Ethereum $ETH breaking through 4300 can be said to be a new high in recent years! Below, the author will analyze the ETH trend based on price aspect, sentiment aspect, and possible future trends.

I. Price aspect

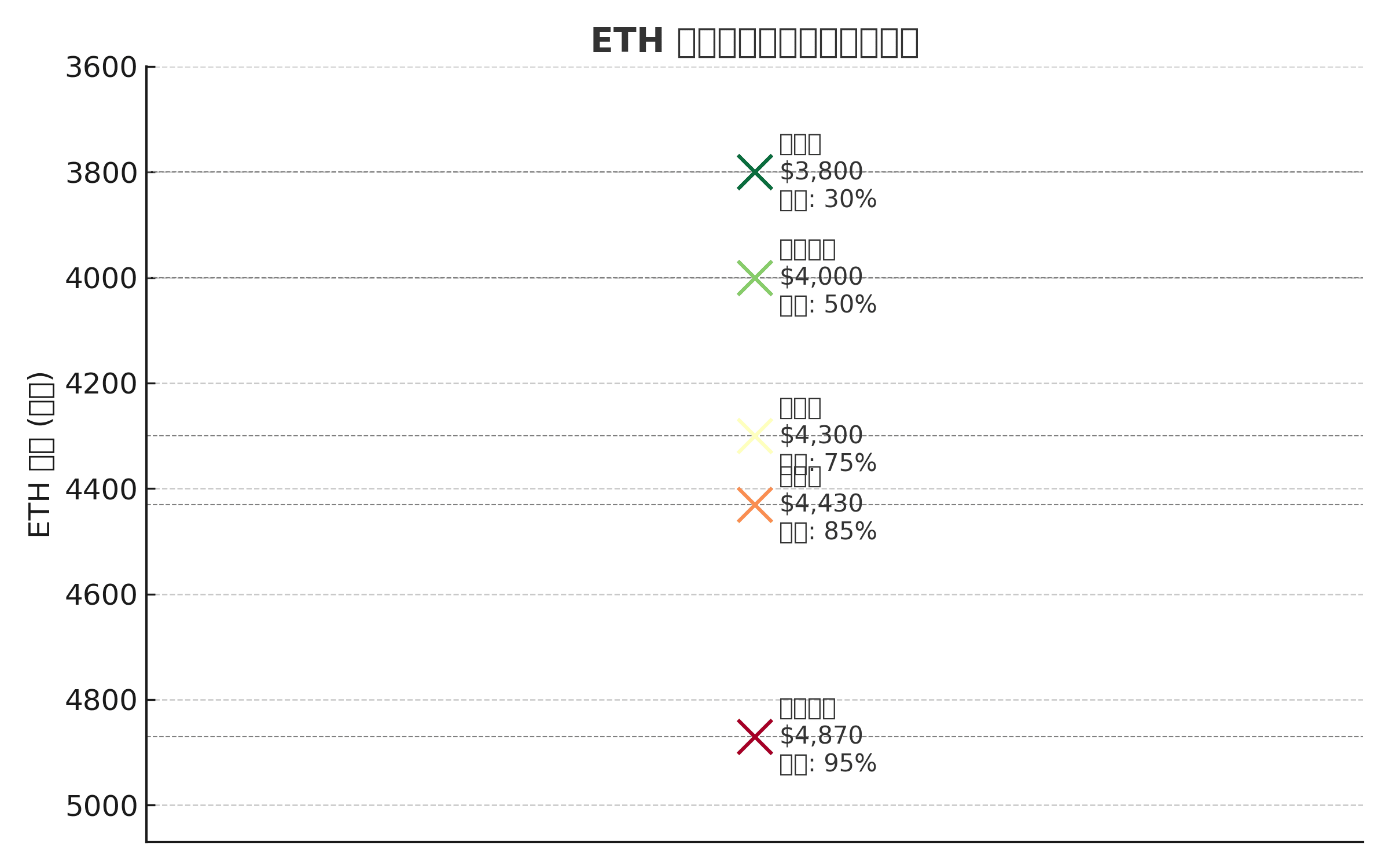

$ETH Current price breaks through 4,300 USD, and the 24-hour increase is close to 7%, indicating active short-term buying. Main technical key levels:

4,000 USD: psychological and technical support level, maintaining it represents a solid foundation for bulls.

4,430 USD: short-term resistance level, a breakthrough would be viewed by the market as a further bullish sign.

4,870 USD: historical high point, once retested may trigger profit-taking and a new wave of chasing highs simultaneously.

II. Sentiment

$ETH independent rise, while BTC only fluctuates around 116,000 USD, indicating that market funds and attention are focused on ETH.

This 'relative strength' will attract short-term traders to increase their positions, and may also cause some BTC funds to shift to ETH, forming a positive cycle.

Although high sentiment drives prices, if the rise is too rapid, short-term pullback pressure will increase accordingly.

III. Possible future trends

Optimistic scenario: after stabilizing at 4,300, break through 4,430, under the support of U.S. inflation data or macroeconomic benefits, challenge the historical high of 4,870.

Neutral scenario: fluctuating in the range of 4,300 to 4,430, waiting for new catalysts (e.g., ETF fund flows, on-chain activity data).

Risk scenario: if it falls below 4,000, it may trigger long stop-losses, testing support at 3,800 USD or even lower.