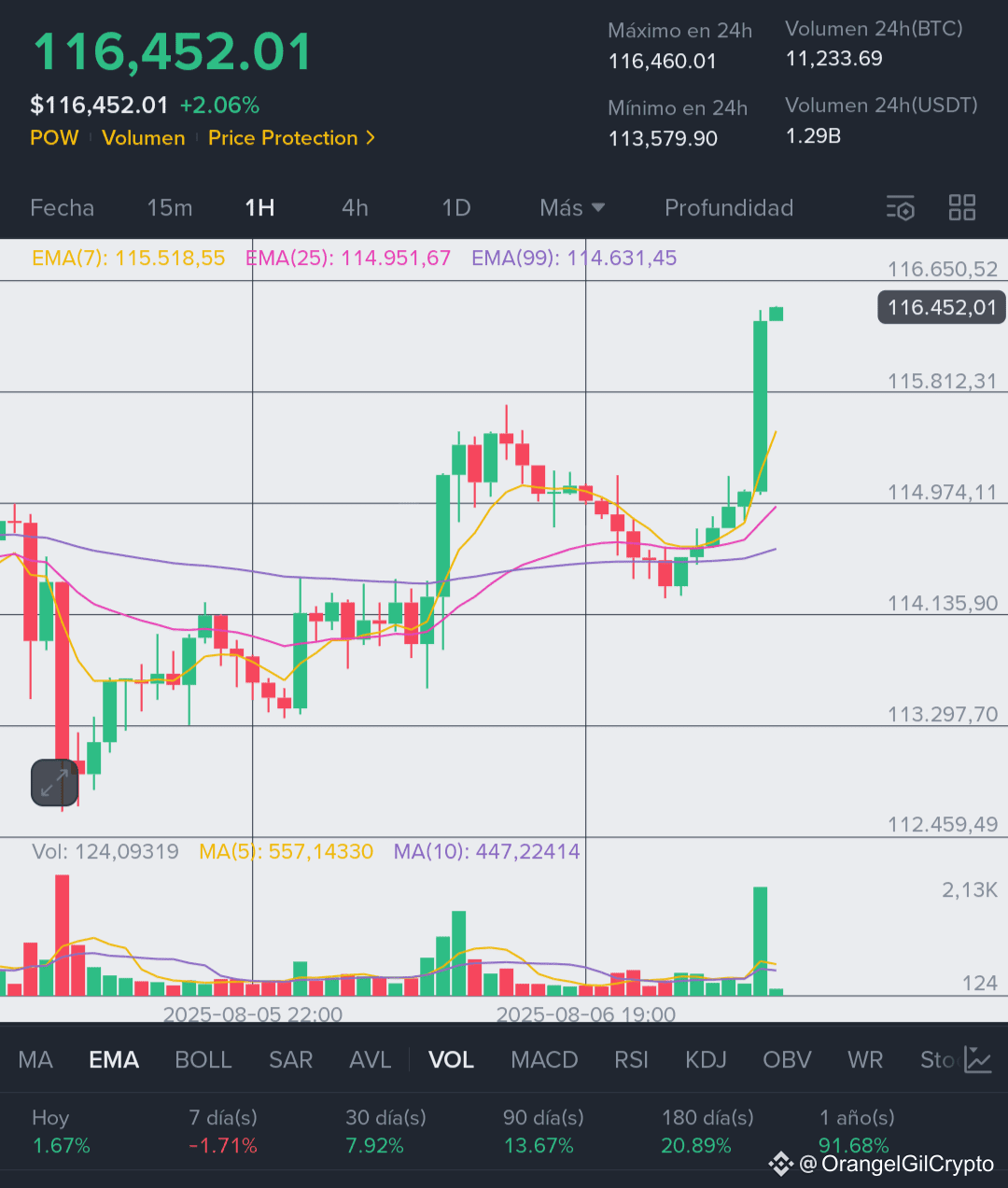

Current Price: $116,377.09

24h Change: +2.00%

Market Cap: $2.31T

24h Volume: $56.50B

Analysis:

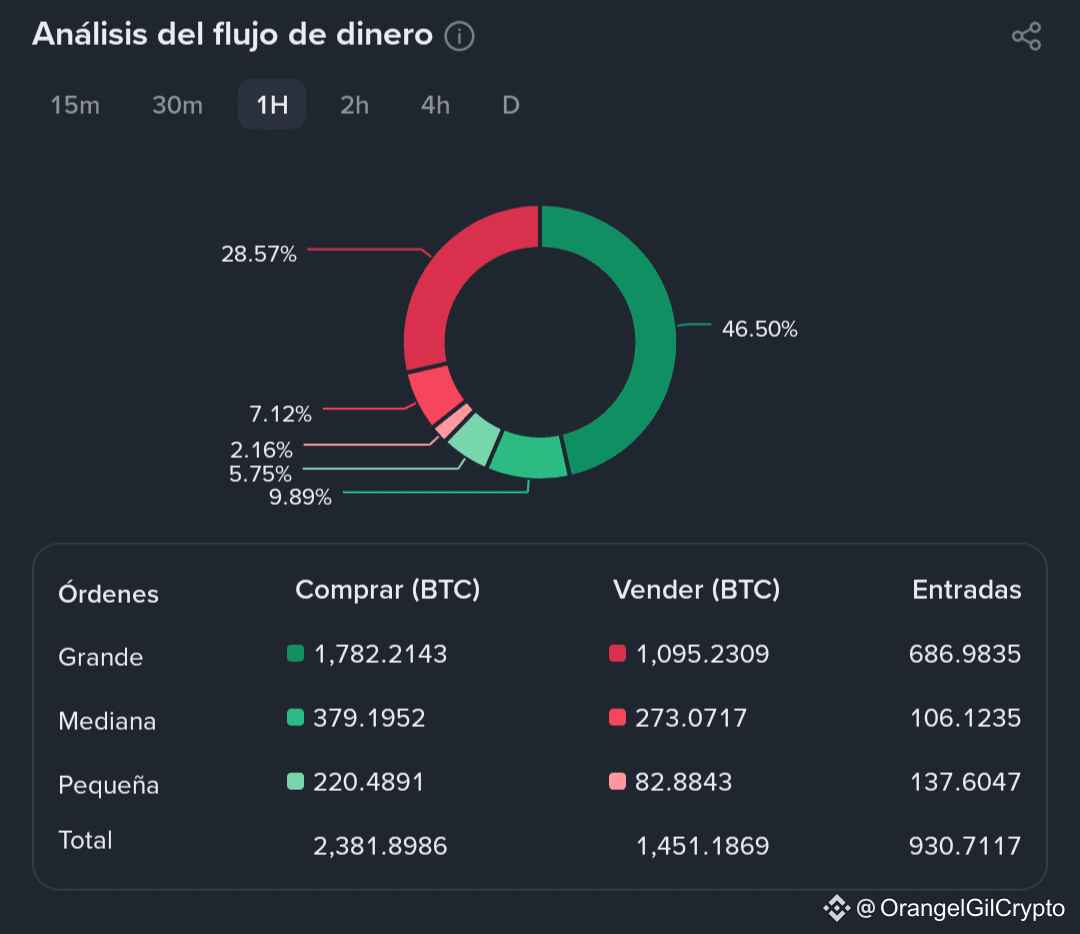

Bitcoin’s break above $116K signals renewed institutional confidence, supported by rising ETF inflows (BlackRock’s iShares BTC ETF added $275M this week alone).

The daily RSI sits near 63—approaching overbought, but not yet in the danger zone. The 200-day MA and support at $112K held firm through last week's dip, reinforcing bullish structure.

Macro Insight:

CryptoQuant notes whale accumulation at the $113K–$115K range, indicating long-term holder confidence. CME futures also show growing open interest, reflecting a healthy derivatives market.

Future Outlook:

If BTC sustains above $115K for 72 hours, the next target is $122K–$125K. Failure could trigger a pullback to $110K.

Strategic Reflection:

Bitcoin is now acting as a macro hedge again—not just a crypto asset. This reinforces its dominance and market leadership.