Main Takeaways

You can now short sell BTC options on Binance. Also known as “writing” options, this lets you collect a premium up front by offering contracts to other traders.

This guide explains what it means to short sell options, how it works, and why it’s long been used to earn income or hedge risk.

Get set up in a few clicks, manage your margin easily, and enjoy stablecoin settlement. Switch to Long/Short Mode to get started!

Markets can be volatile, shorting options is another way to profit from this market environment. Binance has opened up BTC Options Short Selling to all Binance Options users, giving you a powerful way to earn from time decay, hedge risk, or trade non-directional views.

Whether you’re looking to generate income, hedge your positions, or make the most of a sideways trend, you can now short sell BTC Options directly on Binance with stablecoin settlement and some of the most competitive BTC options trading fees in the industry.

Simply switch your account to Long/Short Mode!

In this blog, we’ll break down what short selling options actually means, how it works on Binance, and how you can use it confidently, even if you’re not yet an options expert.

What Does “Selling Options” Actually Mean?

Let’s break it down. On Binance, “short selling” options means you’re selling a new options contract to another trader. You don’t need to hold a long position in advance. In traditional finance, this is called “writing an option”. You’re taking the seller’s side of the trade, and in exchange for taking on that risk, you are compensated with the option’s premium up front. That premium is your potential profit.

Real-World Example

Let’s say BTC is trading at $100,000. You decide to sell a call option — a contract that gives someone the right to buy BTC from you at a set price (called the strike price) within a certain timeframe. The call option you sell has a strike price of $105,000 and expires in 7 days. The buyer pays you $800 USDT for the option. That’s the premium, and you keep it no matter what. Now, two things can happen:

At expiry, the BTC settlement price is below $105,000. The option is not exercised and expires worthless. Your profit on the trade is $800, excluding any applicable transaction fees.

At expiry, the BTC settlement price is above $105,000 — let’s say it’s at $108,000. The option is exercised at $105K. Your profit on the trade is calculated as $800 minus the settlement difference, as well as any applicable transaction and exercise fees.

The bottom line: you’re getting paid for taking on the risk. If BTC doesn’t move much — or doesn’t move in the buyer’s favour — you keep the premium as profit. This kind of strategy has been used by institutions for years. Now, thanks to Binance’s new feature, any Options user can do it too, with just a few clicks and competitive fees at launch.

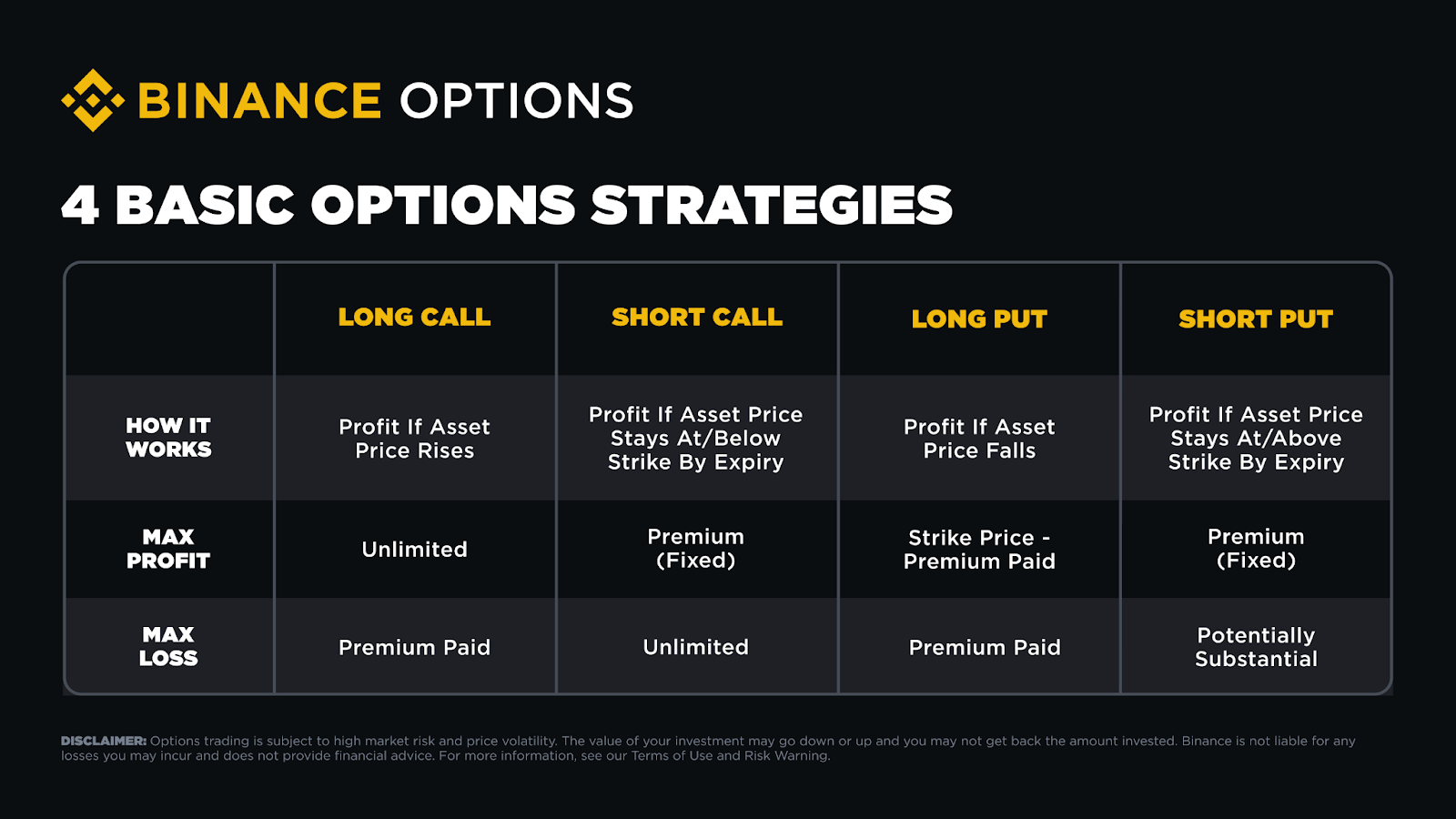

Options at a Glance: The 4 Core Strategies

Let’s take a step back for a moment.

There are four basic strategies in options trading — two for buyers, and two for sellers. Even if you’re only focused on selling, it helps to understand the bigger picture.

Simple definitions

Long Call: You’re buying a call option because you think the price will go up. You’re locking in the right to buy later at a set price, hoping to profit if the market rises.

Long Put: You’re buying a put option because you think the price will go down. You’re locking in the right to sell later at a set price, hoping to profit if the market drops.

Now flip it. That’s where selling comes in:

Short Call: You’re selling a call option. You think the price won’t rise too much. You collect a premium now, but may have to sell at the strike price later if the market moves against you.

Short Put: You’re selling a put option. You think the price won’t fall too far. You collect a premium now, but may have to buy at the strike price later if the market drops.

Here’s how those strategies compare at a glance:

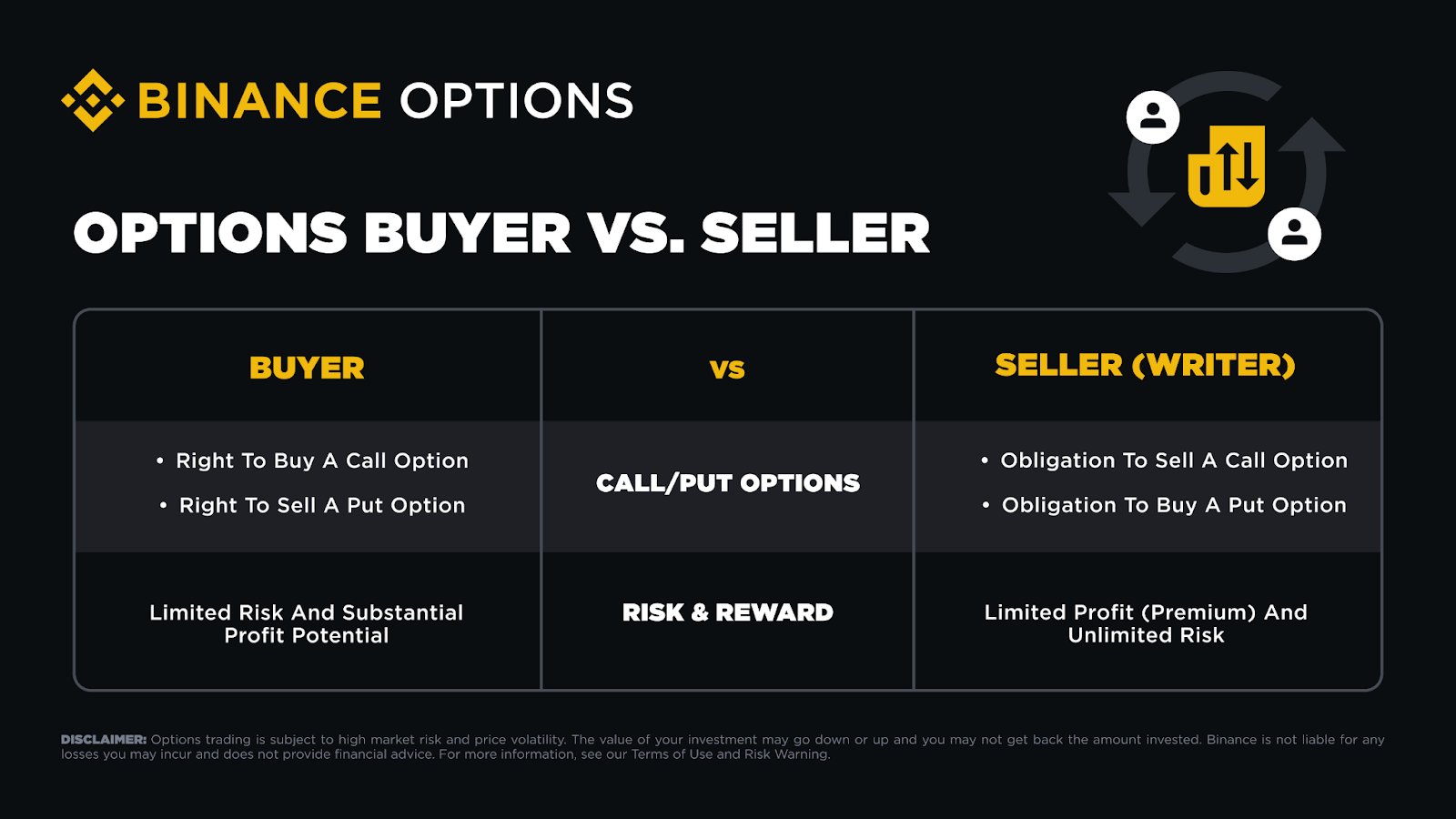

You don’t need to memorise all of these strategies. Just knowing the basics helps you understand the trade-offs. For this blog, we’re focused on selling BTC options — either a short call or a short put — to earn a premium based on your market view. Here’s one more chart that shows what it means to be on the buyer’s side versus the seller’s side of an options contract:

As the seller, you’re giving the options buyer the right to buy or sell, and in return, you get paid up front. You’re earning a premium for taking on risk.

What You Can Do With This Feature

So why would you want to sell options in the first place? Short selling options gives you another way to profit in different market conditions — especially when markets are flat or volatile. Here are a few ways you can use short selling options on Binance:

Earn from time decay. Each time you sell an option, you collect a premium up front. As the option approaches expiry, its value gradually erodes — a concept known as time decay. If the market doesn’t move much (or move against your position), the option may expire worthless and you keep the full premium as profit.

Enhance returns or manage risk on existing positions. If you are holding BTC or trading Futures, selling call options in conjunction with a long futures position can generate additional income, particularly when you anticipate the asset price will not exceed a certain level. This strategy can help you optimize profits while managing your market exposure.

Trade in falling or sideways markets. If you expect BTC to remain stable over a short period or experience a moderate decline, selling options allows you to potentially generate profit from these market conditions without relying on significant price movements.

Do it all in USDT. All Binance Options are settled in stablecoins. That means no wild swings in your collateral, and clearer P&L tracking as you go.

Selling options isn’t just for institutions anymore. With this feature now available to all Binance Options users, you’ve got a powerful new way to trade your market view, whether you’re aiming to earn, hedge, or stay active when the market cools off.

Who Can Use It, And How to Get Started

The good news? This feature is now open to all Binance Options users. You don’t need VIP access or a massive trading volume — just a Binance account with Options enabled. To start selling BTC options, you’ll need to switch your account to “Options Long/Short Mode.” This unlocks the ability to both buy and sell options contracts.

Getting started is easy

Step 1: Head to the Binance Options trading page and open your Options Account.

Step 2: Select a Trading Mode: Long Only Trading or Long & Short Trading.

Step 3: Complete a mandatory quiz and follow the on-screen steps .

Step 4: Once activated, you can start selling BTC options right away

Currently, only BTC options are available for short selling. Other assets like ETH, BNB, XRP, SOL, and DOGE may be added later, but for now, they’re limited to selected users.

What You Need to Know Before You Trade

Selling options offers an additional means to capitalize on diverse market conditions, but it also involves a certain level of risk. As an options seller, you’re agreeing to settle if the market moves against you. That’s why Binance uses margin to manage risk.

What margin is, and why it matters

When you sell an option, you’re agreeing to cover a potential payout. To make sure you can meet that obligation, Binance requires you to keep a certain amount of USDT in your Options Wallet. This is your margin.

Initial margin is what you need to open a trade

Maintenance margin is what you need to keep it open

Binance calculates both automatically based on your position size, market conditions, and how far the strike price (the price agreed in the option contract) is from the current BTC spot price index. If your margin balance drops too low, your position may be liquidated — meaning it gets closed automatically to help limit your losses.

How liquidation works, and how to avoid it

Your account will show your risk level as Normal, Margin Call, or Forced Liquidation. If your margin drops into the danger zone, Binance will send alerts by email or in-app. That’s your signal to either top up your margin or reduce your exposure.

If your account hits the liquidation threshold, Binance will close your positions, beginning with the riskiest ones. This is done to prevent further losses, but it also means you could lose some or all of your margin. If your balance stays negative, even long positions could be liquidated to cover the shortfall.

Be sure to keep an eye on your margin to stay in control.

Final Thoughts

Short selling options might sound advanced, but on Binance, it’s now something any Options user can explore. Whether you’re looking to earn passive income, hedge your positions, or simply stay active in a slower market, this feature gives you more ways to trade your view.

Just remember: every premium you earn comes with risk. But with proper margin management and a clear view of the market, selling options can be a smart, active strategy, even when others are sitting out.

Ready to try it? Head to the Options trading page, switch to Long/Short Mode, and explore what short selling BTC options can do for your strategy!

Competitive fees. Premiums in your pocket. Try it now.

Further Reading

Risk Disclaimer: Digital asset prices can be volatile. The value of your investment may go down or up and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Options trading, in particular, is subject to high market risk and price volatility. Past performance is not a reliable predictor of future performance. Before trading, you should make an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the risks and potential benefits. Consult your own advisers, where appropriate. This information should not be construed as financial or investment advice. To learn more about how to protect yourself, visit our Responsible Trading page. For more information, see our Terms of Use and Risk Warning.