0Grab this chart

17

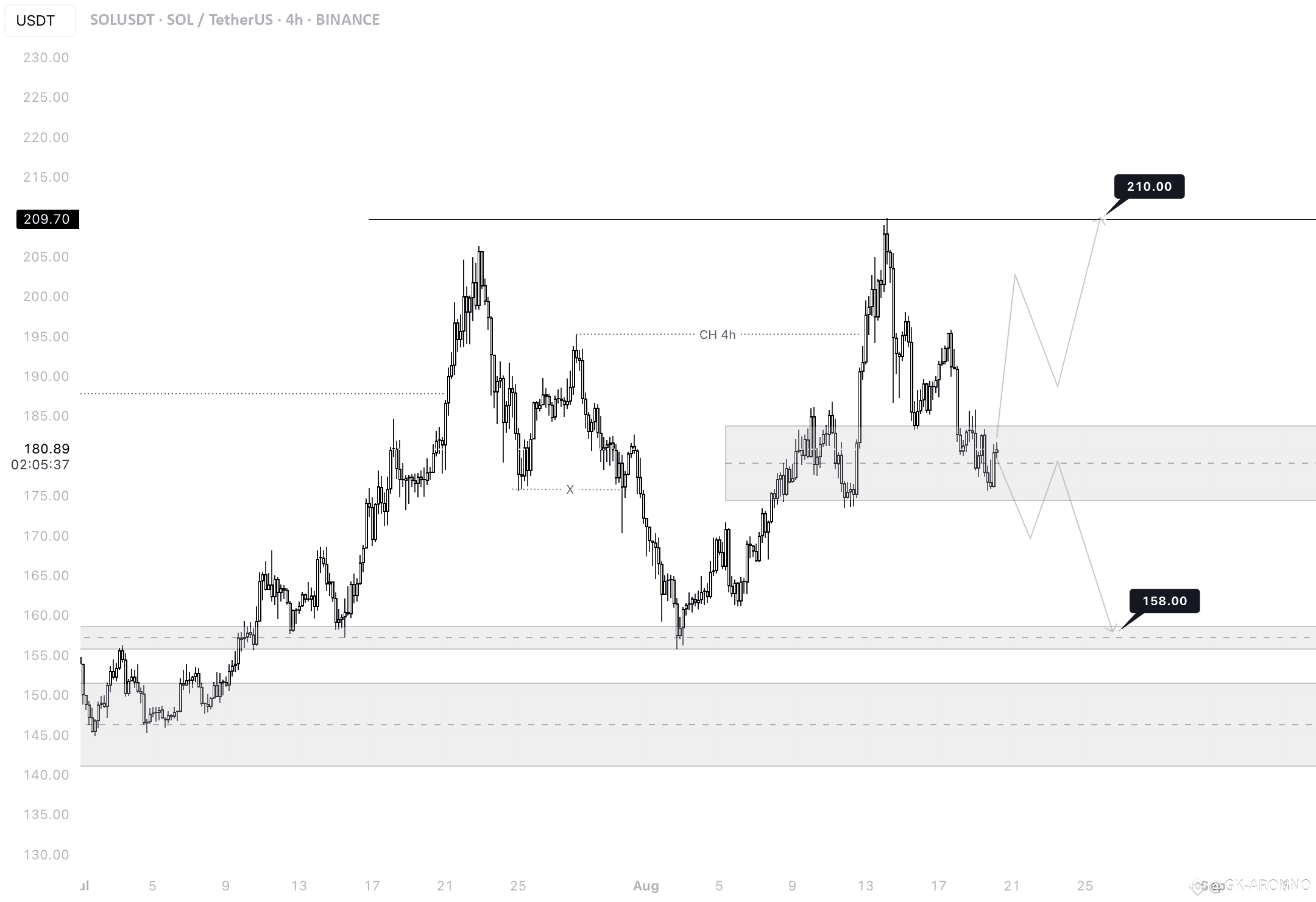

✅ SOL/USDT — 4H (Binance) | Aug 20, 2025 — Professional Technical Read

🔎 Chart context

• Structure is broadly bullish since early Aug, but the last leg printed a lower high → pullback into a 4H demand/FVG block.

• Price now ~180.7 inside that block. Two paths are drawn on your chart: a reaccumulation → breakout to 210 or a loss of demand → sweep 158.

📍 Key levels (approx.)

• Supply / liquidity above: 200–210 (major liquidity line marked 210.00).

• Decision block (current): ~175–183 (4H demand/FVG; prior breakout origin).

• Pivot / CH reference: ~194–196 (CH 4H label — reclaim turns momentum cleanly bullish again).

• Support below: ~158 (tagged on chart), then 150–145 (deeper old base).

🧭 Market structure & liquidity map

• After the CH 4H and rally to the recent peak, price created a higher low around ~165–168, then a spike to ~205, and is now mitigating the 175–183 block.

• Wicks show responsive buyers at the upper edge of the block, but the midline is soft; a clean close below ~175 likely exposes the resting liquidity at 158.

• Above, buy‑side liquidity sits over 200 with a cluster around 209–210 (equal‑highs feel).

📈 Bullish continuation (probable if 175–183 holds)

Conditions:

• Hold 175–183 with a 4H HL and impulsive reclaim of ~188–190, then CH area ~195.

Path & targets:

1. Trigger reclaim: 188–190 → momentum confirmation above 195 (CH 4H).

2. TP1: 198–200 (partial).

3. TP2: 205–206 (prior swing).

4. TP3: 209–210 (liquidity sweep).

Invalidation: a 4H close below 175.

📉 Bearish continuation (activated on loss of demand)

Conditions:

• 4H close below 175 or failed bounce capped under 188–190.

Path & targets:

1. Pullback/failed retest into 182–186 (sell zone).

2. TP1: 168–166 (intermediate shelf).

3. TP2 (main): 158 sweep (your downside tag).

4. Extension (if momentum persists): 150–145 mitigation.

Invalidation: sustained reclaim >195.

🎯 Trade plans (system‑agnostic