Strategy (previously MicroStrategy) recently conducted its third-largest Bitcoin purchase in terms of dollar cost. The firm made this move shortly before revealing its huge successes in Q2 2025, indicating its steady long-term commitment.

Chairman Michael Saylor recently appeared in an interview, explaining his vision for the company’s future. Despite BTC’s slight drop last week, he remains confident in a multi-decade vision for crypto.

Strategy Keeps Buying Bitcoin

Strategy has been a pioneer with its Bitcoin treasury technique, specifically becoming the world leader of corporate crypto acquisition.

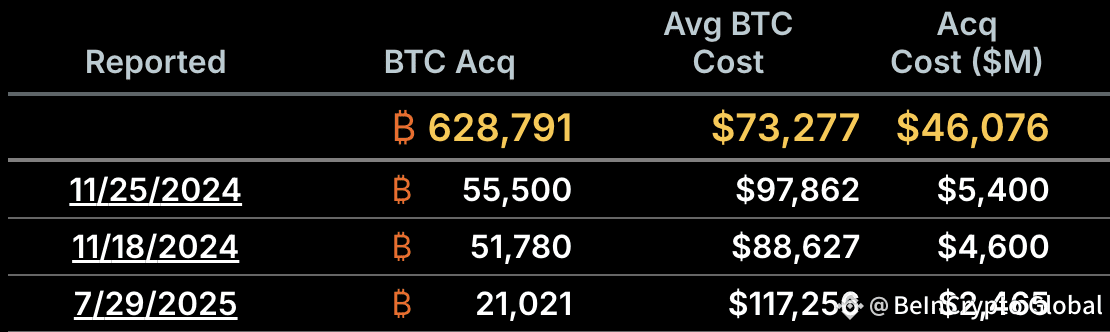

After months of consecutive stock offerings and ambitious purchases, the firm made its third-largest buy by US dollars last week. Outpacing the firm’s biggest moves in 2025, this signaled a firm commitment.

Strategy Bitcoin Purchases Ranked. Source: Strategy

Strategy Bitcoin Purchases Ranked. Source: Strategy

Strategy’s latest Bitcoin acquisition is quite impressive for a few reasons. First of all, this happened towards the tail of a highly profitable quarter for the firm, which followed a bleak posting in Q1 2025.

Strategy continued buying before its new net income was fully realized. Second, Bitcoin’s price momentarily fell shortly after this purchase, for unrelated reasons.

What’s Next for MicroStrategy’s Bitcoin Strategy?

To explain his unorthodox moves, Strategy Chair Michael Saylor agreed to an interview to discuss this ambitious Bitcoin purchase.

His comments were very enthusiastic, brushing off any minor price setbacks as usual.

“This is digital capital. If you’re using traditional treasuries as capital, you’re underperforming the S&P 500 by 10% a year. You’re burning money. If you’re using Bitcoin, you’re outperforming the S&P by something like 40% a year. The more capital you raise [and] hold, the faster you create shareholder value,” Saylor claimed.

In essence, Saylor downplayed the possible risks of Strategy’s Bitcoin purchases, envisioning a scenario where retail traders will continually buy stock to reap higher gains.

Rather than claiming that the firm will hodl its assets forever, Saylor offhandedly mentioned wanting to custody BTC for 21 years. Meanwhile, these stock sales generate massive yields.

Also, Saylor was asked if he’d consider investing in any altcoins, and he praised the TON ecosystem in response. He saluted TON’s technical innovations and enthusiastic community, but Saylor is firmly in the BTC maximalist camp.

Whatever happens next, Saylor isn’t getting off this train any time soon. He spoke of Strategy investors’ desire to use Bitcoin to achieve 2x gains, but claimed it has much more potential.

For now, the company will remain a standard-bearer of corporate confidence in BTC through thick and thin.