🚀 Introduction

In the ever-expanding universe of DeFi (Decentralized Finance), most protocols focus on overcollateralized lending, yield farming, or speculative assets. Huma Finance, however, is carving a new path by bridging real-world income streams and Web3-based credit systems. It creates on-chain credit infrastructure that mirrors the traditional credit economy, yet is permissionless, programmable, and global.

Mention: @Huma Finance 🟣

Hashtag: #HumaFinance

📌 Table of Contents

1. What is Huma Finance?

2. Real-World Income-Based Lending Explained

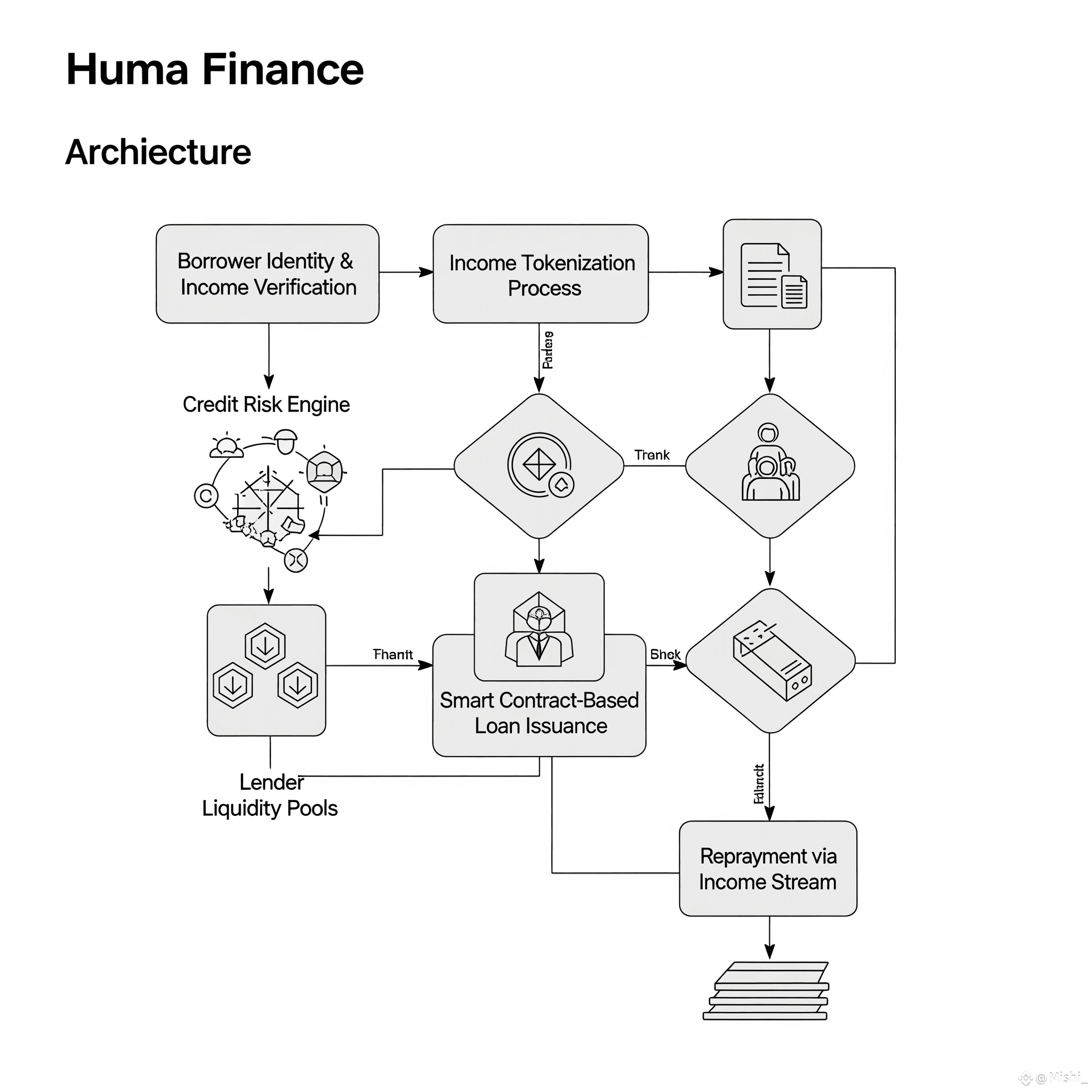

3. Huma’s Credit Protocol Architecture

4. Use Cases of Huma Finance

5. Benefits for Lenders and Borrowers

6. Risks and Considerations

7. Future Outlook

8. Visual Diagram: Huma Protocol Credit Flow

🧠 What is Huma Finance?

Huma Finance is a decentralized protocol that enables under-collateralized lending based on future income rather than on-chain assets. It allows borrowers (e.g., gig workers, freelancers, or businesses) to tokenize their off-chain income streams and access DeFi credit markets.

Unlike typical DeFi models that require a user to lock $10,000 to borrow $5,000, Huma allows someone to borrow against future cash flow such as:

Paychecks

Subscriptions

Invoices

Rental income

💡 Real-World Income-Based Lending Explained

In traditional finance, many credit instruments (like payday loans, invoice factoring, or payroll advances) are based on expected income rather than hard collateral. Huma mirrors this model on-chain using:

Income verification oracles (off-chain data bridges)

Smart contracts to enforce payment flows

Programmable repayment terms

Example:

A freelance developer has a $4,000 monthly retainer contract. With Huma, she can tokenize that contract and borrow up to 70% of her future income instantly from DeFi lenders.

⚙️ Huma’s Credit Protocol Architecture

1. Borrower Onboarding

Verifies identity and income source

Tokenizes expected revenue as a yield-bearing token (e.g., "FutureIncomeToken")

2. Lender Liquidity Pools

Capital providers stake stablecoins or USDC into liquidity pools

Liquidity is algorithmically allocated based on credit scoring and risk

3. Risk Assessment Engine

Uses credit scoring algorithms fed by data oracles (like Chainlink, The Graph)

Evaluates:

Payment consistency

Contract terms

Debtor trust rating

4. Repayment and Liquidation

Repayments are auto-deducted from incoming income

Defaults are flagged to community credit registries

✅ Benefits for Lenders and Borrowers

For Borrowers:

Access to capital without large crypto holdings

Automated repayment via income streams

Builds on-chain credit history

For Lenders:

Diversified real-world credit exposure

Transparent payment streams and scoring

Higher yields than traditional DeFi

⚠️ Risks and Considerations

Oracle Risk: Accuracy of income data is critical

Smart Contract Vulnerabilities: Protocol bugs or exploits

Default Risk: Borrowers may lose income unexpectedly

Regulatory Concerns: RWA tokenization must comply with local laws

🔮 The Future of Huma Finance

Huma represents a new era of DeFi, one where financial inclusion goes beyond collateralized whales and allows real people to build trustless credit histories on-chain.

As on-chain reputation protocols (e.g., Gitcoin Passport, Lens Protocol) evolve, Huma's model of lending based on real-world income could help build Web3-native credit rails for billions.

📝 Conclusion

Huma Finance is transforming DeFi by blending traditional income-based credit with decentralized protocols. By turning future cash flow into immediate capital, it empowers a new class of Web3 participants — one not defined by their token holdings, but by their earning potential.

Mention: @Huma Finance 🟣

Hashtag: #HumaFinance