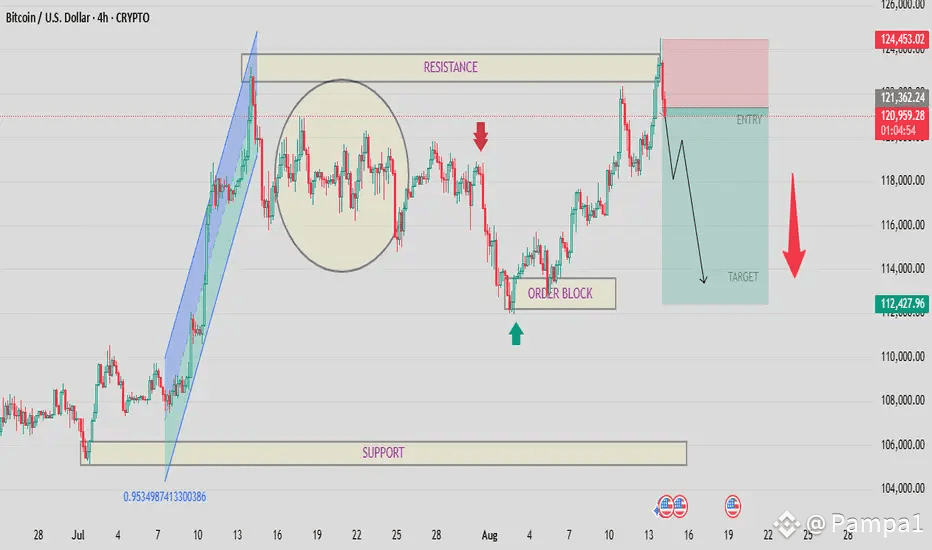

Bitcoin (BTC/USD) has recently experienced a sharp drop, approaching a key lower support zone that traders are watching closely. After mounting strong gains in July 2025 and briefly testing resistance near $122,000-$123,000, BTC price pulled back sharply amid a mix of macroeconomic headwinds and profit-taking. The U.S. Federal Reserve's decision to maintain higher interest rates without cuts has dampened risk appetite, fueling this retracement.

Key support levels near $112,000 to $110,000 are critical in the near term. A bounce from this zone could attract buyers looking for a favorable entry after the drop. However, failure to hold these supports may lead to further declines toward $106,000 or even lower, heightening volatility.

Technically, Bitcoin has broken out of a consolidation channel to the upside in the past, but the recent drop signals a countertrend move as sellers lock in profits from recent highs just below $124,000. This correction may be a healthy pause before another leg up, as past performance shows August is often a challenging month historically, with average declines observed before renewed rallies.

Traders should watch for a recovery bounce in the lower demand zone, which could provide a strong foundation for the next upward move. Stop losses are crucial around these support levels to manage downside risk, while profit targets should be adjusted given the recent volatility.

This setup offers a high-octane opportunity for nimble traders to capitalize on the current weakness, balancing between seizing a well-timed entry near support and protecting against further drops. The crypto market remains highly reactive to macro news, so staying alert to Federal Reserve signals and regulatory developments will be essential.

In summary, Bitcoin's current sharp drop approaching a lower zone is a critical decision point: a potential rebound base or a sign of deeper correction. The next days and weeks will tell if this dip is a springboard or a selling cliff in the broader bull saga. Traders should be ready to act but also manage risks prudently in this volatile phase.