1. Current situation and liquidity gathering

- BTC price reached $117,000, triggering short positions - a classic "liquidity grab" scenario by large players.

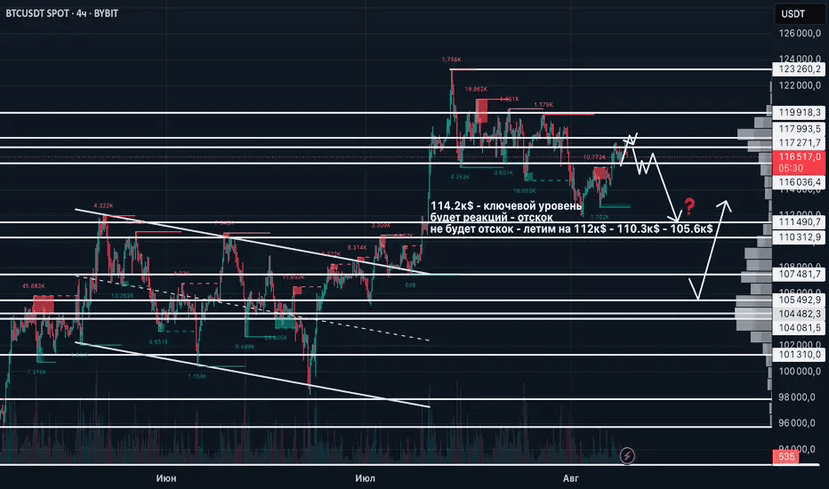

- After testing $117,000, selling began, indicating a rise in bearish sentiment. Key level - $116,000: closing below it will confirm further decline.

2. Technical indicators and levels

- Bearish divergence on 4H: Large players are taking profits, target $118,000 achieved. Now the overbought zone is $115,000–$114,000. In the absence of support, a pullback to $111,490–$105,492 is possible.

- Key support: $111,490 (minimum of the previous movement). Testing this level for liquidity gathering is possible.

- Resistance: $118,000–$119,000 (impulsive growth over the weekend is possible, but with subsequent correction).

3. Altcoins and BTC dominance

- Rare scenario: BTC is correcting while altcoins are rising. BTC dominance has dropped to ~60%, opening the path for an "altseason".

- Strategy: Local corrections in BTC are possible in the coming weeks, but altcoins may continue to rise even amid BTC weakness.

4. Trading ideas

- Short scenario: Entry in the zone of $117,800–$119,000 with a stop loss above $119,300. Targets: $115,000 → $111,490.

- Long scenario: A breakout above $119,000 with volume confirmation will open the way to $120,000–$122,000.

5. Macro factors and cyclicality

- Post-halving cycle: The April 2024 halving historically leads to growth through 6–12 months. A strengthening trend is expected by the end of 2025.

- Institutional demand: Approval of ETH-ETF and Fundamental Global reserve of $5 billion support the market.

Conclusion

- Short term: BTC is in a correction phase with the potential to test $111,490. Altcoins may take advantage of the drop in BTC dominance.

- Medium term: If $115,000 is held, a rise to $125,000–$130,000 is possible by September.

- Risks: Geopolitics (new regulatory initiatives) and capital outflow from ETFs.

> Main: The market follows cyclicality. Plan trades for both scenarios - growth and correction. Altseason has already started - focus on ETH, XRP, SOL.

Analysis based on data from TradingView, CryptoQuant, and macro trends. 🚀