In cryptocurrency trading, many newcomers believe that substantial capital is required to achieve significant profits. The reality is different — with disciplined strategy, sound risk management, and mastery of chart patterns, even a modest starting capital of $680 can potentially grow into $40,000 over time.

The core skill enabling this transformation is pattern recognition — understanding market psychology through price formations. Once mastered, every chart becomes a roadmap for informed entry and exit decisions.

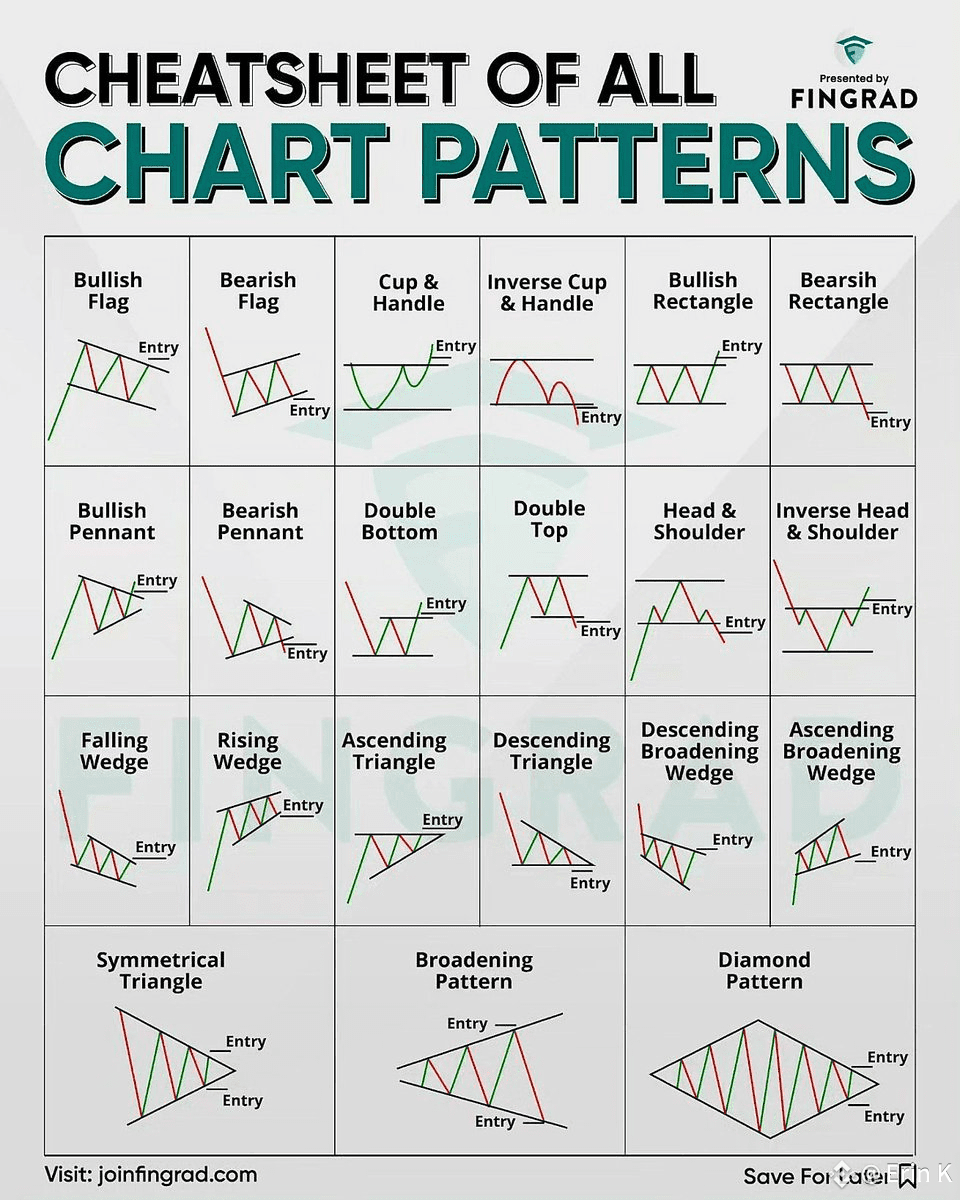

Step 1: Understanding the Four Core Pattern Categories

1. Bullish Continuation 🚀

Patterns: Ascending Triangle, Bullish Wedge, Bullish Flag, Bullish Symmetrical Triangle

Meaning: Indicates temporary consolidation before the price continues its upward trend. Ideal for entering strong uptrends early.

2. Bearish Continuation 📉

Patterns: Descending Triangle, Bearish Wedge, Bearish Flag, Bearish Symmetrical Triangle

Meaning: Signals a pause before further decline. Suitable for short trades or closing long positions.

3. Bullish Reversal 🔄

Patterns: Double Bottom, Triple Bottom, Inverted Head & Shoulders, Falling Wedge

Meaning: Marks the end of a downtrend and potential start of an upward move. Useful for identifying market bottoms.

4. Bearish Reversal ⚠️

Patterns: Double Top, Triple Top, Head & Shoulders, Rising Wedge

Meaning: Suggests the uptrend is losing strength, with potential for a downward reversal. Key for locking in profits.

Step 2: Structuring Your Trading Plan

Starting Capital: $680

Risk Per Trade: 2–3% ($14–$20)

Leverage: Use 3–5x only on high-confidence setups to avoid unnecessary exposure.

Entry: At the confirmed breakout point of the pattern.

Stop Loss: Placed just beyond the pattern’s key support/resistance level.

Take Profit (TP): Apply the “measured move” technique — target is the height of the pattern projected from the breakout.

Step 3: Leveraging the Power of Compounding

Consistent small gains, when reinvested, lead to exponential growth:

Target Gain Per Trade: 3–5%

Duration: 100+ trades over 6–12 months

Projected Growth Example:

Trade 1: $680 → $714

Trade 10: $960 → $1,008

Trade 50: $5,200 → $5,460

Trade 100+: $40,000+

Step 4: Prioritizing Risk Management

Even with a strong win rate, losses are inevitable. Effective traders:

Always set a Stop Loss

Avoid chasing missed opportunities

Align trades with the broader market trend

Step 5: Practicing Before Going Live

Before deploying real capital:

Backtest these patterns using historical price data

Validate setups using RSI, MACD, and volume analysis

Develop the ability to identify valid patterns in real time

Conclusion

With disciplined execution, consistent risk management, and mastery of the 16 essential chart patterns, it is possible to scale a modest account into a significant portfolio. In trading, skill compounds as much as capital — the more you refine your craft, the more your results will grow.