@Dolomite is a next-generation decentralized money market and DEX rolled into one. Instead of being just another lending protocol, Dolomite combines spot trading, margin trading, and over-collateralized lending under a single modular framework—built to be the most capital-efficient platform in DeFi.

With Dolomite, you can:

Hedge or leverage your portfolio with ease

Borrow against a wide range of assets (even non-standard ones)

Trade internally or with external liquidity sources

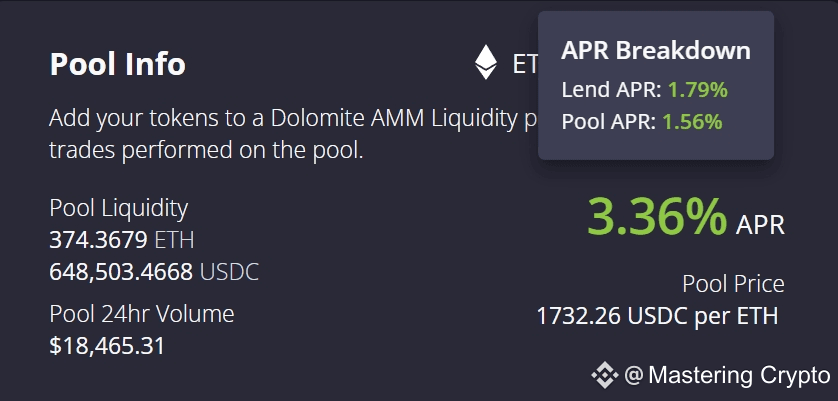

Earn lending yield while also collecting swap fees

It’s not just flexible—it’s built to pass rewards directly to users, avoiding rent-seeking models common in DeFi.

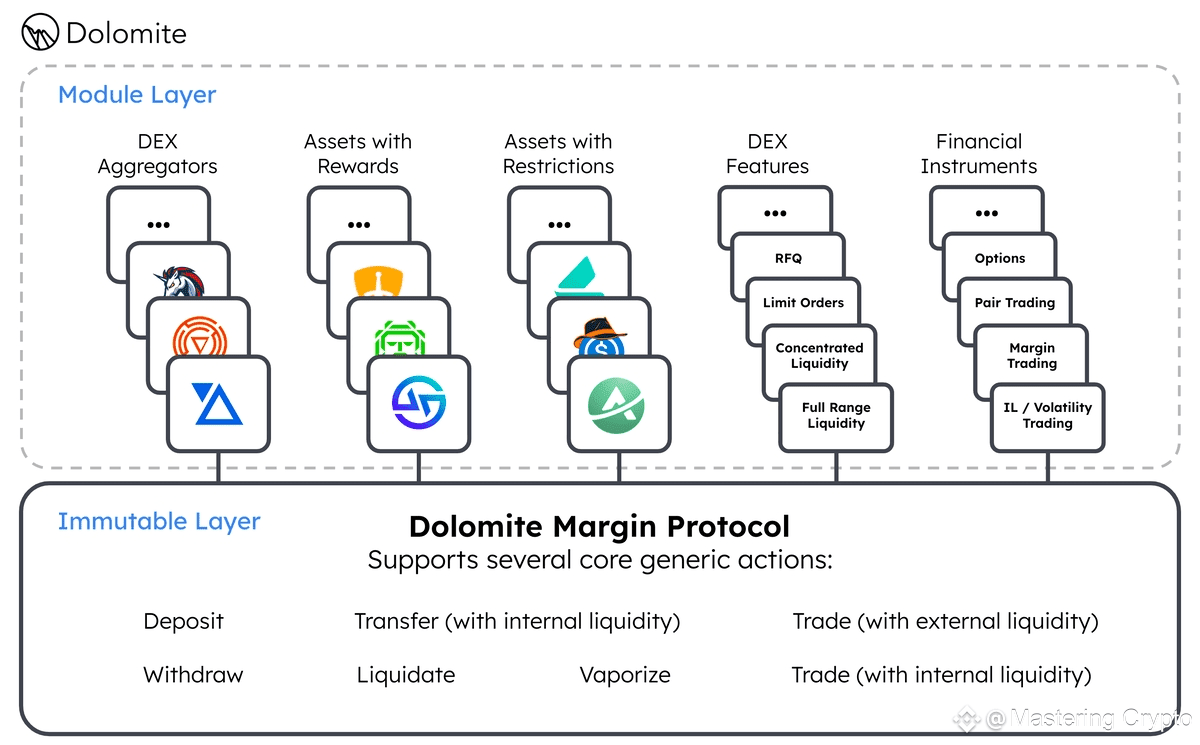

Modular Architecture: Built to Evolve

Dolomite’s design is split into two layers:

Core Layer (immutable): The base logic that can’t be changed, ensuring security and trust.

Module Layer (mutable): Flexible add-ons that adapt to new DeFi trends, allowing upgrades without breaking the system.

This architecture means Dolomite can continuously introduce new features like pair trading, impermanent loss strategies, or yield-boosted collateral types—all without disrupting the existing ecosystem.

Capital Efficiency Through Virtual Liquidity

Traditional money markets leave liquidity locked up and underutilized. Dolomite’s virtual liquidity system flips this model:

Liquidity can be reused across multiple strategies.

Users can earn swap fees and lending yield simultaneously.

Withdrawals remain available even during stress events (like the 2023 USDC depeg) because assets don’t need to leave the system to be useful.

In short, liquidity doesn’t just sit idle—it works harder for you.

Retain Control Over Your Assets

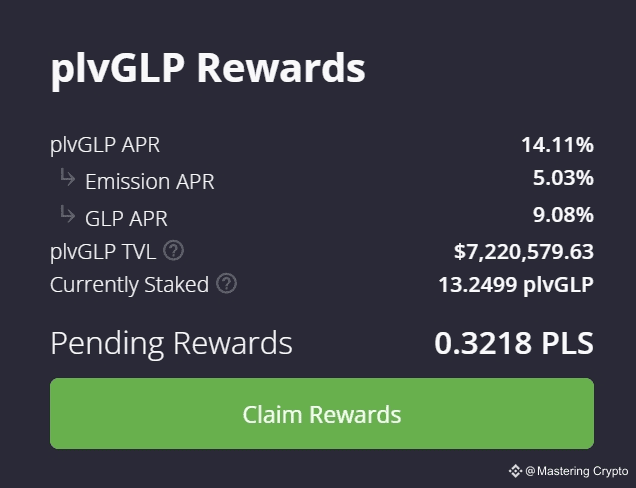

Dolomite introduces Isolation Mode and virtualized balances, giving users more flexibility than ever. For example, with plvGLP, you can:

Stake your full balance inside Dolomite to keep earning rewards.

Borrow against your staked balance without unwrapping it.

Manage multiple isolated positions at once.

This is a big leap forward in letting users both participate in an ecosystem and unlock liquidity at the same time.

Broad Token Support

Unlike older lending platforms limited to ERC-20s, Dolomite can support thousands of assets—including non-standard tokens. Whether it’s staked GLP, custom yield tokens, or DAO-specific assets, Dolomite is built to integrate them all.

This makes Dolomite more than just a money market—it’s a hub for DAOs, yield aggregators, funds, and individual traders to run complex on-chain strategies without being bottlenecked by token standards.

Dolomite isn’t just another DeFi protocol—it’s an evolving ecosystem that makes your capital work harder, unlocks hidden yield, and keeps you in control.