Written by: Qingfeng BTC | Structured Finance Researcher / Crypto Market Analyst

As the Treehouse Protocol lands on Binance's mission square, with the mainnet launch imminent, this low-profile yet structurally complete fixed income protocol is gradually attracting the attention of capital and researchers.

If its underlying logic (tAssets + DOR) constructs the on-chain 'interest rate hub' and 'standard yield notes', then this article will take you further into its product landscape:

Treehouse is not just a financial tool, but a set of on-chain fixed income infrastructure networks, expanding along a three-layer structural system.

These three layers are:

Note Layer (tAssets): Standardized structural certificates

Interest Rate Layer (DOR): On-chain discount rate system

Structural Layer (FRAs, Synthetics): Composite assets, secondary market, derivatives

This article will dissect layer by layer, analyze its product architecture and future path, and discuss how it transitions from a strategy interface to the on-chain 'debt/rate financial layer'.

I. Product structure map: Three-layer system with clear division of labor

1️⃣ Note Layer (tAssets): Standard yield certificates

tAssets are the products most directly encountered by users. Each tAsset is essentially a:

Real stablecoins (USDC, DAI, etc.) supported by strategy pools

Fixed interest rate + fixed term (30 days / 60 days / 90 days)

Principal + yield can be redeemed upon maturity

The design goal of this level is:

Provide simple and predictable 'on-chain financial products' for retail users / DAOs / RWAs

Characteristics:

✅ Similar to structured notes in the real world

✅ All yield paths and maturity rates are transparent and verifiable

✅ Can be used for DAO financial allocation / fixed income allocation / risk hedging

⚠️ Note: tAssets themselves are 'indivisible structural certificates', but this lays the foundation for higher-level products.

2️⃣ Interest Rate Layer (DOR): On-chain discount rate curve system

DOR (Discounted On-chain Rate) is the 'on-chain interest rate benchmark engine' in the Treehouse protocol.

Core objective is:

Collect annual return data for all 'fixed income strategies' on-chain

Modeling using factors such as time, volatility, and capital demand

Deriving a stable 'on-chain discount rate curve'

Similar to the role of LIBOR/SOFR in TradFi

Uses include:

🧠 Pricing anchor for tAssets

🧠 Future interest rate settings for all synthetic assets in Treehouse

🧠 May provide reference interest rates for external protocols (DAOs, DeFi strategies, re-staking platforms)

If you consider tAssets as 'bonds', then DOR is their 'credit discount curve'.

3️⃣ Structural Layer (FRAs & Synthetics): Composite assets and derivatives design layer

The third layer of Treehouse's product structure is still under construction, including:

✅ FRAs (Forward Rate Agreements)

Support users in locking in a fixed interest rate at a certain future point in time

Can be used for DAO budgeting, leverage strategy pre-setting

Similar to interest rate swaps / hedging tools in TradFi

✅ Synthetics (Synthetic Assets)

Package multiple tAssets into long-term compound notes

For example: 90 days + 180 days + 360 days combination, forming 'long-term bond-type assets'

May support functions like circulation, staking, lending, re-mortgaging, etc.

The goal of this layer's structure is:

Allow traditional financial operations like 'bond portfolios, option structures, yield swaps' to appear in DeFi

Ultimately forming a core foundation of an 'on-chain bond market + interest rate derivatives market'.

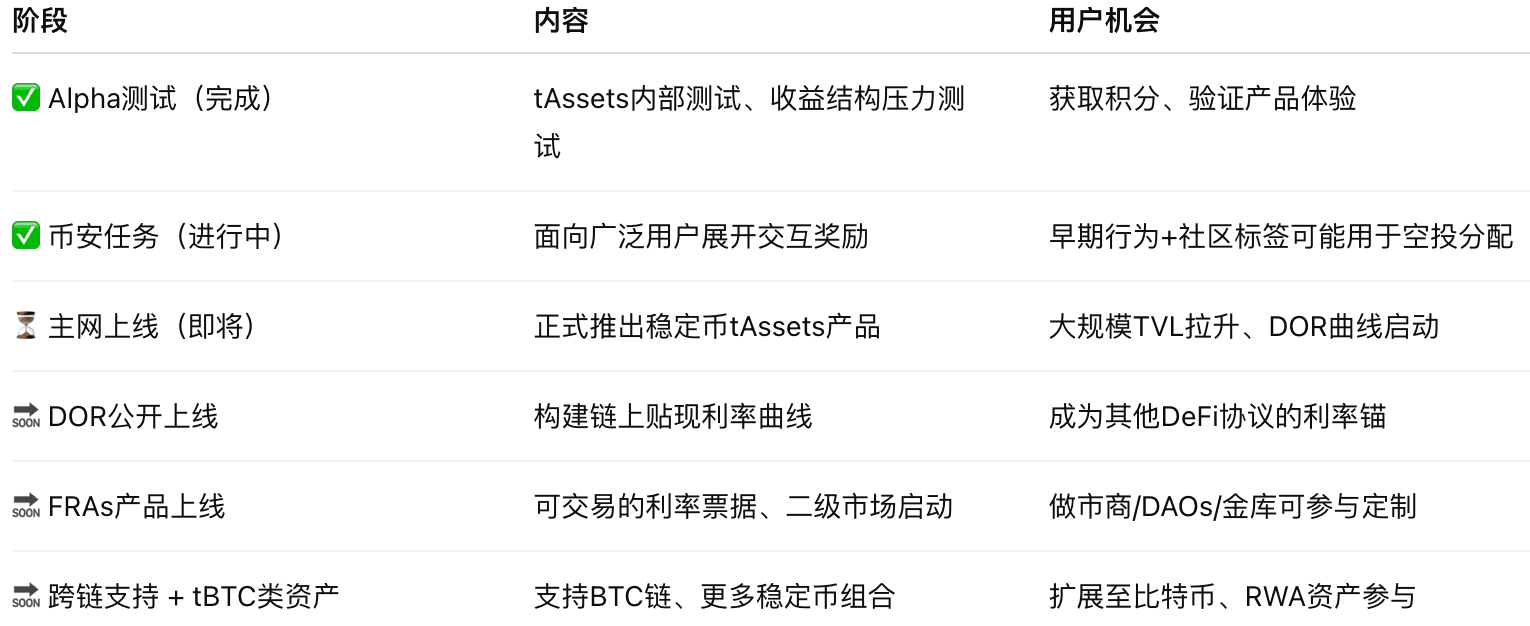

II. Current product roadmap: What are the key stages?

Treehouse has basically completed the testing of the first layer of note products and has entered the early airdrop task phase.

Below is its currently known/published product roadmap rhythm:

III. Future development map: Three clear growth mainlines

User layer growth: Standard financial products → DAO treasury tools → Cooperative wallet integration

Interest rate layer output: DOR becomes the standard for on-chain interest rate tools → On-chain protocol interest rate anchor point

Asset layer expansion: Structured note combinations → Circulating asset markets → Connection with RWA projects

For example:

DAOs can use tAssets as stable income allocation

Secondary market for fixed income notes appears (can exit with a discount in advance)

Issue real assets (like T-Bills) as on-chain tAssets through RWA, pegging DOR as the interest rate reference

IV. Conclusion: The expansion of Treehouse is not about product offerings, but about building 'market infrastructure'

From any perspective, Treehouse does not resemble a 'hit project': it does not tell stories, does not rely on rankings, and does not cater to gambler psychology expectations.

But it may become one of the most fundamental aspects of future on-chain finance:

Every DAO checks DOR when budgeting

Every user configures tAssets in their wallet

Each RWA project packages notes using it, going through on-chain financing processes

What it's doing is not a 'product MVP', but a steadily laid out:

On-chain fixed income standardization path + interest rate benchmark output path + structured finance network interface

We are witnessing the 'starting point of the bond market in the crypto world'.