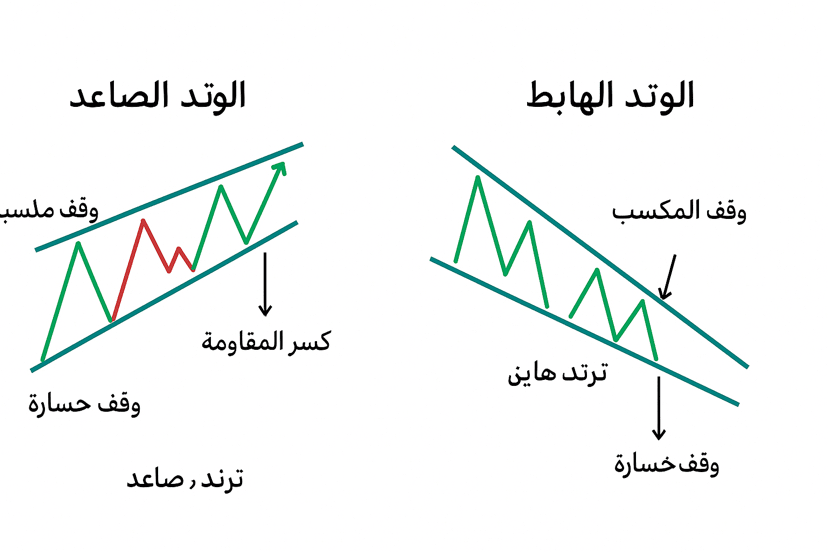

Falling Wedge pattern –

Pattern explanation:

• The Falling Wedge is a price pattern that forms when the price moves within two converging lines (descending support and resistance).

• The upper line (resistance) tends to go down.

• The lower line (support) also tends to go down, but its slope is weaker.

• This makes the shape of the pattern look like a “narrow triangle” but directed downwards.

Its properties:

1. Previous trend: Usually appears after a descending trend.

2. Internal Behavior: The price oscillates up and down within the boundaries of the wedge (as in the drawn green and red stocks).

3. Reversal Signal: When breaking the upper resistance line (breaking upwards) → considered a strong bullish signal.

4. Price Target: Often measured by the widest part of the wedge and added to the breakout point.

5. Stop Loss: Below the last low within the pattern (as shown “Stop Loss”).

Notes on the chart:

• Written: “Break of Resistance” = Entry Point for Buying.

• “Take Profit” = target.

• “Stop Loss” = below the pattern.

• The large arrow at the bottom “Downward Trend” indicates that the pattern came after a decline.

🔑 Summary:

The Falling Wedge is often a bullish reversal pattern, meaning an increase is expected after it despite its descending shape.

Ascending Wedge:

Definition:

The ascending wedge is a price pattern that forms when the price moves within two converging ascending lines:

• The upper line = Resistance.

• The lower line = Support.

Since the two lines are ascending but coming closer to each other, the price is confined between them until a breakout occurs.

⸻

Properties of the ascending wedge:

1. Previous trend: Often forms after an ascending trend.

2. Behavior within the pattern: The price moves in ascending peaks and troughs, but weak and converging.

3. Decisive Point: Usually, the breakout occurs downwards (breaking support), giving a bearish signal.

4. Price Target: Measured by the distance between the widest part of the wedge and subtracted from the breakout point.

5. Stop Loss: Above the last peak within the pattern (or above the resistance line).

⸻

Significance:

• In an upward trend: Considered a bearish reversal pattern (warning of the end of the rise and the beginning of the decline).

• In a downward trend: It may appear as a continuation of the decline after an upward correction.

⸻

🔑 Summary:

The ascending wedge = a negative pattern in most cases, indicating a likelihood of price decline after breaking the lower support line.

Quick comparison between the ascending and descending wedge:

📌 Ascending Wedge

Shape: Ascending and converging support and resistance lines.

Previous trend: Often ascending.

Expected breakout: Downwards (breaking support).

Signal: A bearish reversal pattern.

Meaning: Weakness in the ascent and a potential start of a decline.

📌 Falling Wedge

Shape: Descending and converging support and resistance lines.

Previous trend: Often descending.

Expected breakout: Upwards (breaking resistance).

Signal: A bullish reversal pattern.

Meaning: Weakness in the descent and a potential start of an ascent.

🔑 Summary:

The ascending wedge = negative (bearish).

The Falling Wedge = positive (bullish).

Here’s a clear educational example—the image above shows both the ascending and descending wedge patterns in a chart (for either gold or Bitcoin), with breakout points indicated:

The upper part represents the Ascending Wedge: Two ascending lines converge, often forming after an upward wave, and gives signals for a downward breakout.

The lower part represents the Falling Wedge: Two descending lines converge, often appearing after a downward wave, and gives signals for an upward breakout.

Real examples:

1.Bitcoin: Real Falling Wedge pattern

According to a recent report, Bitcoin moved within a descending wedge for four months, then successfully broke above the wedge resistance and closed above the 200-day moving average, giving a strong bullish signal.

The price target was divided by measuring the width of the wedge and adding it to the breakout point, indicating a potential reach to higher levels like $107,000.

2.Gold: Appearance of a bearish Rising Wedge pattern

In the gold chart, an ascending wedge appeared during an upward trend and acted as a warning of the end of the rise. After the pattern completed, the price quickly declined, demonstrating the effectiveness of this pattern in predicting reversals.

Summary of comparison in a practical verbal context:

Descending Wedge pattern:

Appeared in Bitcoin.

The price formed within two intersecting descending ranges.

The breakout occurred upwards, signaling the start of an increase.

Strong upward signal and a clear strategy for the target (measuring the width of the pattern).

Real example: Breaking the 200-day moving average and aiming for a target value of $107,000.

Ascending Wedge pattern:

Appeared in gold.

The price broke the pattern upwards, but the breakout came downwards.

Strong reversal signal and a warning of the end of the upward trend.

Real example: A pattern appeared at a peak and translated into a rapid price decline.

Summary:

The Falling Wedge pattern in Bitcoin is a great practical example of a bullish reversal, with a calculated price target and a strong base.

The Ascending Wedge pattern in gold indeed proves to be a bearish reversal pattern; everyone bought it thinking it was a continuation, but it quickly collapsed.