3/

Short-term (before the end of 2025)

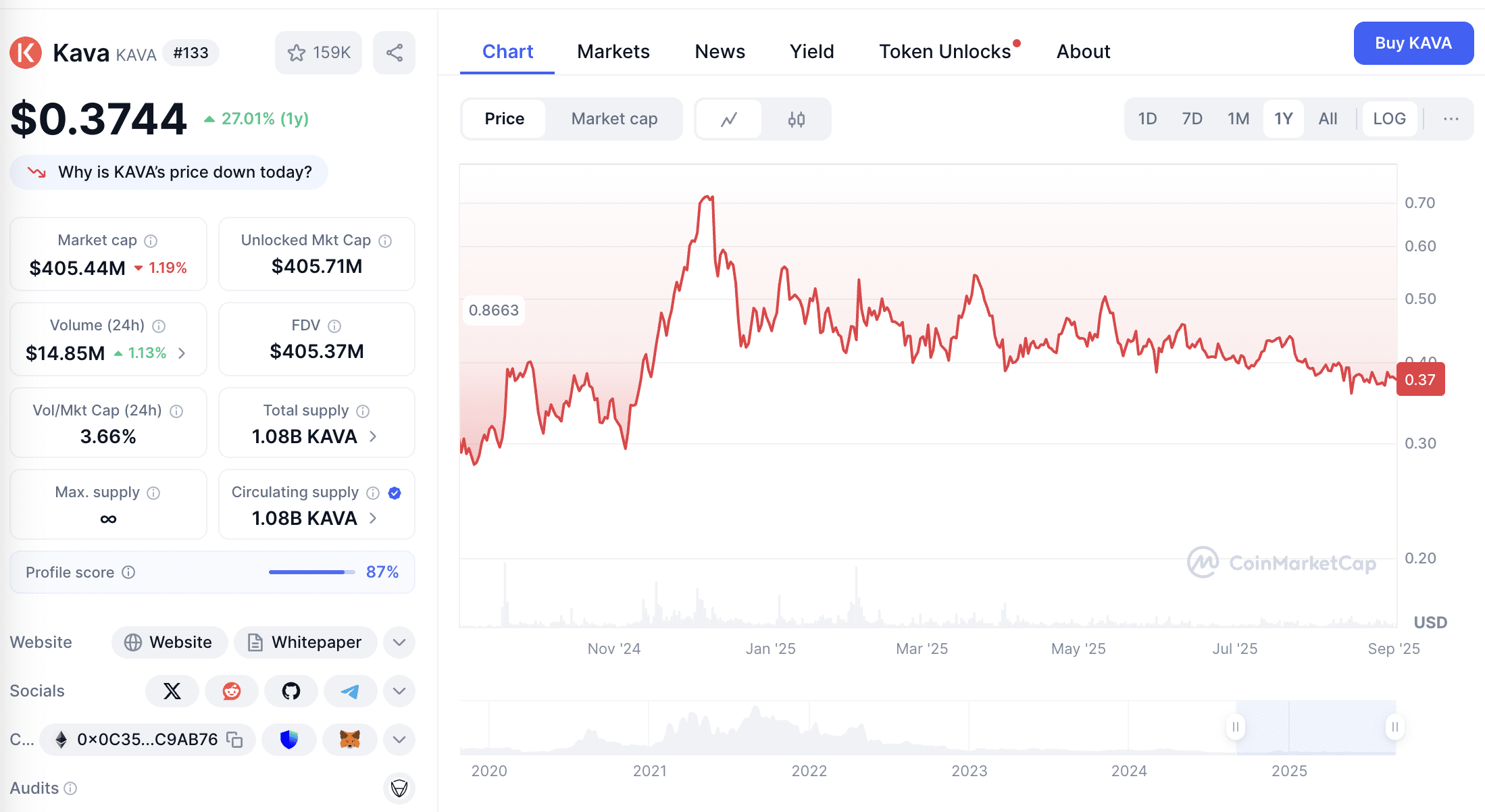

By September 2025, KAVA's price may range between $0.371–$0.436, averaging about $0.404, with a slight increase in October, reaching the range of $0.388–$0.439.

Binance platform user consensus: Expected price in 2030 is $0.486, about $0.3999 in 2026.

Traders Union's model is somewhat conservative: it may reach $0.359–$0.345 in 2025; expected $0.456 in 2029.

The short-term market is not optimistic about KAVA.

Medium to long-term (2026–2028)

Institutional predictions indicate an average of $0.73 in 2025, up to $0.99; $0.93 in 2026; $1.49 in 2027; $2.03 in 2028.

The Currency Analytics gives a similar expectation: average price about $0.73 in 2025; $0.93 in 2026; $1.49 in 2027; $2.03 in 2028; could reach a maximum of $4.60 by 2030, averaging about $3.57.

StockInvest.us indicates that KAVA is currently in a short-term buy signal, but long-term moving averages still issue sell signals; watch for resistance at $0.383 and support at $0.374–$0.377.

CoinLore's technical analysis shows that current technical indicators are bearish, with no buy signals among 17 indicators and 13 sell signals. If the price breaks through $0.4329, it will open a medium-term upward window; if it falls below $0.3219, it may trigger further declines.

Technical architecture and competitiveness

Dual-engine architecture: Kava runs both the EVM execution environment (supporting Ethereum DeFi projects) and the Cosmos SDK modules (supporting cross-chain communication and rapid expansion).

This allows Kava to be compatible with a large number of developers and DApps in the Ethereum ecosystem while leveraging the cross-chain capabilities of Cosmos IBC to connect assets between chains.

From a fundamental perspective, this 'dual-ecology' architecture is Kava's differentiated advantage compared to other single-ecosystem L1 projects.

Ecological development situation

Top protocols implemented: Curve, Aave have been deployed on Kava, and PancakeSwap v3 is running on Kava with an incentive program. This means Kava has the foundational DeFi puzzle.

Cross-chain liquidity integration: Through Stargate and Axelar, mainstream assets like BNB, BTCB, USDT, ATOM can flow seamlessly on Kava, reducing user migration costs.

Developer incentives: The Kava Rise program provides ongoing token subsidies to developers and protocols to attract new DApps, maintaining TVL and activity.

Narrative and strategic positioning

BNB Chain Summer: Incorporating Kava into Binance's ecological activities equates to gaining additional exposure and traffic entry.

AI + DeFi new narrative: Kava proposes the direction of 'AI-driven DeFi protocols.' Although it is still early for implementation, the narrative itself has the potential to attract funds.

Positioning as a cross-chain financial hub: Attempting to become a connector between Cosmos ↔ EVM ↔ BNB Chain, rather than a single public chain.

The orange cat is optimistic about KAVA in the long term but needs to remain vigilant and observe the actions of BNBChain summer.

$KAVA #kavabnbchainsummer @kava