Many forecasts about the future trend of the price of Bitcoin are still bullish, but in the short term, it is necessary to pay attention to what might happen today.

In fact, the inflation data in the USA for the month of July will be released, and this could cause volatility in the financial markets.

The problem is that there are signals indicating that the price of Bitcoin might react poorly to this volatility today.

The data on inflation

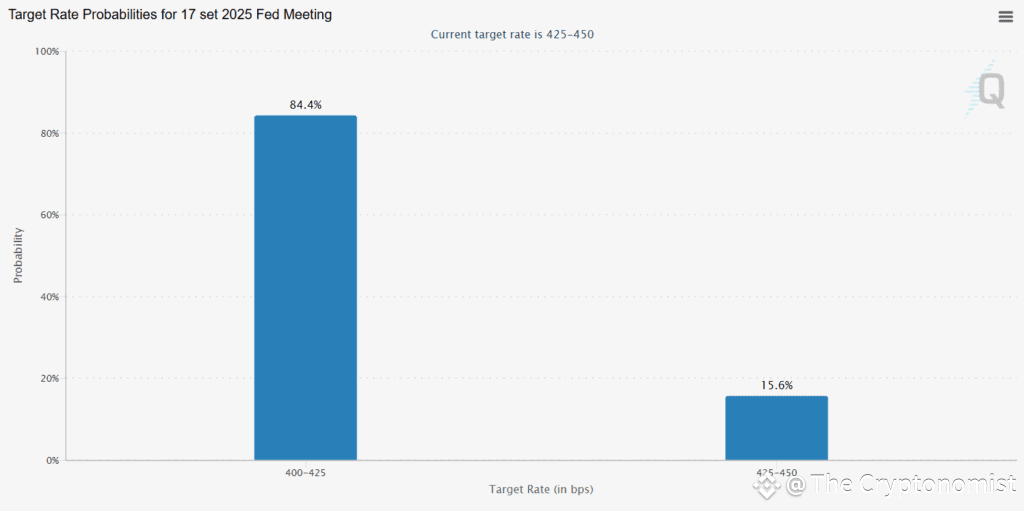

Currently, the markets are betting on a next cut in interest rates by the Fed in September, considered likely at more than 80%.

Analysts assign an 84.4% probability to a 25 bps interest rate cut during the next Fed meeting. Source: CME Group | Fed Watch

Analysts assign an 84.4% probability to a 25 bps interest rate cut during the next Fed meeting. Source: CME Group | Fed Watch

A potential cut would reduce the yield of American government bonds, thus prompting some current holders of Treasuries to sell them. Such a sale, if it were to occur, should theoretically weaken the dollar, and since the price trend of Bitcoin tends to be inversely correlated with the Dollar Index in the medium term, a potential weakening of the dollar could cause Bitcoin to rise.

However, there is still more than a month until the next Fed decision on rates.

In the meantime, today the updated data on inflation in the USA for the month of July will be released.

The fact is that, should inflation be high, the chances of a Fed rate cut in September would decrease, and with this also the chances of a decline in the Dollar Index.

Regarding the monetary policy of the US central bank, the most important data is the core inflation (excluding energy and food).

Currently, the consensus is for an increase in core inflation from 2.9% to 3%, particularly due to the Trump tariffs.

Note that Trump’s tariffs only slightly began to have a negative impact on prices in July, causing them to increase, and this dynamic at the current speed could continue for months.

The goal of the Fed is to bring inflation to 2%, so with core inflation rising to 3%, in theory, they should not cut rates.

It is expected, however, that they will do so both because they are too high, and especially because the Fed also has another primary objective, that of full employment, and the US labor market is showing small signs of difficulty, probably still due to Trump’s tariffs.

The reaction of Bitcoin’s price

If the data published today, related to core inflation, were to be exactly 3%, then most likely the reaction of the markets would be minimal.

If instead it should already be just 2.9% or 3.1%, the reaction could also be significant.

In particular, if the annual core inflation in the USA in July were to remain at 2.9%, the reaction of the markets could also be very positive, because the probabilities of further Fed cuts in October and December would increase.

If, on the other hand, the annual core inflation in July were to rise to 3.1%, the reaction would be decidedly negative, because the probabilities of a cut already in September could decrease significantly.

It should be remembered that the markets are already pricing in this hypothetical cut, so if the probabilities were to collapse, they should align as quickly as possible.

The medium-term forecasts on the price of Bitcoin (BTC)

All this, however, applies only in the short term.

In the medium term, in fact, everything changes.

The point is that starting from July, the trend of the price of Bitcoin began to resemble, in proportion, that of the end of 2017.

In particular, compared to the trend of the Dollar Index, the monthly candle of Bitcoin’s price in July 2025 really resembles that of August 2017, and the current and incomplete one of this August still resembles that of September 2017.

At the time, after a relatively difficult September, there were then three crazy months, with the second largest speculative bubble ever inflated on the price of BTC, thanks to which it rose from less than $4,000 to almost $20,000, only to fall back to about $6,000.

Although it is by no means certain that history must repeat itself at all costs, there are still many analysts who see the price of Bitcoin rising to $150,000 by the end of the year.

Candlestick chart of Bitcoin price (BTC/USD), Binance market. Source: TradingView { “lineWidth”: 2, “lineType”: 0, “chartType”: “candlesticks”, “fontColor”: “rgb(106, 109, 120)”, “gridLineColor”: “rgba(242, 242, 242, 0.06)”, “volumeUpColor”: “rgba(34, 171, 148, 0.5)”, “volumeDownColor”: “rgba(247, 82, 95, 0.5)”, “backgroundColor”: “#0F0F0F”, “widgetFontColor”: “#DBDBDB”, “upColor”: “#22ab94”, “downColor”: “#f7525f”, “borderUpColor”: “#22ab94”, “borderDownColor”: “#f7525f”, “wickUpColor”: “#22ab94”, “wickDownColor”: “#f7525f”, “colorTheme”: “dark”, “isTransparent”: false, “locale”: “en”, “chartOnly”: false, “scalePosition”: “right”, “scaleMode”: “Normal”, “fontFamily”: “-apple-system, BlinkMacSystemFont, Trebuchet MS, Roboto, Ubuntu, sans-serif”, “valuesTracking”: “1”, “changeMode”: “price-and-percent”, “symbols”: [ [ “BINANCE:BTCUSD|1D” ] ], “dateRanges”: [ “1d|1”, “1m|30”, “3m|60”, “12m|1D”, “60m|1W”, “all|1M” ], “fontSize”: “10”, “headerFontSize”: “medium”, “autosize”: false, “width”: 800, “height”: 500, “noTimeScale”: false, “hideDateRanges”: false, “hideMarketStatus”: false, “hideSymbolLogo”: false } Peter Thiel’s prediction on Bitcoin

According to the co-founder of PayPal, Peter Thiel, the Bitcoin boom is similar to the Internet boom of the late ’90s of the last century.

Thiel, however, also argues that Bitcoin is still undervalued, just like the Internet was in the early 2000s.

If you compare the current overall value of the various activities on the Internet with what the activities on the Internet had overall 25 years ago, the gap turns out to be immense. At that time, just to be clear, there were already Amazon and Google, but there were neither Facebook nor Twitter (now X) yet.

Furthermore, Google was not yet listed on the stock exchange, and Amazon shares, despite the infamous dot-com bubble, were valued at forty times less than their current value on the stock exchange.

This view is, in part, shared by many innovation experts, but in fact, it only concerns the long or very long term.