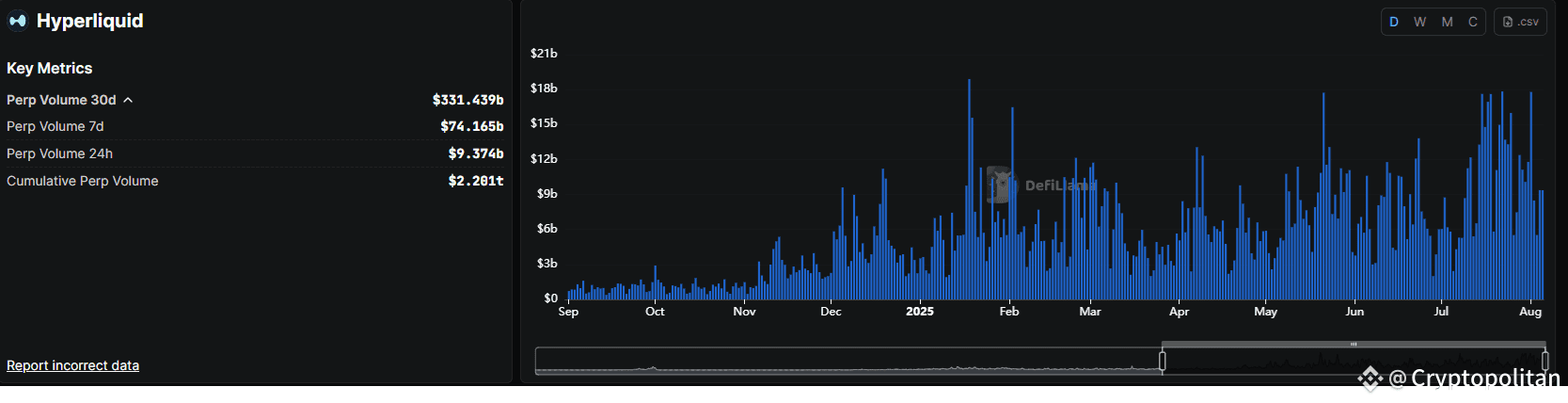

Hyperliquid retained its leading position as a perpetual DEX, closing its best month in terms of trading volumes. The turbulent July trading led to 47% volume growth, boosted by altcoins.

July turned out to be a dynamic crypto month, leading Hyperliquid to a new record of monthly trading volumes. The month was the most dynamic to date, achieving up to $320B in cumulative volumes for the month. Hyperliquid saw its volumes increase by 47%, retaining the trend of regular monthly growth.

Hyperliquid had its best month in history in terms of trading volumes, driven by increased interest in ETH trading. | Source: DeFiLlama.

Hyperliquid had its best month in history in terms of trading volumes, driven by increased interest in ETH trading. | Source: DeFiLlama.

Hyperliquid also broke above $15B in total open interest for the first time in history. One of the main drivers for the growth was Ethereum, nearly doubling its open interest for the past month.

Hyperliquid retains its top spot due to first mover advantage and the presence of whales and traders. For now, the exchange competes with centralized markets offering derivatives. Hyperliquid’s activity now makes up 11.9% of Binance’s derivative markets. However, Hyperliquid offers riskier trades with higher leverage, often attracting dramatic positions and public liquidations.

Currently, Hyperliquid carries $597M in total value locked based on collaterals. In July, the exchange produced over $4M in daily fees regularly, with a minimum of $2M. The fee generation also reflected the unprecedented activity, with almost no idle days in July.

Hyperliquid token HYPE struggles to retain positions

One of the sources of activity for Hyperliquid is the native HYPE token. The asset traded at $38.54, extending its losing streak after almost touching $50.

Most of the HYPE activity is still dependent on the native exchange, carrying over 40% of volumes. However, HYPE trading has shifted to other exchanges, changing the mechanism of price discovery. The ability to arbitrage HYPE on several markets has stopped its seemingly endless climb from the early months of the exchange.

HYPE open interest is also down to a one-month low at $1.46B. Of that open interest, $1.1B is still on Hyperliquid. More than 70% of traders are long on HYPE, potentially inviting attacks against their positions.

High-ranked traders still use Hyperliquid for exposure

At the end of July, one of the most widely known traders, James Wynn, seemingly gave up on Hyperliquid. He has no positions open as of August 5, and recently claimed he would focus on meme tokens.

Landed back in Monaco.

Just ordered a double espresso martini while I wait for the crew to arrive early morning.

Going full trench mode over next 2 months.

X and perps has burnt me out. Won’t be tweeting much.

Just shilled a complete shitter in my tg.

That’s where…

— James Wynn 🤴 (@JamesWynnReal) August 4, 2025

Wynn has also opened other addresses, but took up much smaller positions in the past few weeks.

Trader Aguila Trades has switched to a 40X BTC short position, which is now once again threatened by liquidation. Aguila Trades lost over $35M in July, following risky positions as BTC shifted direction within hours.

The White Whale recently appeared as a public trader with a more cautious and rational approach, closely watched for decisions and analysis. For now, the White Whale has managed to avoid dramatic liquidations.

Hyperliquid’s position as a global hub for perpetual futures trading may be challenged by regulated exchanges offering a similar product. However, for now, Hyperliquid remains the only directly accessible platform, no-KYC market, settling directly on-chain.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.