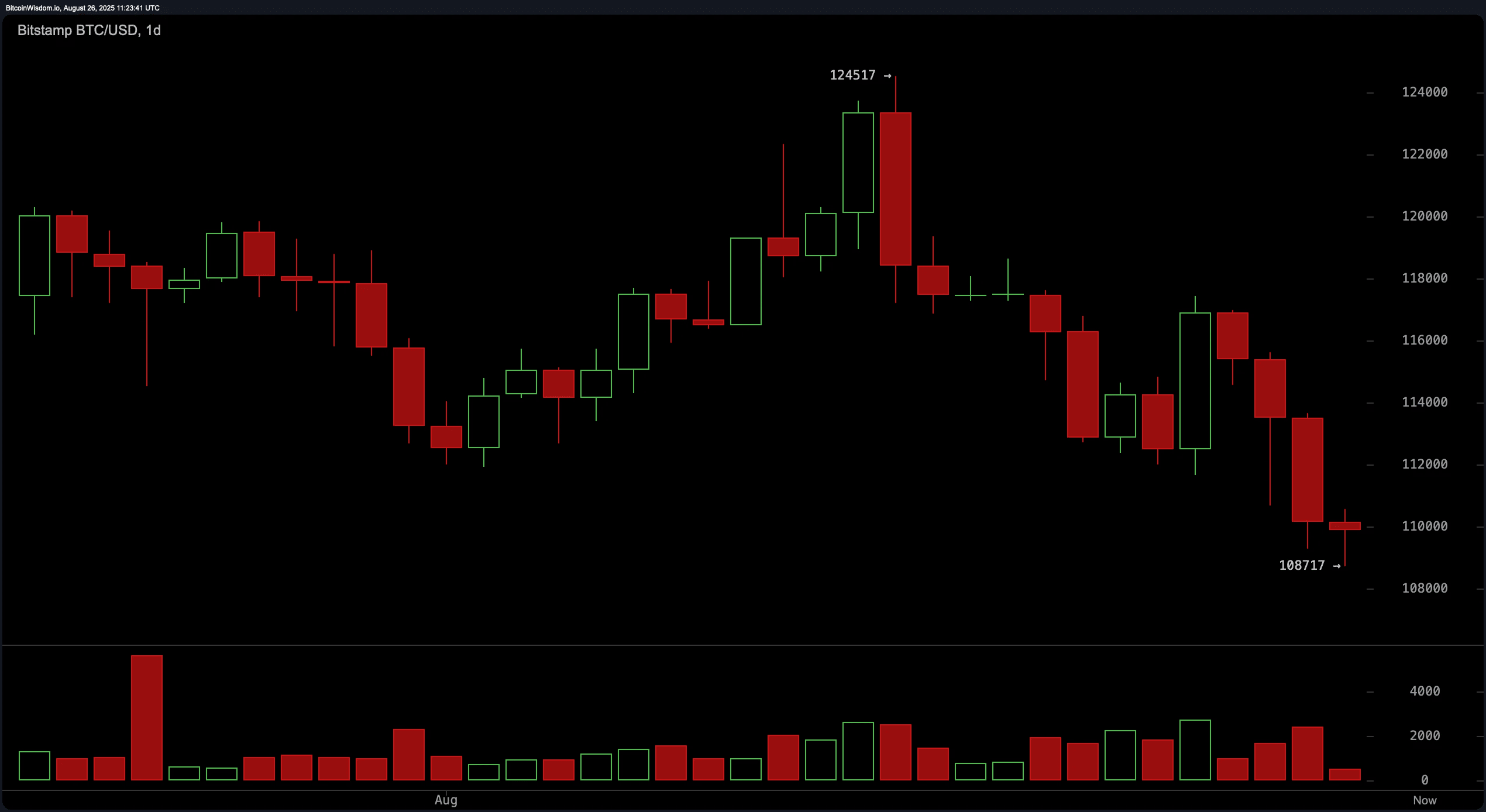

$BTC On the daily timeframe, Bitcoin remains in a defined downtrend, forming lower highs and lows that define price movement.

A sharp rejection from the recent local high of $124,517 led to a price drop of more than 12%, with the last daily candle closing around $108,717.

This pattern is reinforced by bearish engulfing candles and increased red volume bars, signaling seller dominance. Despite the downward pressure, the appearance of candles with narrow bodies may indicate a pause or potential exhaustion phase, although there is currently no confirmed bullish reversal.

==========

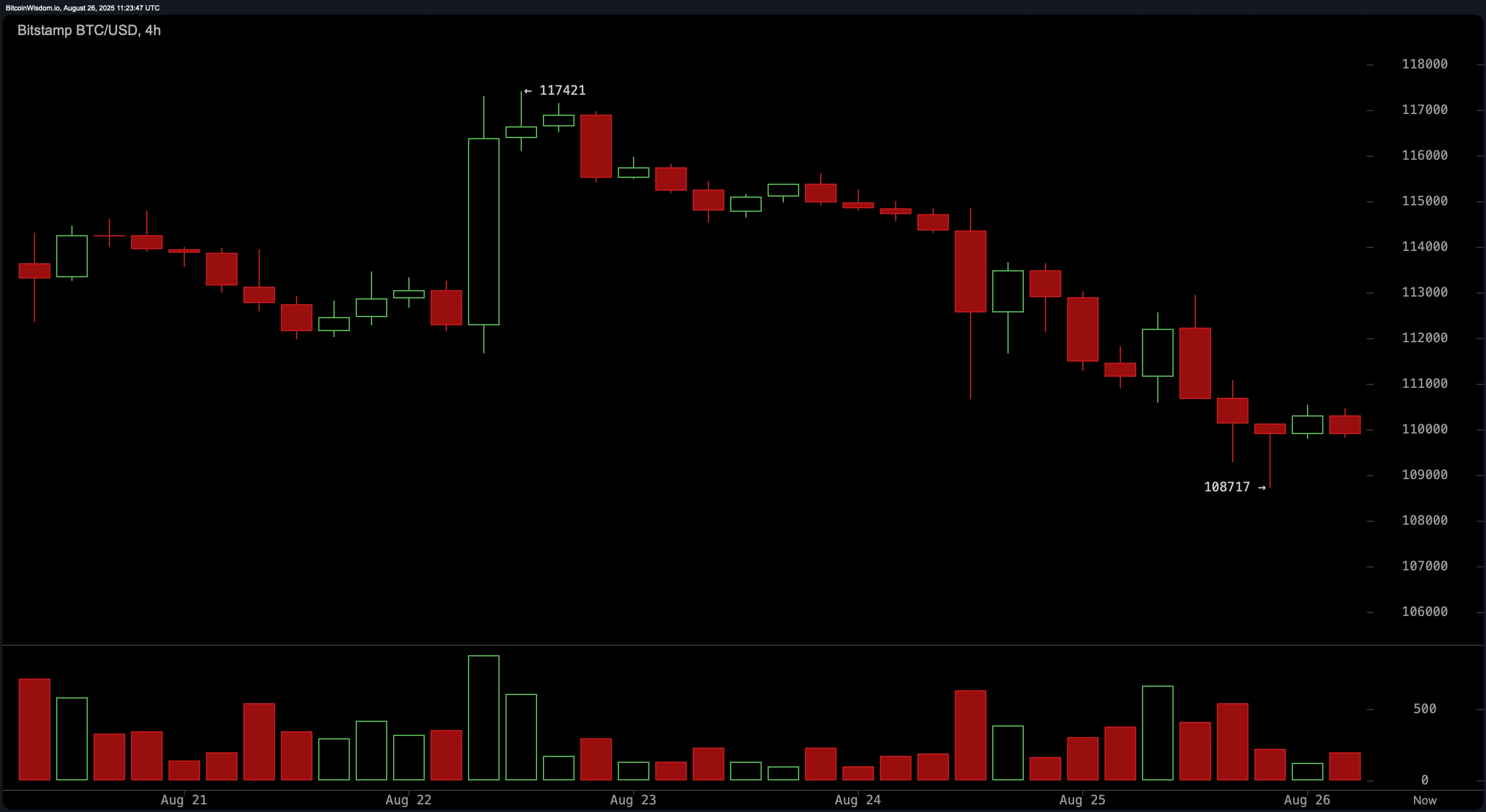

The 4-hour Bitcoin chart aligns with this bearish outlook, showing accelerated decline from $117,421 to $108,717.

Attempts to rise are consistently held back, with each bounce forming lower highs and facing resistance around $112,000 – $113,000.

Bearish volume spikes further confirm the weakness of bullish momentum.

A tentative double bottom structure is forming around $108,700, but without confirmation, traders are advised to exercise caution. Short-term positions on intraday bounces remain preferable while the resistance ceiling holds.

=========

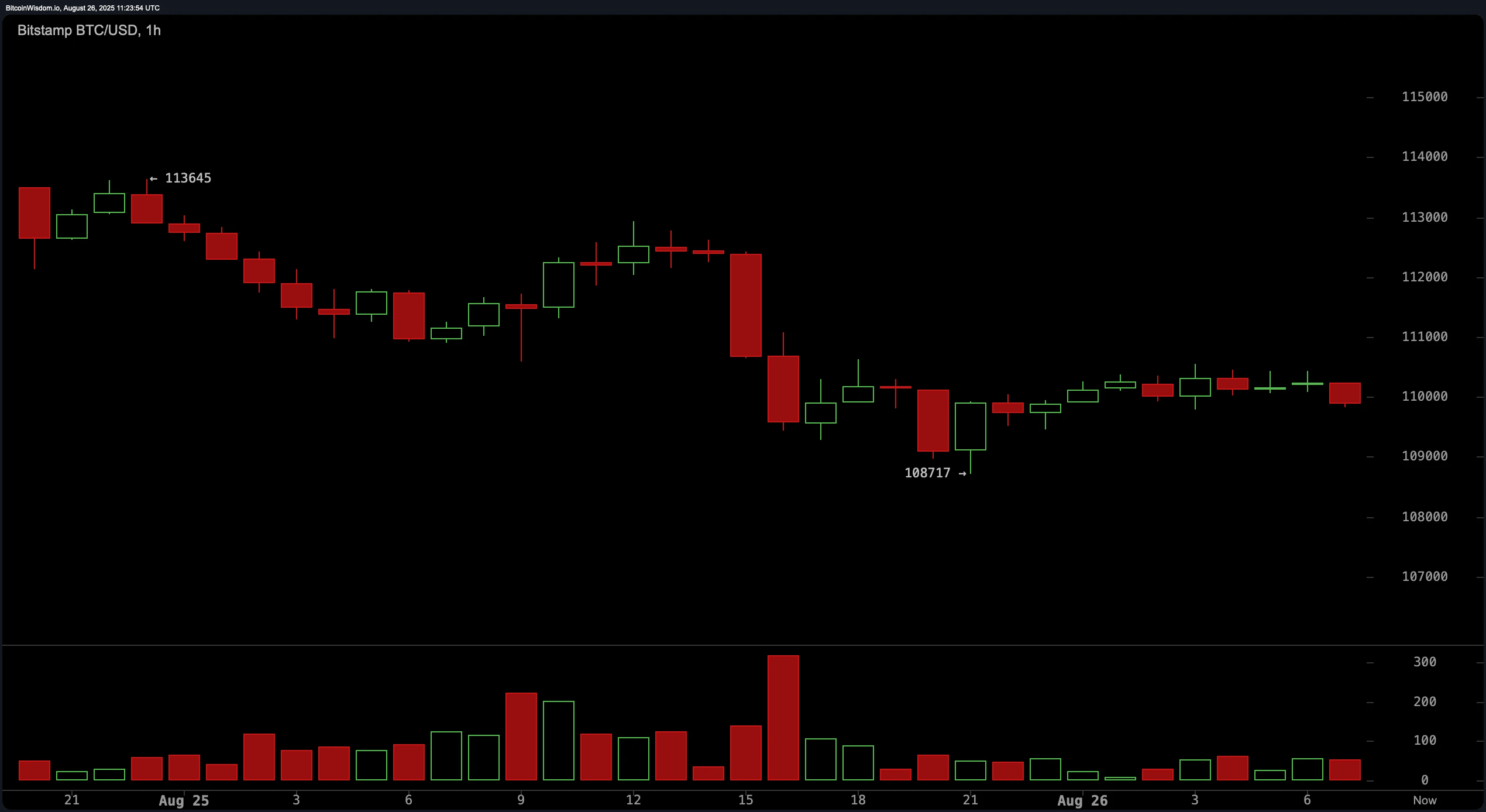

On the 1-hour timeframe, Bitcoin's trend shifts from clear bearishness to short-term consolidation.

After a recent drop, Bitcoin has stabilized in a narrow range between $109,000 and $110,500.

Decreasing candle sizes and declining volume indicate a contraction in volatility.

Although buyers have so far defended the support level at $108,700, upward movements have lacked continuation, indicating weak conviction.

Scalping trades may be considered on clearly defined setups, but traders should maintain strict risk control due to existing chaos.

==========

Bullish Verdict:

Although Bitcoin's price remains under pressure from short-term bearish momentum, successful defense of the support zone at $108,700 could provide a basis for a reversal.

Sustained movement above $113,000 along with improved volume and oscillator confirmation will be needed to change the structure towards a bullish recovery.

===========

Bearish Verdict:

Technical indicators across various timeframes continue to lean towards a downturn, with persistent rejections at key resistance levels and weak momentum confirming bearish control.

If Bitcoin fails to confidently reclaim the $113,000 level, sellers are likely to remain in command, with further declines towards $106,000 as the probable next step.