Executive Summary

Bitcoin (BTC) has long been revered as pristine collateral and a sovereign store-of-value. Yet, despite its $1 trillion market cap and global institutional recognition, BTC has lacked one crucial component: scalable, compliant yield infrastructure.

BTC+ by Solv Protocol introduces a paradigm shift: a structured, institutional-grade Bitcoin yield vault that aggregates on-chain and off-chain returns through a multi-strategy, auditable, and Shariah-compliant framework.

With the support of Binance, BNB Chain Foundation, and partners like BlackRock, Hamilton Lane, and Amanie Advisors, Solv has delivered the foundation of the emerging Bitcoin Finance ecosystem.

BTC+ turns idle BTC into a compliant, yield‑bearing institutional-grade asset.

BTC+: Turning Bitcoin Into Programmable Yield

BTC+ is the flagship structured yield vault by Solv Protocol. Built for both institutions and individual holders, BTC+ offers exposure to yield through a one-click BTC deposit experience. Users retain native BTC while accessing:

On-chain credit markets

Liquidity provisioning

Funding rate/basis arbitrage

Protocol staking incentives

Real-world asset yield flows (e.g. BlackRock's BUIDL, Hamilton Lane's SCOPE)

BTC+ compresses these strategies into a transparent, auditable vault framework designed for capital scale. It integrates:

Chainlink Proof-of-Reserves for real-time transparency

NAV-based safety guards and segregated architecture

Shariah-compliant certification via Amanie Advisors

BTC+ is accessible on Solv's dApp, allowing seamless BTC deposits with no bridging or wrapping.

The Institutional Backing: Trust at the Highest Level

Solv is the first Bitcoin-native asset manager entrusted with powering Binance Earn's BTC yield product. This is an unprecedented endorsement of operational trust from the world’s largest exchange, marking Solv as a credible partner in shaping Bitcoin’s yield future.

Further validations include:

BNB Chain Foundation acquiring $25,000 in $SOLV tokens as part of its $100M program

Amanie Advisors certifying BTC+ as the first Shariah-compliant Bitcoin yield vault

Avalanche collaboration to support RWA-backed BTC products

Partnership with Omakase (formerly Kudasai), Japan’s leading validator

It's harder to earn institutional trust than a token listing — Solv has earned both.

The Market Opportunity: $1 Trillion in Idle Bitcoin Capital

Despite global adoption, Bitcoin remains structurally underutilized:

$1T+ in idle BTC capital

$100B+ in BTC ETF AUM captured in under 12 months

$5T+ in Islamic finance capital inaccessible due to non-compliant structures

$10T+ in pensions/insurance seeking fixed-income alternatives

BTC+ addresses this with an auditable, compliant, and yield-optimized vehicle:

BTC+ turns Bitcoin from passive store-of-value into programmable yield infrastructure at trillion-dollar scale.

Yield Infrastructure: From Friction to Flow

BTC+ solves the structural inefficiencies preventing BTC from becoming yield-bearing:

Structural Challenges BTC+ Addresses

Dormant Capital: Most BTC remains idle or in passive wrappers

Operational Friction: Bridging, manual execution, and rebalancing complexity

Institutional Barriers: Lack of compliance, off-chain yield access, or PoR standards

(+) BTC+ Features

Multi-Strategy Stack: Credit markets, arbitrage, DEX liquidity, RWA cashflows

CeFi–DeFi Convergence: Managed via Solv, distributed via Binance

RWA Token Integration: Access to yields from BlackRock, Hamilton Lane, and others

Compliance & Risk Controls: Chainlink PoR, NAV guards, Shariah compliance

=) How BTC+ Works

BTC+ abstracts the complexity of yield into a single, easy-to-use vault:

Deposit BTC into the Solv dApp — no wrapping/bridging needed

Receive BTC+ tokens representing your share

Solv auto-allocates capital across top-performing yield strategies

Yield accrues passively, rebalanced periodically

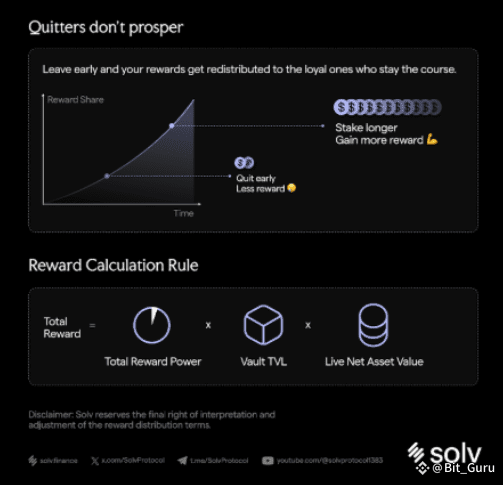

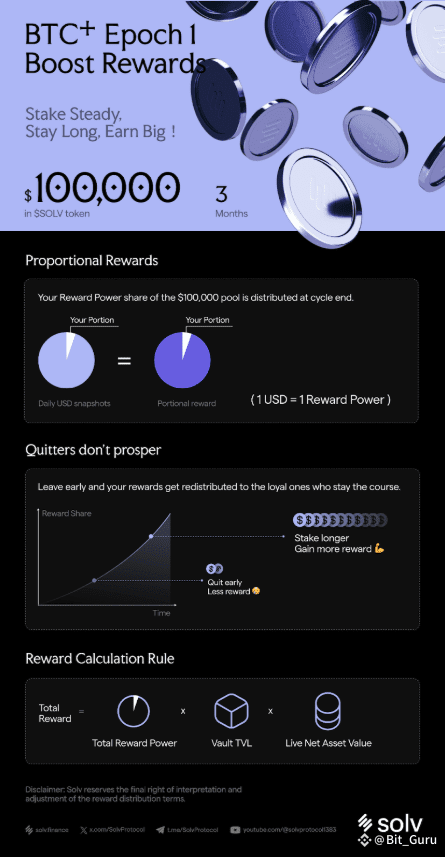

Withdraw during designated Epochs (every 90 days)

Distribution Strategy: Multi-Channel Access to BTC Yield

Solv provides two tailored access layers for users across the capital spectrum:

1. Onchain Prosumer / Institutional (BTC+ via Solv dApp)

Target: Crypto-native prosumers, funds, and institutions

Flow: Connect wallet → Deposit BTC → Subscribe to BTC+ → Track yield

Why it matters: Meets institutional mandates for transparency and compliance

BTC+ aligns with the mandates of sovereign wealth funds, treasurers, and crypto-native allocators alike.

2. Offchain Retail (Binance Earn Product Powered by Solv)

Target: Everyday BTC holders unfamiliar with DeFi

Flow: Deposit BTC → Select "On-Chain Yield / Solv BTC Staking" → Track yield in Binance UI

Why it matters: Provides secure, KYC-compliant access to on-chain yields via familiar interfaces

Islamic institutional capital.

Expanding the Bitcoin Finance Stack: The Solv Ecosystem

Solv is not just launching BTC+ — it's building the entire financial stack for Bitcoin:

SolvBTC: A universal reserve token backed 1:1 with BTC, bridging BTC to DeFi/CeFi/TradFi

xSolvBTC: Liquid staking token with yield, integrated with Babylon

Solv Vaults: Programmatic vaults for BTC-based yield generation

BRO (Bitcoin Reserve Offering): Structured instruments giving institutional investors BTC exposure convertible into SOLV

Final Thoughts: Bitcoin Finance Has Arrived

DeFi grew to $100B TVL in 4 years. Spot BTC ETFs captured $100B in under 12 months.

Now begins the next S-curve: yield-bearing Bitcoin for all.

BTC+ marks the beginning of Bitcoin’s financialization era — one that is inclusive, transparent, and accessible to institutions, retail users, and sovereign wealth alike.

BTC+ is not just a product — it is the infrastructure for Bitcoin’s financial future.

#BTCUnbound | $SOLV | @Solv Protocol

Learn more and start earning: https://app.solv.finance/btc+?network=ethereum