In DeFi, innovation moves quickly, but without reliable benchmarks, that growth can hit a ceiling.

That’s where TreehouseFi comes in.

They’re rolling out something ambitious: a decentralized rate oracle called DOR, now on testnet and it could reshape how we think about yield and stability across the space.

🔸 This isn’t just a new feature. It’s the kind of foundational infrastructure that DeFi’s been missing.

💡 DOR: A Transparent Rate Engine for DeFi

At its core, DOR (Decentralized Offered Rates) is an on-chain reference rate system.

It helps protocols figure out:

📉 Borrowing costs

🔄 Swap rates

📊 Projected yields

without a single central party pulling the strings.

Instead of guesswork, it uses real trade data and formulas to generate fair, tamper-resistant rates.

🔸 It’s built for transparency. And it’s here for the long run.

🧰 Solving What TradFi Took for Granted

TradFi’s got LIBOR, SOFR, and others as benchmarks, supporting trillions in financial products.

DeFi? 👀 Until now, had nothing close.

TreehouseFi is filling that gap, giving builders a launchpad for:

🔁 Lending markets that react in real time

🔄 Interest rate derivatives

🧮 More accurate staking or LP-based yields

🔸 Everything starts with a rate you can trust and now, DeFi has one.

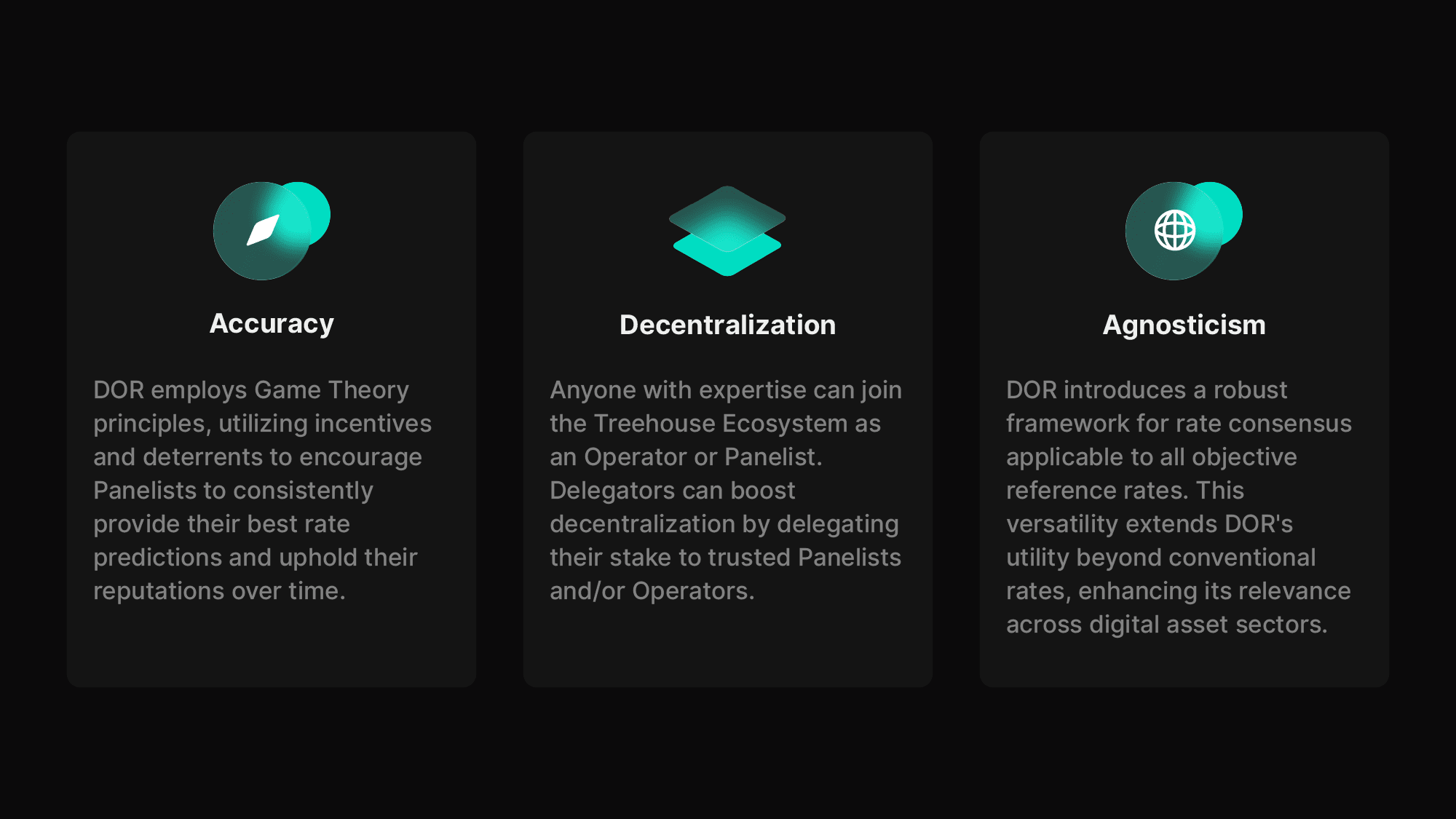

🕸️ Accuracy, Incentives, and Accountability

DOR isn’t just some feed spitting out numbers.

It’s a system with real roles and checks:

🧑🔬 Panelists forecast rates from on-chain signals

🙋 Delegators back the ones they trust

🎯 Accurate contributors get rewarded

❌ Manipulators get slashed

🔸 It’s fair because it’s designed to be.

🧠 Keeping the Data Honest

Manipulation? Not so easy. TreehouseFi built in some serious guardrails:

🚨 Outlier detection filters extreme values

🎲 Random sampling ensures fairness

⚖️ Staking/slashing adds consequences for bad actors

🔸 Basically, if someone tries to game the system, they’re paying for it.

DOR introduces the transparency and reliability DeFi’s been missing, setting the stage for secure financial innovation.

DOR introduces the transparency and reliability DeFi’s been missing, setting the stage for secure financial innovation.

🌱 A Bigger Vision Behind DOR

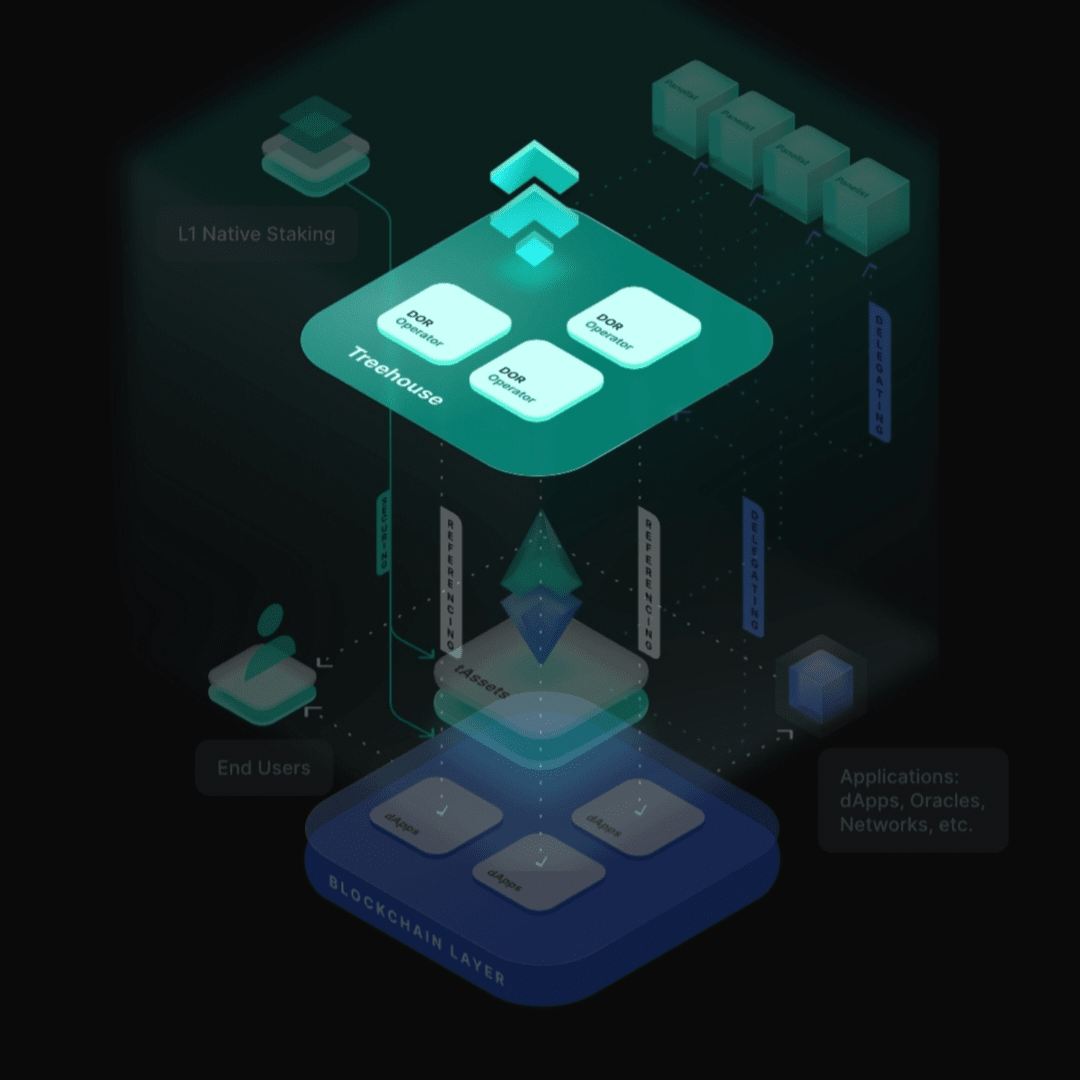

DOR isn’t just a standalone tool, it’s a key part of Treehouse’s bigger DeFi model.

This diagram shows how TreehouseFi connects real yield sources, DOR operators, and applications to build a full fixed income layer in DeFi, all resting on the blockchain layer.

This diagram shows how TreehouseFi connects real yield sources, DOR operators, and applications to build a full fixed income layer in DeFi, all resting on the blockchain layer.

It links:

1. 🧩 Real yield sources (like staking or LP fees)

2. 🧭 A reliable rate layer (via DOR)

3. 🧑🤝🧑 A contributor ecosystem that keeps it running

🔸 Together, they form a framework for secure, repeatable fixed income in DeFi.

🔍 This Is Just the Start

Now that DOR’s live on testnet, the real fun begins.

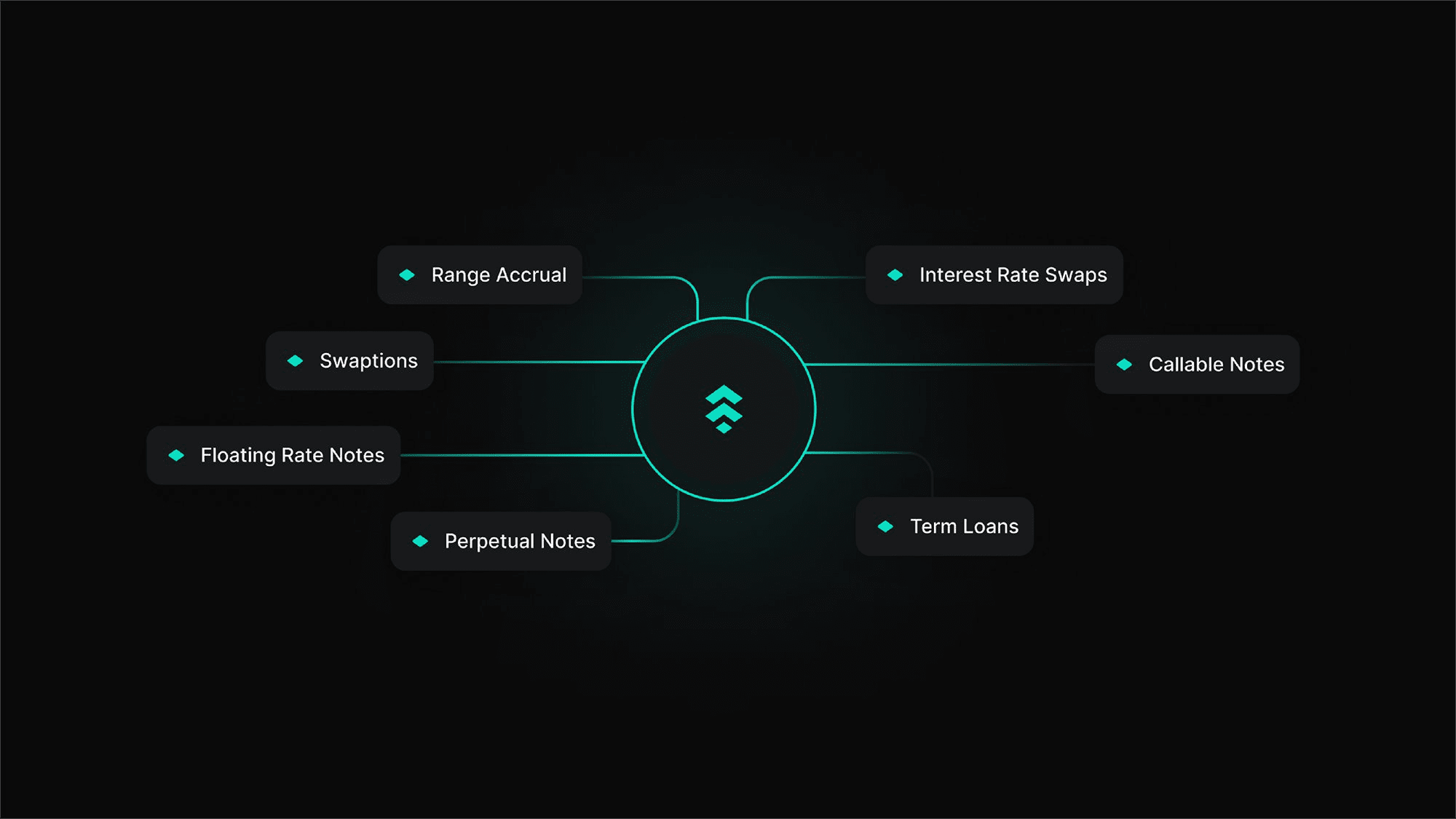

Builders can finally create structured financial products on top of clean, decentralized rates — like:

💹 Tokenized treasury-style yield curves

🔁 Interest rate swaps

🏦 Synthetic lending markets

🔸 TreehouseFi isn’t adding more noise to DeFi. It’s cutting through it with clarity.

🧩 With DOR as the benchmark layer, TreehouseFi unlocks a new wave of DeFi primitives, from interest rate swaps to tokenized loans and more.

🧩 With DOR as the benchmark layer, TreehouseFi unlocks a new wave of DeFi primitives, from interest rate swaps to tokenized loans and more.

🛠️ Ready to Build?

The release of DOR marks a shift.

DeFi is finally ready for serious, scalable, institutional-grade products without relying on institutions.

📡 The rate infrastructure is live.

🔓 It’s open.

🚀 And it’s waiting for the next wave of DeFi builders to plug in.

🔁 Share this if you believe DeFi deserves real benchmarks.

🌿 Tag a builder who needs to see what @Treehouse Official is doing with #Treehouse and $TREE