As one of the few cryptocurrencies beating out wider market headwinds, bullishness is building for the AAVE price outlook.

Aave has found a potential bottom at $175, rebounding over 5% over the past 12 hours to reclaim $190 as most other altcoins face profit-taking and a shakeout of weak hands.

The rebound comes just days before the U.S. Federal Reserve’s annual economic symposium, a key event that will set the tone for potential September interest rate cuts.

This week will be decisive for rate cuts.

This week will be decisive for crypto. pic.twitter.com/LINyXkAx5F

— CryptoGoos (@crypto_goos) August 20, 2025

Traders are de-risking in anticipation of hawkish comments, though analysts still expect up to four cuts before year-end, with the potential to stimulate new demand for risk assets like crypto.

What’s Happening With Aave?

Aave is carrying its weight on fundamentals alone, with on-chain metrics noting record adoption.

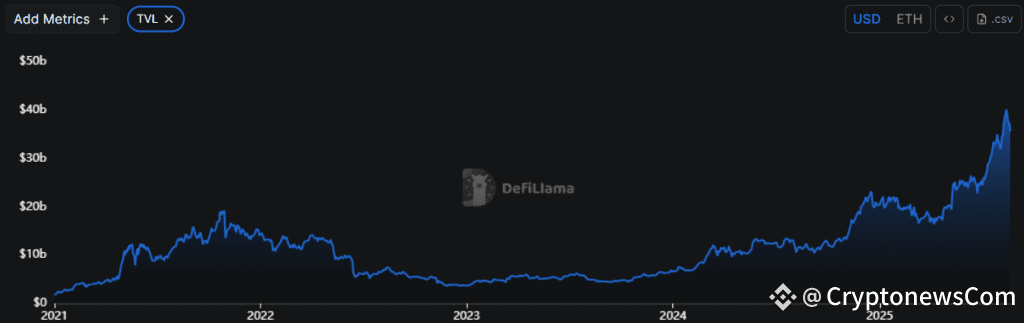

DefiLlama data shows that total value locked (TVL) on Aave has surged over 50% in the past three months to a peak of 40 billion, a sign of increasing user stickiness and protocol engagement.

Aave Total Value Locked (TVL) hits a new all-time high. Source: DefiLlama.

Aave Total Value Locked (TVL) hits a new all-time high. Source: DefiLlama.

This pace of growth strengthens XLM’s position as a credible DeFi play as the bull market matures, solidifying Aave as the go-to lending protocol.

Since mid-July, the majority of all revenue on lending protocols has been on Aave v3. pic.twitter.com/j1JigMOkfU

— DefiLlama.com (@DefiLlama) August 19, 2025

AAVE Price Analysis: Can the Bull Run Go on?

The market warming effect of bullish fundamentals could give Aave the momentum it needs to break free from a bull flag pattern, extending its early August rally.

The key breakout threshold sits at $290, a resistance level that has yet to flip into solid support.

That said, momentum signals suggest that bulls are regaining control. The RSI has bounced from the low 30s into the mid-40s, indicating rising buy pressure.

The MACD line has also formed a golden cross, surpassing the signal line, a move which often marks the start of a short-term uptrend on the 4-hour chart.

A successful breakout opens the door for a retest of past strong resistance around $310 and the 2025 high around $340.

If both these levels can be recovered, the full flag pattern breakout sets a potential $380 AAVE price target, representing a 32% gain from current prices.

That outlook, however, hinges heavily on macro signals. A dovish tone from the Fed at the August 22 symposium would likely set the stage for risk-on appetite in anticipation of rate cuts.

A hawkish outcome could instead see AAVE retrace to retest support at $275, opening the door for deeper downside.

Traders Are Also Betting on the Bitcoin Ecosystem this Bull Run – Here’s Why

Those who have opted for alternative Layer 1s over the leading crypto may be forced to reconsider, as the Bitcoin ecosystem finally addresses its biggest limitation: ecosystem growth.

Bitcoin Hyper ($HYPER) is bridging the reliability of Bitcoin with Solana’s lightning-fast tech, creating a Layer-2 network that’s both secure and incredibly efficient.

Slow transactions, high fees, and limited programmability have held Bitcoin back from competing with Ethereum and Solana—until now. And just in time.

With some analysts predicting BTC could hit $250,000 this cycle as ETFs and corporate treasuries drive fresh traditional finance demand, $HYPER is well-positioned to ride the wave.

Investors are already rallying behind the project with over $10.8 million raised in its ongoing presale, potentially credited to its high 103% APY on staking that rewards early investors.

You can keep up with Bitcoin Hyper on X and Telegram, or join the presale on the Bitcoin Hyper website.

Click Here to Participate in the Presale

The post What is Happening with Aave? AAVE Price Defies Market Trends, Spikes Above $290 appeared first on Cryptonews.