🚀 CME XRP futures soar to $9 billion! Can the approval of a spot ETF help XRP rebound?

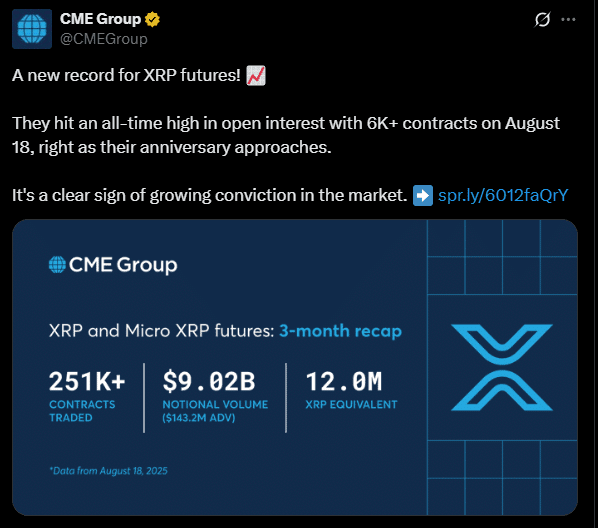

Recently, the crypto market has once again focused on XRP, especially after the CME futures market hit an all-time high🔥. Data shows that the open interest in XRP futures soared to nearly 12 million XRP, with a cumulative value of up to $9.02 billion💰. This indicates that institutional investors' interest in XRP has reached unprecedented heights, and market confidence has significantly increased📈.

However, everyone is asking — in the face of a slowdown in large institutions' layouts, can XRP really see a rebound? Especially before the potential approval of a spot ETF in the U.S., the market is filled with expectations and uncertainties🤔.

📊 Overview of CME futures market

According to data from the Chicago Mercantile Exchange (CME), the open interest in the XRP futures market has reached an all-time high, which is a way for investors to express their confidence. However, overall trends indicate a slight decline in demand and prices for futures recently💨.

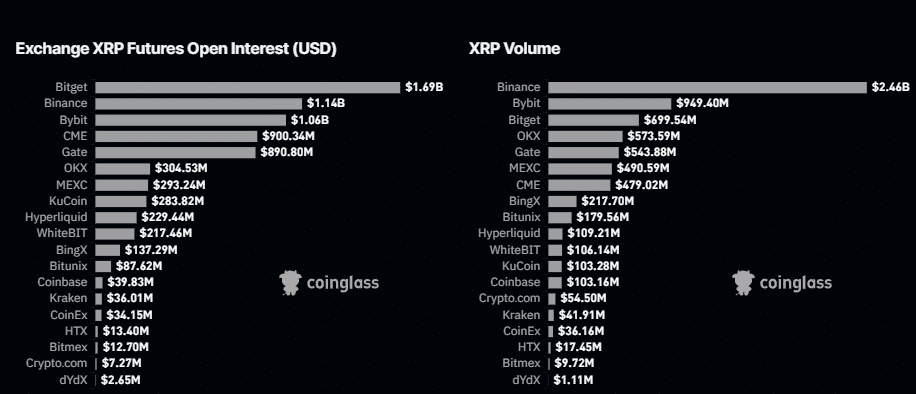

It's worth noting that CME ranks fourth among exchanges, behind Bybit, Binance, and Bitget. Although overall demand has decreased, the record market value of $9 billion still indicates strong market interest in XRP💎.

In the past few days, the price of XRP has shown a synchronized downward trend with futures demand. Looking back at late July, the total open interest in Bitcoin futures once peaked at $10 billion, but plummeted to $7.3 billion on August 22, cooling the entire market. XRP's market value fell from $3.6 billion to $2.8 billion, a drop of 23%📉.

🛡 Key observation of support levels

During the pullback in the third quarter, $2.8 became a key support level, and the market is generally concerned about whether this level can hold🧐. If the support holds firm, it will provide a solid foundation for XRP's rebound; conversely, if it is broken, the market may continue to face pressure.

Despite volatility, the growth of CME futures is viewed by market participants as a positive signal for the approval of the spot ETF✨. This means that institutional confidence in XRP is still accumulating, and once the ETF is approved, it may trigger a new wave of buying and market recovery.

🔗 Comparison of XRP and Chainlink

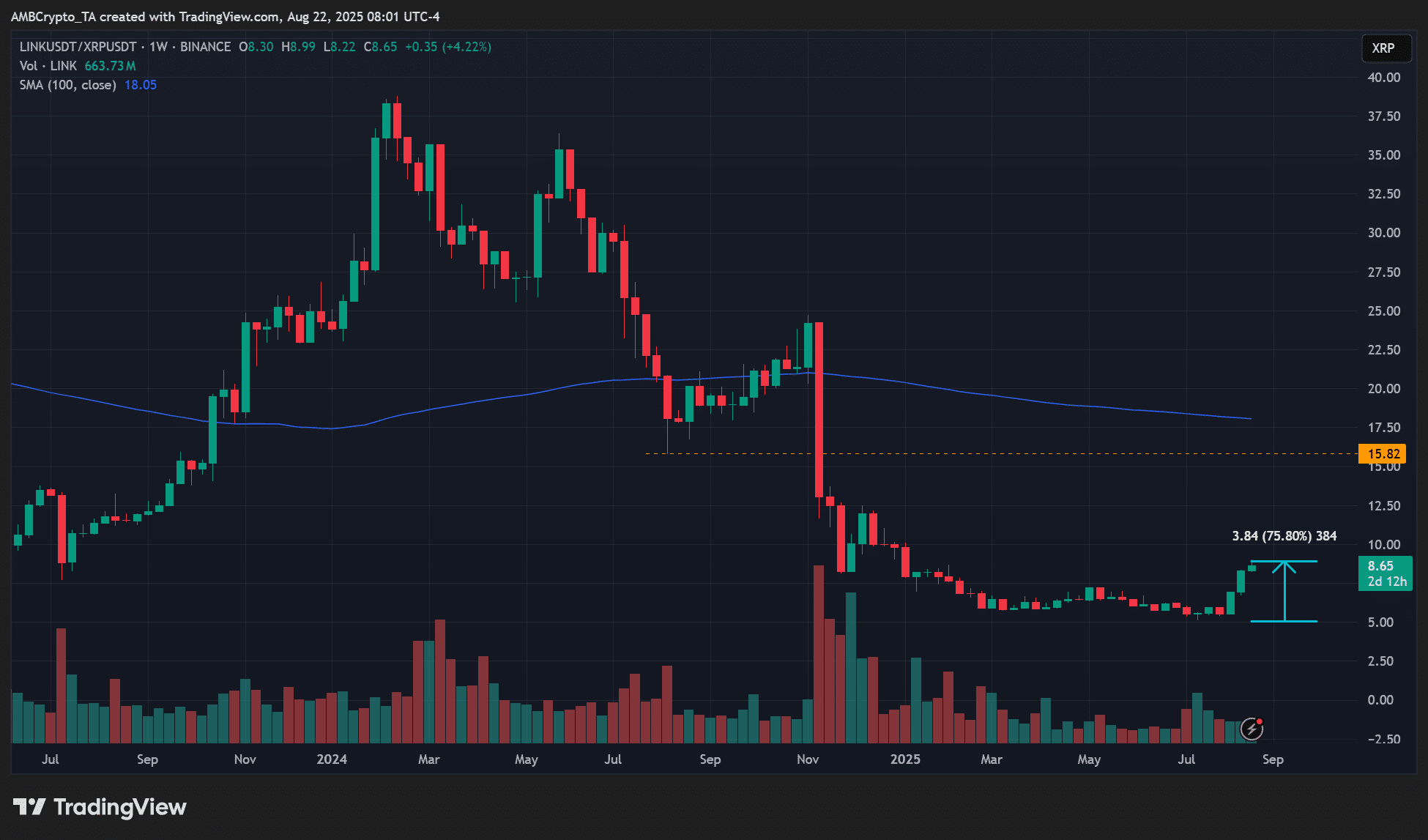

Interestingly, in the cryptocurrency Twitter community, XRP and Chainlink (LINK) investors seem to be caught in a 'cold war'❄️. A key official from Chainlink pointed out that Swift is collaborating with the XRP network, rather than XRP itself, sparking market discussions.

Data shows that LINK has risen 75% in three weeks, temporarily outperforming XRP in the third quarter📈. Nevertheless, XRP's long-term dominance over the past two years cannot be ignored💪. This leaves investors with a question — can LINK truly surpass XRP in the short term?

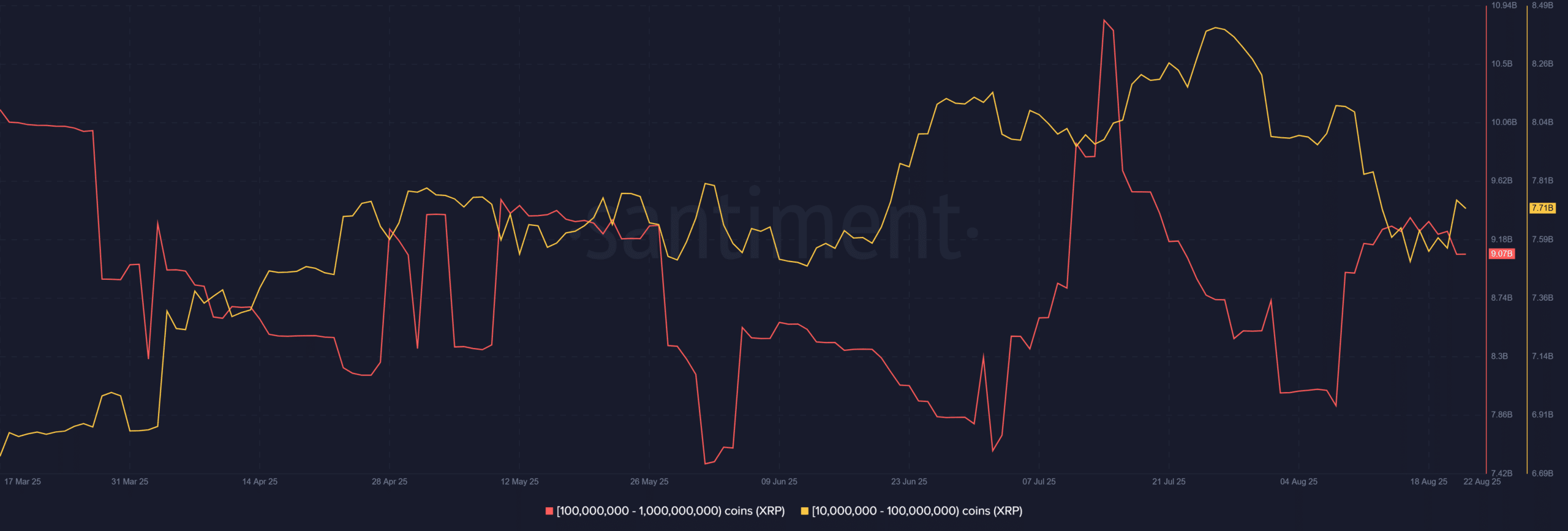

🐋 Changes in whale activity

In the market, the major whale group holding 10 million to 1 billion XRP has recently seen a reduction in sell-offs🔻. Compared to the significant sell-offs in July and early August, this change is particularly crucial.

The robust bidding from these large investors may provide strong support for XRP, easing the pressure of a pullback. If whales increase their buying power again💸, it is expected to drive the market into a new round of rebound.

⚡ Institutions and market sentiment

XRP's recent performance is not only influenced by price but is also closely related to the strategies of institutional investors. Events such as Federal Reserve policy adjustments, the adoption of stablecoins, and mining acquisitions have collectively driven institutional participation in XRP📊. Once viewed as a 'retail coin', XRP is now gradually attracting large funds, and the market structure is quietly changing.

In the short term, traders are mainly focused on:

1️⃣ Can XRP hold the support level around $2.8? 2️⃣ Will the approval of the spot ETF trigger new buying? 3️⃣ The game between whales increasing their positions and retail investors taking profits 4️⃣ Market sentiment and the response of open interest in futures contracts

If these factors align smoothly, XRP is expected to welcome a medium to short-term recovery trend🚀.

💡 Summary

CME futures hit all-time high, market confidence increases

Approval of spot ETF may become a catalyst for price rise

Whale sell-off eases, potential buying supports price

Key support level at $2.8, short-term trend worth monitoring

The trend of XRP is not only about price but also reflects the institutionalization and compliance processes of the entire crypto market🌐. For investors, this is a market environment where opportunities and risks coexist. Keeping an eye on trading volume, support levels, and ETF progress will be key to judging XRP's next move🔑. #xrp