ETH + FOMC = Volatility Ahead ? 🔥

Ethereum at Make-or-Break Zone: $4,100 Support in Focus!

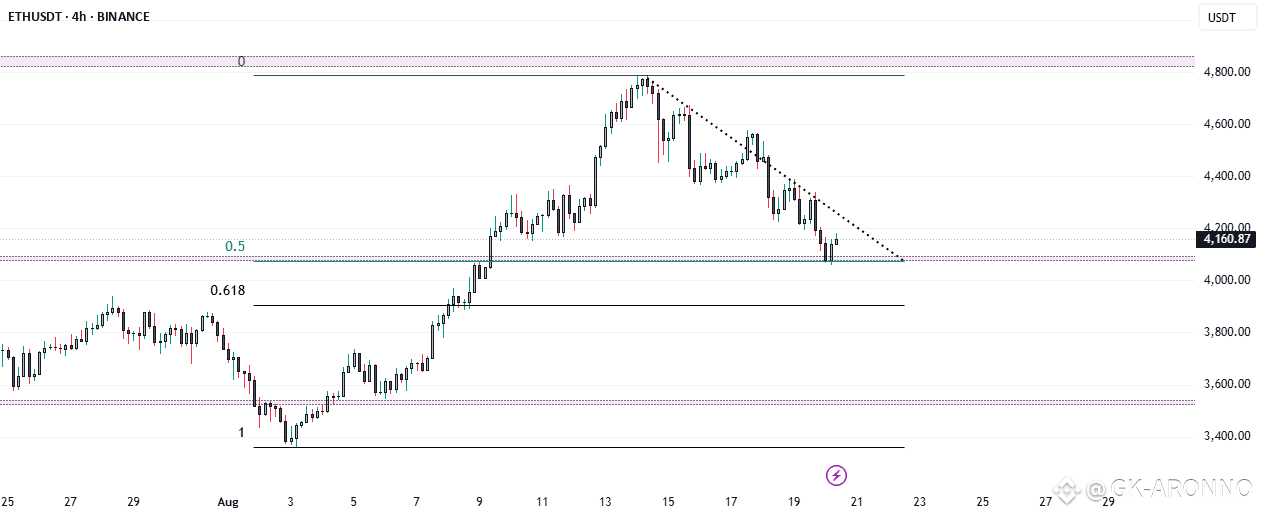

Ethereum (ETH/USDT) on the 4H timeframe is showing a decisive battle between bulls and bears. After topping near $4,700, ETH has been in a steady downtrend, respecting the descending trendline.

🔑 Key Levels to Watch

* Immediate Support: $4,100 – $4,150 (0.5 Fib retracement)

* Major Support: $3,950 – $4,000 (0.618 Fib retracement)

* Resistance Zone: $4,300 – $4,350 (descending trendline)

* Major Resistance: $4,600 – $4,700 (recent swing high)

📈 Bullish Scenario

✅ A breakout above $4,300 trendline resistance could trigger strong momentum toward $4,500 - $4,600.

✅ Holding $4,100 support will keep buyers in control.

📉 Bearish Scenario

❌ If ETH fails to hold $4,100, expect a deeper retracement toward $4,000 (0.618 Fib).

❌ A break below $3,950 may extend the fall to $3,700 – $3,600.

⚠️ Market Note

📌 Today’s FOMC meeting could heavily impact the crypto market trend.

Expect volatility as Fed commentary on interest rates may guide ETH’s next major move.

⚖️ Conclusion

ETH is at a critical support zone where the next move will define short-term direction.

* Above $4,300 → Bulls regain control.

* Below $4,100 → Bears target $4,000 and lower.