Bitcoin exchange-traded funds (ETFs) remained under pressure on Tuesday, posting a $196 million outflow, their fourth consecutive day in the red. Ether ETFs staged a recovery with $77 million in net inflows, signaling diverging investor sentiment.

Bitcoin ETFs Red Streak Hits Day 4 As Ether ETFs Turn Green with Solid Inflows

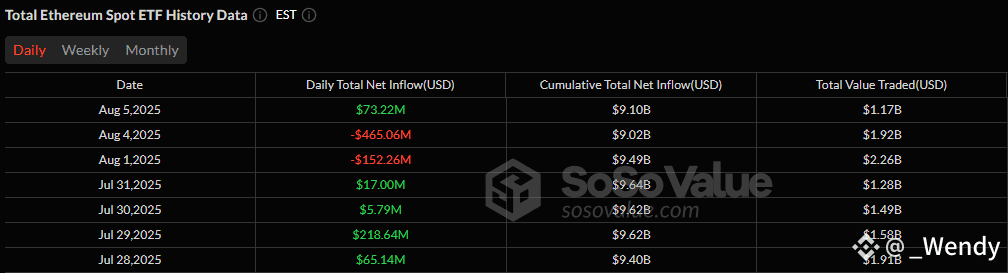

The split in investor behavior between bitcoin and ether ETFs widened on Tuesday, August 5, as funds tracking the two largest cryptocurrencies moved in opposite directions. Bitcoin ETFs saw a 4th straight day of outflows, losing $196.18 million, while ether ETFs posted a $73.22 million inflow, signaling renewed demand for ethereum exposure despite market volatility.

The bulk of bitcoin’s outflows came from Fidelity’s FBTC, which shed $99.11 million, followed by Blackrock’s IBIT with $77.42 million. Grayscale’s GBTC rounded out the losses with $19.65 million exiting the fund. Trading activity remained elevated at $2.66 billion, with total bitcoin ETF net assets settling at $146.18 billion, down significantly from last week’s highs.

Source: Sosovalue

Ether ETFs, on the other hand, rebounded strongly. Blackrock’s ETHA dominated inflows with a robust $88.77 million entry, while Vaneck’s ETHV added $5.24 million and 21Shares’ CETH contributed $3.57 million.

However, the green run was slightly offset by redemptions from Grayscale’s Ether Mini Trust and ETHE, which lost $13.45 million and $10.91 million, respectively. Ether ETF trading volume stood at $1.17 billion, pushing net assets to $19.99 billion.

The contrasting flows highlight a growing narrative: while bitcoin faces sustained selling pressure, ethereum’s institutional products continue to attract interest, perhaps tied to optimism around ETH’s DeFi and staking ecosystem. Whether this divergence holds or narrows will be a key theme as the week unfolds.