Two paradigms, two paths, who can build the next financial fulcrum?

Written by: Qingfeng btc | Structured finance researcher / crypto market analyst

The DeFi fixed income sector is entering a deep water phase.

From the earliest yield aggregators to the 'yield splitting' model brought by Pendle, and then to the 'structured notes + interest rate anchor' system that Treehouse attempts to build, this field, once considered too 'uninteresting', is gradually turning into a deep casino between capital and protocols.

If Pendle represents the 'first paradigm shift' in fixed income DeFi, Treehouse is likely the **'second definition'**.

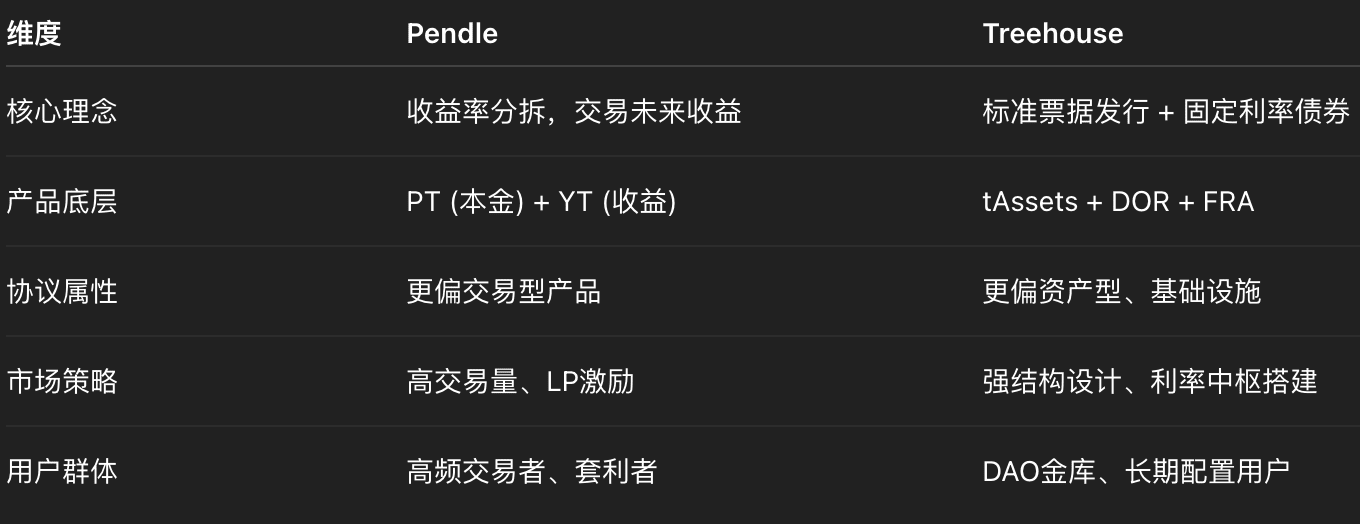

In this article, we will horizontally compare the two representative projects: Treehouse and Pendle:

Target positioning: to DeFi or to TradFi?

Technical path: split vs combine?

User group: trading type vs stable type?

Market space: gaming vs standards?

Long-term potential: asset layer or infrastructure?

1. Comparison of project fundamentals: What problems are they solving?

2. Technical paradigm differences: disassembly vs reconstruction

📊 Technical path of Pendle: split and trade again

Pendle splits yield assets (such as stETH) in two:

YT: Represents future yield (tradable)

PT: Represents the principal redeemed at maturity

The advantages of this approach:

Market-oriented pricing

Introduced true 'yield volatility' to DeFi

Opened the precedent for 'yield trading'

But there are also challenges:

High entry threshold: novice users find YT and PT complex to understand

High requirements for LPs: TVL depends on market-making capital depth

The essence of yield still depends on the risk of underlying assets

🧱 Technical path of Treehouse: combination + standardization

Treehouse does not do 'disassembly', but 'structured notes':

Fixed interest rates and fixed-period tAssets

Can be combined into FRA, long-term synthetic notes

All asset pricing is anchored to the DOR interest rate system

Advantages:

More suitable for DAO budgets, stable allocations

Higher integration with TradFi (note logic)

Easier to become a debt issuance tool for RWA projects

Challenges:

The growth rhythm of TVL may not be as explosive as Pendle's

No liquidity pools or market-making mechanisms have been launched yet

User education and acceptance of structured assets still need to be built

3. User perspective: speculation vs allocation

Let's look at two typical users:

✅ Pendle user profile:

High-frequency traders, DeFi players

Interest rate volatility arbitrage, manual rebalancing

Participate in ETH / LST yield direction judgment

More focused on trading, gaming, short-term profits

✅ Treehouse user profile:

DAO treasury / RWA projects / stablecoin protocols

Requires medium-term stable yields or predictable cash flows at maturity

Long-term allocation, strategic use

Closer to traditional institutional logic

In other words:

Pendle is the 'yield futures market' of DeFi,

Treehouse is the 'wealth management note market' of DeFi.

4. How to coexist in the DeFi market?

In fact, the two are not opposites, but complementary:

Treehouse can serve as an asset issuer, providing Pendle with separable tAssets

Pendle can accept the structured asset trading market of Treehouse, providing secondary liquidity

DAOs can use Treehouse to manage the treasury and then hedge or arbitrage with Pendle

From a higher dimension perspective:

Pendle is the 'interest rate trading layer', Treehouse is the 'interest rate structure layer'

Both jointly built the 'yield financial infrastructure' of DeFi

5. Who is more likely to become the industry standard in the future?

There is no single answer to this question, but we can observe some trends:

6. Conclusion: different paradigms, building the same market

Pendle is a pioneer in exploring on-chain yield liquidity, while Treehouse is a builder designing 'interest rate standards and structured assets' for on-chain assets.

This 'dual-hero' situation is not competition but a symphony:

On one side is financial innovation in yield rights trading,

On one side is the institutional design of on-chain bonds.

In this new cycle of the 'on-chain yield market', the synergy of the two may be the beginning of DeFi's move towards scaled asset management.