Real-time market analysis.

1. Technical perspective: Weak rebound hides danger.

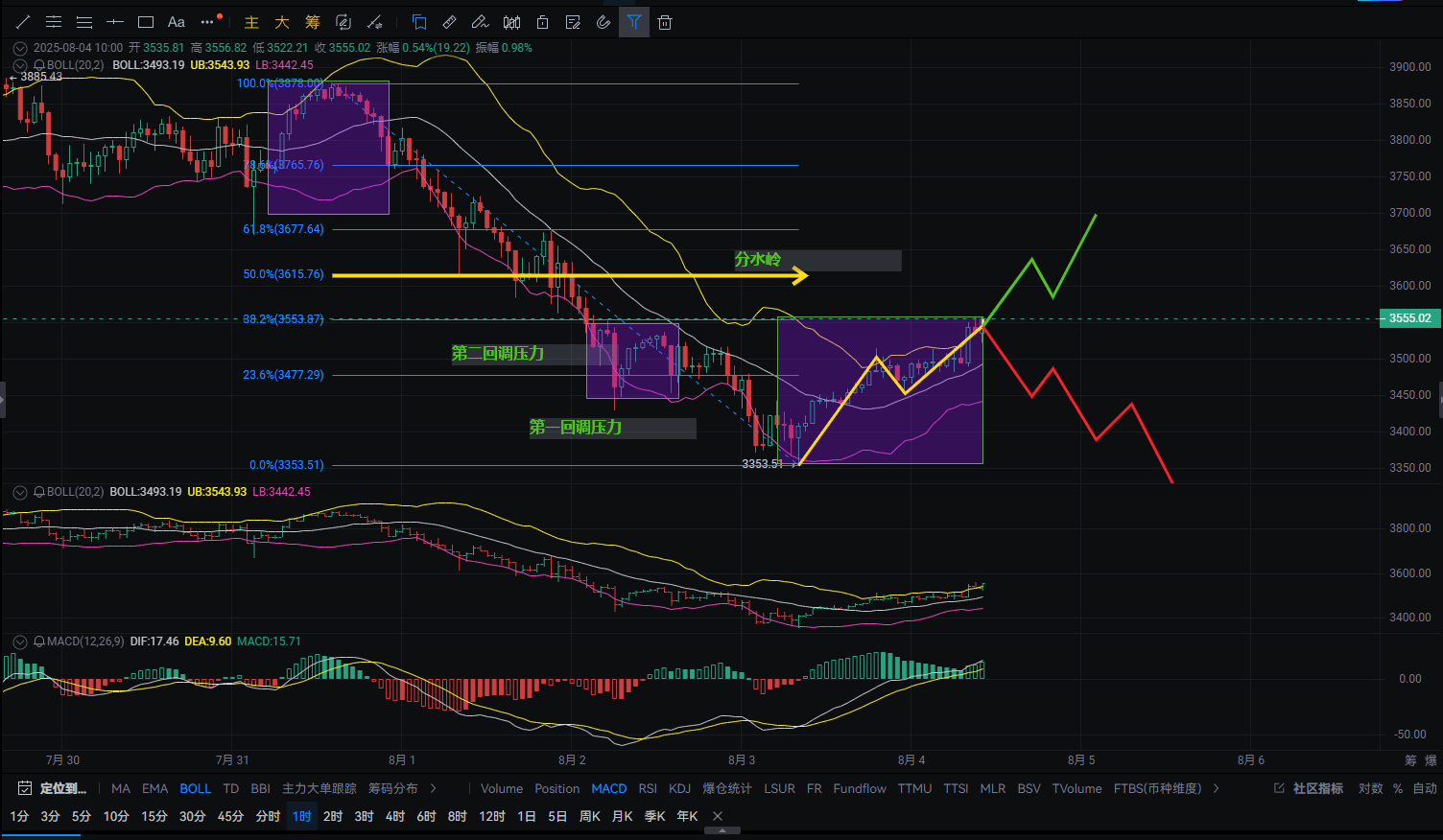

K-line script: The hourly chart shows a 'downward continuation' pattern, rebounding to 3530 after a spike to 3350 last night, seemingly stabilizing but actually weak, MACD red bars expanding again, fast and slow lines dead cross underwater.

Key watershed:

Ceiling pressure: Bollinger middle band at 3538 + concentrated area of trapped positions at 3550-3580 on August 2, last night's rebound was hit here.

Floor support: 3500 psychological barrier daily MA120 life + real support at 3420, July 30 institutional accumulation area.

My view: Volume continues to shrink, current trading volume is only 5.17K, less than a third of yesterday's, this shrinking rebound is like 'an insufficiently inflated life raft', it will burst if poked!

2. Three major bombshells in the news.

SEC strikes again: Bloomberg confirmed this morning, Ethereum ETF approval delayed until October, regulatory negative news overexpected fermentation! On-chain monitoring detected a market maker urgently withdrawing 18,000 ETH liquidity.

Undercurrents before non-farm payroll: Current CME interest rate futures show, if tonight's non-farm exceeds 180,000, the interest rate hike probability rushes to 78%, ETH's correlation with US stocks' Nasdaq rises to 0.91, beware of linked crashes!

Lido suspends redemption upgraded to black swan: Latest progress! Lido team states it needs 24-48 hours to fix, 135,000 staked ETH frozen, exacerbating short-term liquidity panic.

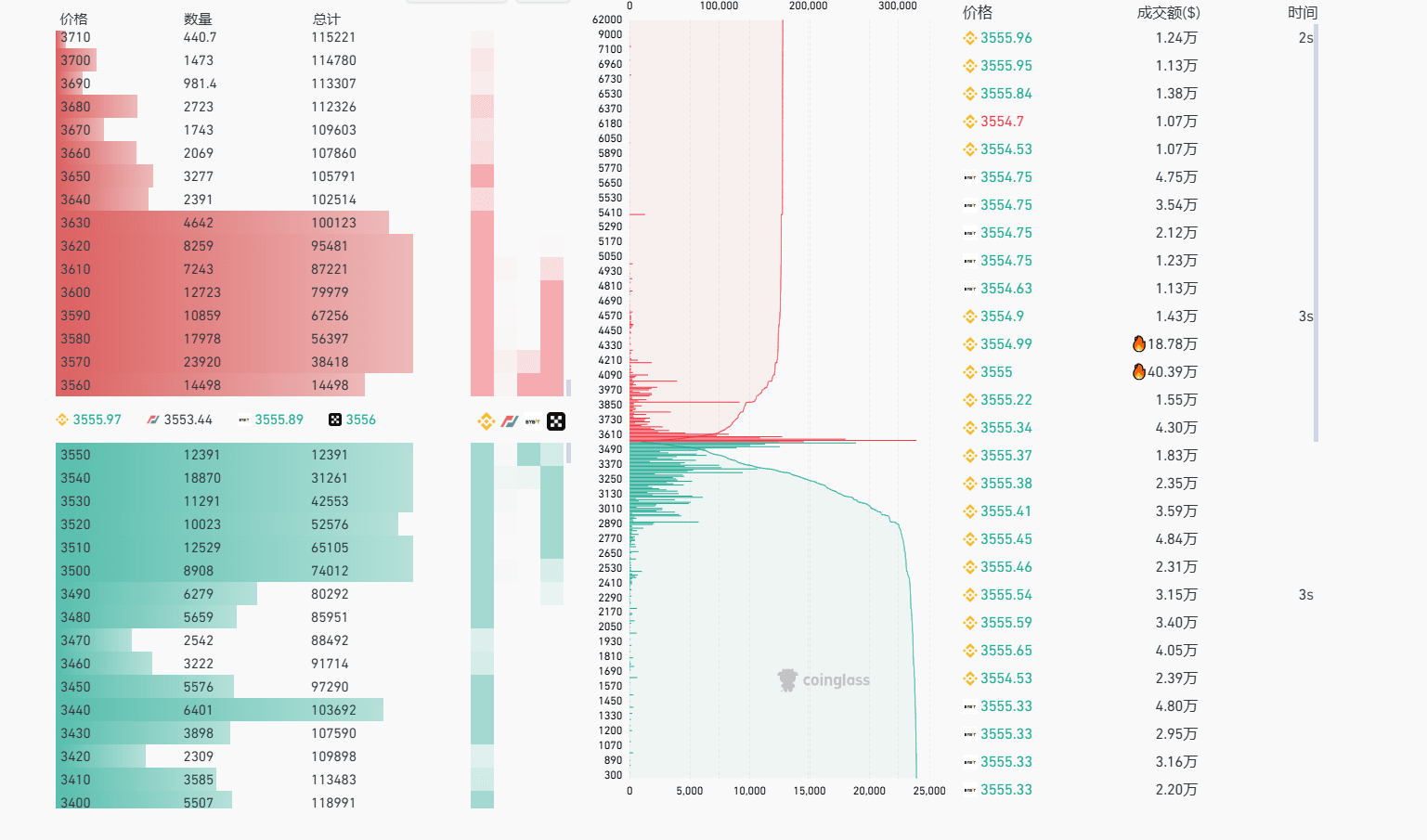

Main fund game situation.

Bears showing teeth: Binance ETH/USDT perpetual contract current funding rate -0.006%, whales are placing a sell wall of 32,000 ETH above 3530.

Signal of severed reinforcements: USDT off-exchange premium drops below 6.97, on-chain stablecoin inflow to exchanges sharply reduces by 62%, the exhaustion of incremental funds is already a clear signal!

My operational strategy.

Short-term life and death situation.

Case: This morning's 3535 buyers have been buried! Current price of 3534 is just the 'stop-loss minefield'.

Radicals: Place a sell order at 3528, take profit at 3450, stop loss at 3560.

Conservatives: Wait for an effective drop below 3500 before shorting.

Avoid 'bottom-fishing delusion'! Below 3400 is the safe zone, reference July 28 institutional cost zone at 3370.

Medium to long-term survival guide.

Brothers holding spot listen up: August will enter the 'regulatory vacuum period', but ETH/BTC exchange rate approaches 0.062 strong support over three years, once it breaks it may trigger a collapse. Suggestion:

Those holding more than 50% in spot positions, immediately buy 3400 Put options expiring in December for hedging.

Regular investors pause increasing positions, waiting for two major reversal signals:

ETF delay storm fully digested.

USDT premium returns to 7.0+ and maintains for 6 hours.

Ending hook:

When 99% of retail investors are staring at the fluctuating numbers of the K-line, the smart money is laying out in the dark web!

Xcoin daily sharing, the team behind only serves ambitious lunatics, the 10x coin password is directly fed to you.