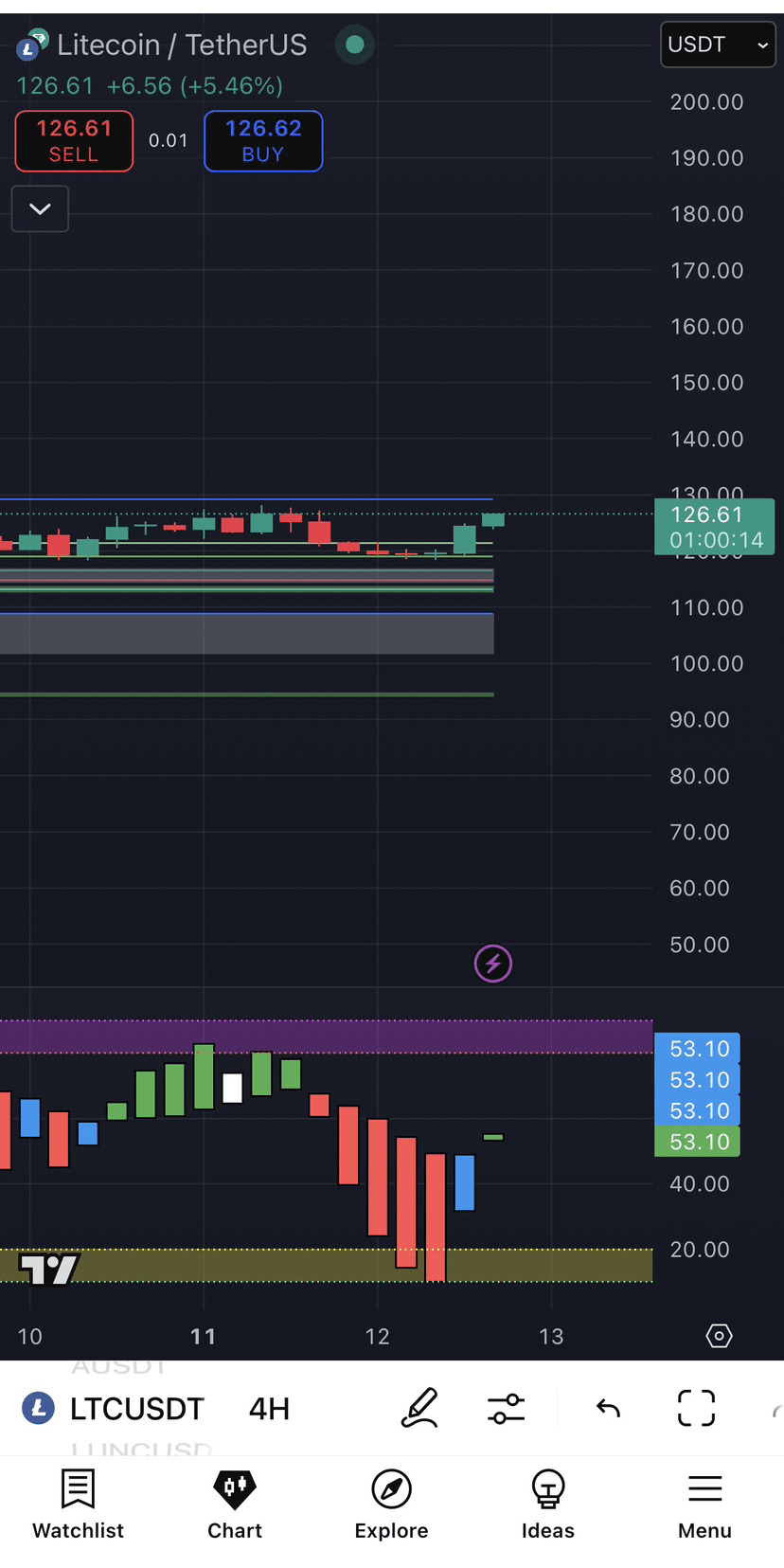

Time period: 4 hours

Current Price: $126.61 (+5.46%)

1. Price Trends and Key Ranges

• Short-term trend: The 4-hour K-line shows that the price rebounded strongly from the $120 support level and broke through the range above $126.

• Resistance Test: The current price is testing the short-term resistance level of $127-130. If it can break through, it is expected to rise rapidly to $140-150.

• Support range: $118–120 remains the key support level, if it falls below, the price may return to $110.

• Bullish breakout zone: If it breaks through $130 on strong volume, the next targets will be $150, $180 and eventually challenge the psychological barrier of $200.

2. Technical indicators and momentum

• The green bullish candlestick on the 4-hour chart shows that buyers are actively intervening.

• Volume confirmation is key. Every breakout needs to see an increase in buying pressure to sustain the upward momentum.

• The momentum/oscillator area below the chart showed a rebound from oversold territory, suggesting further upside potential in the short term.

3. Market Background

• Ethereum is heading towards $5,000, driving the entire altcoin market upward; historically, when ETH rises, LTC tends to follow as traders transfer profits to older, larger-cap currencies.

• If Ethereum breaks through its all-time high (ATH), LTC could gather momentum and move towards its long-term target of $500. However, this is a multi-month expectation.

• Chinese traders react quickly to strong performance in large-cap cryptocurrencies, and are particularly active when BTC and ETH are in a clear bullish trend.

4. Contract Trading Strategies (Short-Term Chinese Traders)

• Entry: Consider going long on a pullback to $122–124 and confirmation of support.

• Breakout strategy: Enter the market when the 4-hour K-line closes above $130, with a target of $140-150.

• Stop Loss: Set strictly below $119 to protect capital.

• Leverage recommendation: Since volatility will increase significantly when ETH approaches its historical high, it is recommended to avoid excessive leverage; 5–10x is more stable in this type of trend market.

5. Spot Trading Strategies (Swing Trading and Hodling)

• Position Building Range: $118–124 remains an ideal buying zone for medium-term holding.

• Target price: $140, $180, and $200 in stages.

• If LTC holds above $200 while ETH nears its all-time high, long-term holders could eye the psychological target of $500, last seen during the 2021 bull run.

• Chinese spot traders should also monitor the RMB/USD exchange rate, as local sentiment tends to accelerate buying when dollar-denominated assets appear cheap from a RMB perspective.

6. Long-term forecast

• Scenario 1 – Bullish: ETH breaks through $5,000 → BTC breaks through $90,000 → LTC receives speculative capital inflow → is expected to stand above $300 by the end of 2025, and if the altcoin season fully starts, $500 is also possible.

• Scenario 2 – Neutral/Short: ETH is blocked near its all-time high → BTC is trading sideways → LTC is stagnant between $150–200.

💡 Tip for Chinese traders: Monitor sentiment indicators in WeChat crypto trading groups and Binance CN; sudden spikes in social media discussion often precede large price swings in Chinese trading circles.