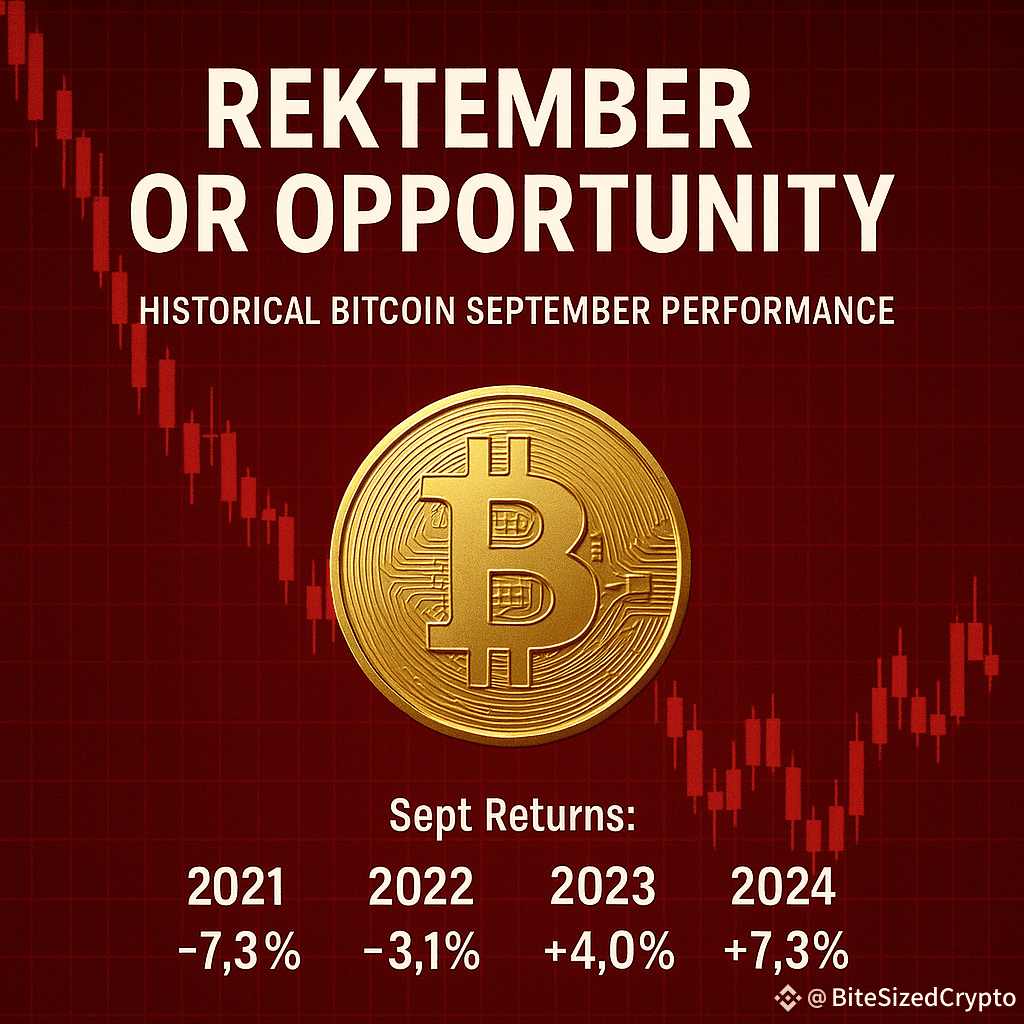

Historically, September has been rough for crypto — Bitcoin has closed red in most of the past 12 years, averaging around –3% to –7%. That’s why the month is often called “Red September” or “Rektember.”

But this year might not follow the script. Here’s why 👇

🔻 The Bearish Case:

Seasonality still matters: investors often take profits and rebalance in September.

Technicals show possible downside toward $100K or even lower in a sharp correction.

Sentiment remains fragile after August’s pullback from the $124K highs.

🟢 The Bullish Case:

Fed Governor Waller has signaled a potential rate cut this month — liquidity usually helps risk assets like crypto.

ETF inflows are returning (over $200M in late August), adding structural support.

Derivatives traders are already positioning for $120K–$140K targets by the end of the month.

Upcoming regulation (like the CLARITY Act) could boost long-term confidence.

📊 What This Means:

If September does dip like history suggests, it may offer a buy-the-dip opportunity ahead of the usual “Uptober” rally.

If macro tailwinds hold, we could even see September break the curse and surprise to the upside.

⚠️ This is just my personal view, not financial advice. Markets are unpredictable, and past patterns don’t guarantee future results. Always DYOR before making moves.

Save 📌 | Share 📤 | Follow for more crypto news⏳