Key Takeaways:

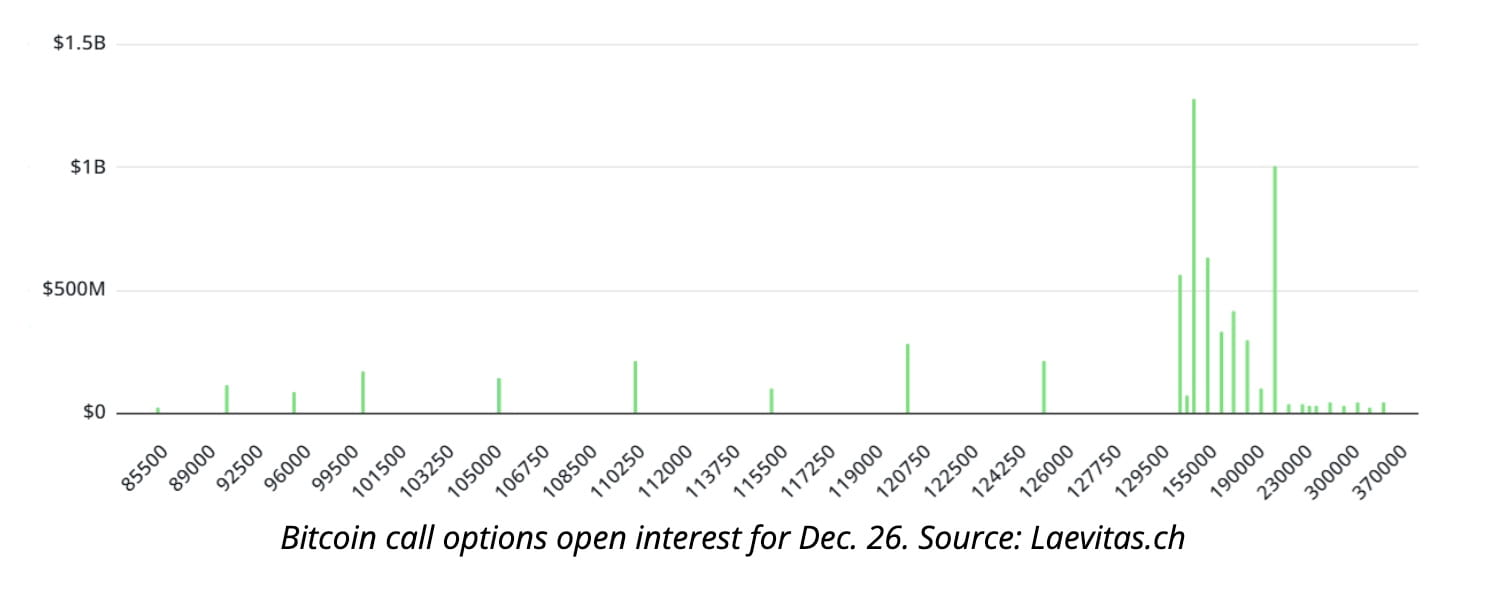

$8.8B in BTC options expire Dec. 26, with $1B+ in call options activating above $200K.

Market-implied probability of BTC hitting $200K by year-end is under 3%.

Structured strategies like diagonal spreads and inverse butterflies benefit if BTC trades near $160K.

Nearly $900M in put options target $50K–$80K, showing hedging remains active.

Polymark estimates a 13% chance of BTC reaching $200K in 2025, higher than Black-Scholes projections.

Bitcoin options traders are making bold bets on a potential year-end surge to $200,000, but market data suggests the odds of such a rally remain slim.

Over $8.8 billion in Bitcoin options are set to expire on December 26, according to Deribit. Among them, more than $1 billion in call options would become active only if Bitcoin trades above $200,000, requiring a staggering 72% rally from current levels near $116,649.

Despite the aggressive strike prices, analysts caution that these positions reflect strategic plays, not necessarily widespread belief in a six-figure BTC by year-end.

Options Market: Calls Dominate, But $200K Unlikely

Total open interest in call (buy) options stands at $6.45 billion, well ahead of $2.36 billion in put (sell) options, signaling bullish positioning. However, only $878 million in call options would hold value if Bitcoin ends the year around $116,500.

Several calls have strikes above $170,000, which are deep out-of-the-money and likely to expire worthless unless BTC gains more than 45% in the next five months.

“Traders use far-out-of-the-money calls in strategies with limited risk, not necessarily expecting BTC to reach $200K,” analysts say.

Structured Trades: Betting on $140K–$160K Levels

Professional traders are using options spreads to target more realistic price ranges:

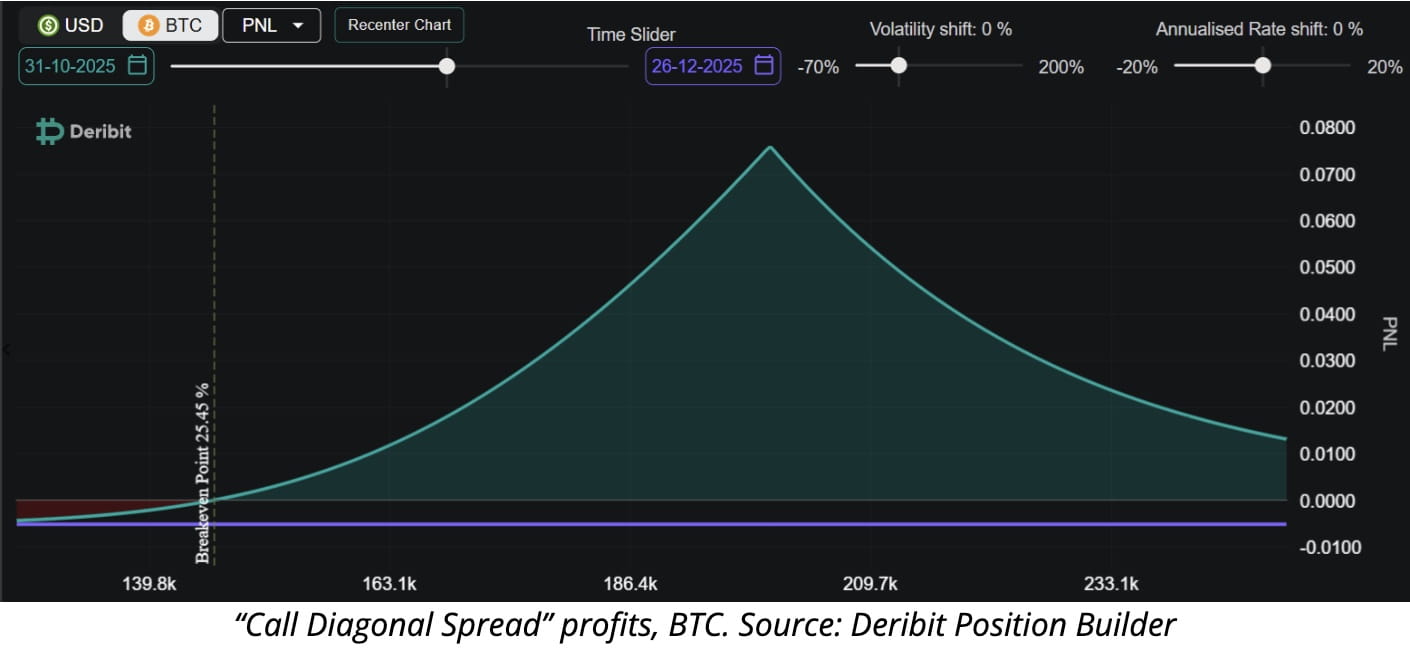

Diagonal Call Spread:

Involves buying a $200K December call and selling a $200K October call. This setup profits most if BTC reaches $146,000 by October, allowing the short-term call to expire worthless while the long-dated call appreciates.

Max gain: 0.0665 BTC (~$7,750)

Max loss: 0.005 BTC (~$585)

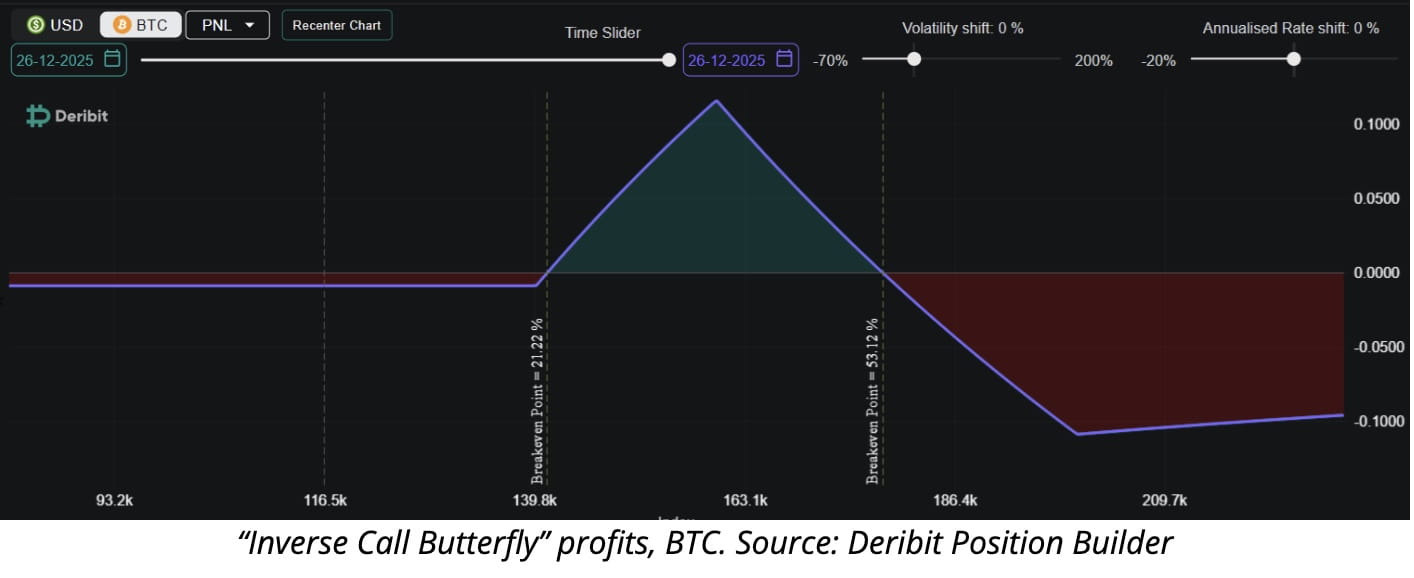

Inverse Call Butterfly:

This strategy involves buying a $140K call, selling two $160K calls, and buying a $200K call — all expiring in December. It profits the most if BTC hits $160K at expiry, with capped downside if BTC spikes too high.

Max gain: 0.112 BTC (~$13,050)

Max loss: 0.109 BTC (~$12,700)

These setups reflect a view that Bitcoin may rally to the $140K–$160K range, but not necessarily as high as $200K.

Bearish Bets Still in Play

Despite the focus on high call strikes, nearly $900 million in put options target $50,000 to $80,000 for December, highlighting ongoing bearish hedging.

According to the Black-Scholes model:

A $140K call is priced at 0.051 BTC (~$5,940), implying a 21% chance of profit.

A $200K call is priced at just 0.007 BTC (~$814), reflecting a sub-3% probability.

Polymark: Odds Slightly Higher

While Black-Scholes suggests under 3% odds, prediction platform Polymark places the likelihood of BTC hitting $200,000 in 2025 at 13%, suggesting that some traders see a longer timeline for explosive upside.

Bitcoin options traders may appear to be betting big on $200K, but the real strategies in play reflect a more measured outlook, with most positioning for BTC to land between $140K and $160K. Out-of-the-money calls are being used more for leverage and limited-risk upside, not as high-confidence predictions, according to Cointelegraph.