Overview

• Huma Finance pioneers the PayFi model, transforming real-world income—like invoices, salaries, and receivables—into on-chain collateral for credit access.

• This PayFi protocol makes DeFi inclusive by enabling lending for people and businesses who lack crypto collateral but have steady income.

• Since its April 2025 launch, Huma has processed over $4.5 billion in transactions with zero defaults, demonstrating both demand and reliability.

Core Offerings

• PayFi Lending Model – Borrow against future payments using programmable smart contracts.

• Dual Lending Paths – Huma Institutional (permissioned, KYC-verified) and Huma 2.0 (permissionless, for retail users) open the protocol up to broad use cases.

• Multi-Chain Reach – Active across Solana, Polygon, Stellar, Celo, and Scroll, with 12 lending pools seamlessly spanning ecosystems.

Technical & Ecosystem Highlights

• On-Chain Underwriting – Automated loan approval using both on-chain and off-chain data for transparent risk assessment.

• Programmable Payments – Smart contracts manage repayment flows and settlement timing—no manual processes required.

• Real-World Yield Generation – Liquidity providers earn stablecoin returns from invoice financing, payroll advances, and payment settlement activities.

• Modular PayFi Architecture – Distinct roles for borrowers, capital providers, underwriters, and platform partners ensure flexibility and scalability.

• $HUMA Token Utility – A capped supply utility and governance token enables staking, voting, revenue sharing, and access to advanced protocol features.

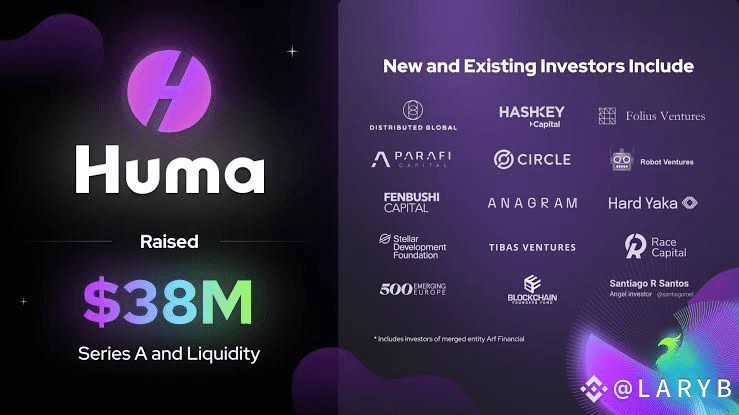

Funding & Backing

• Credible Backers – Supported by Solana, Circle, Stellar Development Foundation, and Galaxy Digital, bringing both tech and market trust.

• Robust Usage Metrics – More than $2.3 billion in credit originated and $4.5 billion total transaction volume highlight rapid traction.

Why It Matters

• Real Credit for Real People – Opens paths to financial inclusion for those without crypto assets, instead tapping into future income.

• Attractive Real-Yield Opportunities – Liquidity providers earn from real economic activity, not just crypto speculation.

• Bridges DeFi and Traditional Finance – By tokenizing real-world receivables, Huma creates a new layer of financial interoperability.

• Enterprise and Retail Friendly – Dual-tier access (institutional & retail) ensures broad participation while preserving regulatory rigor.

• Scalable, Trust-Minimized Lending – On-chain automation, smart contract flows, and proven performance make Huma a standout in real-world DeFi innovation.

#HumaFinance @Huma Finance 🟣 $HUMA