In the fast-paced and often chaotic world of DeFi (Decentralized Finance), traders, institutions, and DAOs are navigating a constantly shifting landscape. TVL isn’t enough—what you need is true insight. That’s where @Treehouse Official emerges as a game-changer: a platform delivering enterprise-grade DeFi analytics, built to bring transparency, structure, and intelligence to decentralized asset management.

With the rise of cross-chain liquidity, yield farming, volatile tokenomics, and layer-2 ecosystems, even experienced traders struggle to accurately measure exposure, risk, and return. Treehouse’s mission is to turn this chaos into clarity—empowering users with real-time, actionable, and deeply contextualized DeFi analytics.

🧠 What Exactly Is TreehouseFi?

Treehouse is not just a portfolio tracker—it’s a risk management platform. Designed for both institutions and individual users, Treehouse bridges traditional financial analytics with decentralized technologies by offering:

Portfolio-wide risk metrics (including VaR, volatility, delta exposure)

Real-time yield tracking and impermanent loss analysis

Alerts and risk scenarios across market downturns or protocol changes

Cross-chain visibility and protocol-level decomposition

All this is powered by $TREE, the native utility token of the Treehouse ecosystem.

🔍 Core Tools That Power the Treehouse Ecosystem

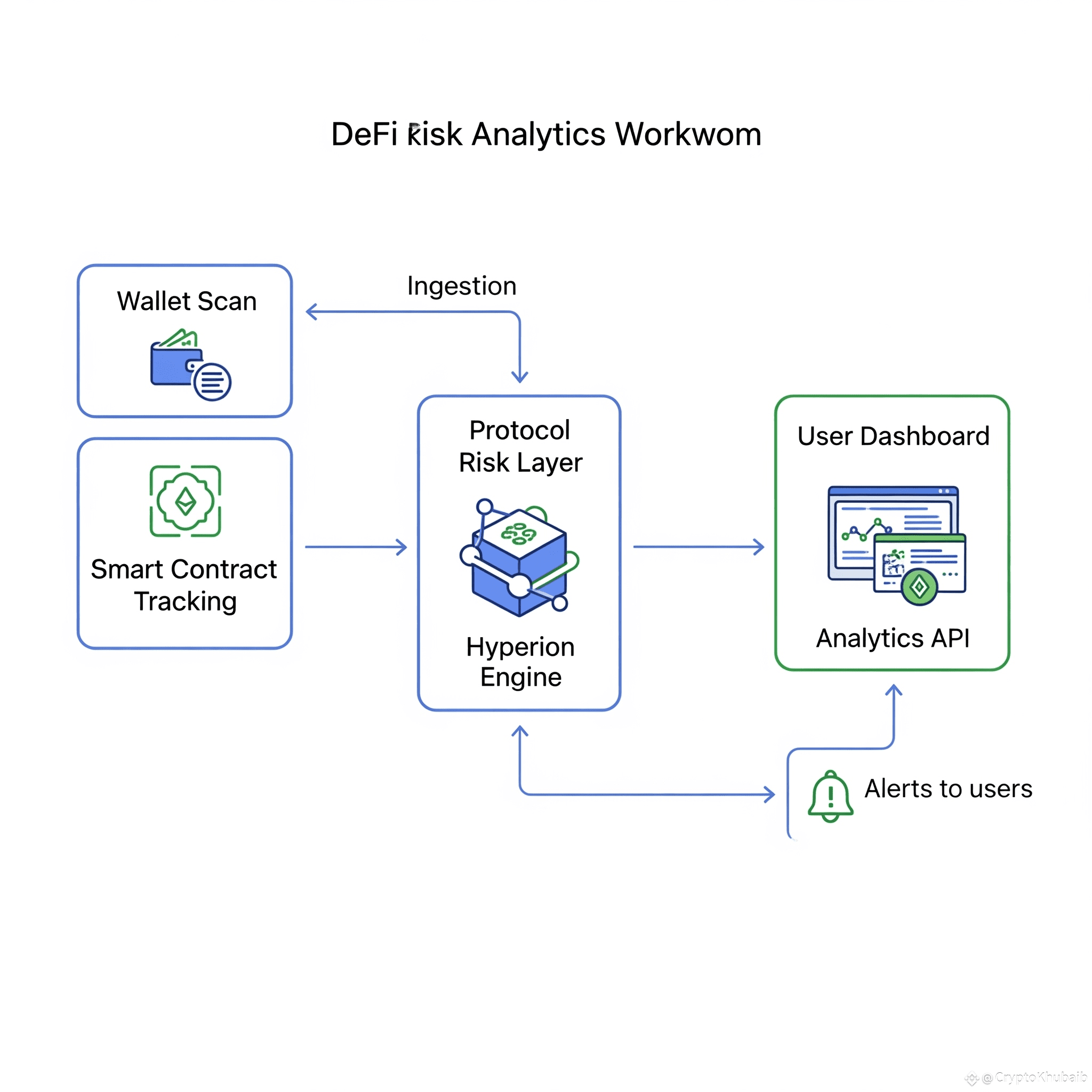

1. Hyperion – Your DeFi Control Center

A real-time dashboard that consolidates all your DeFi positions across multiple wallets, chains, and protocols. Hyperion helps you visualize portfolio health, track unrealized PnL, and simulate stress tests based on historical drawdowns or on-chain volatility.

2. Otto – DeFi’s Smart Yield Assistant

Otto analyzes farming strategies, lending pools, and staking opportunities, ranking them based on net APY, historical risk, protocol trust score, and more. Say goodbye to manual comparisons—Otto finds the best yield, fast.

3. Canopy – Risk Alerts, Simplified

Canopy watches your wallet 24/7. It triggers custom alerts when:

Collateralization ratios drop.

Gas prices spike.

Impermanent loss exceeds a threshold.

Protocol liquidity falls suddenly.

Risk management shouldn't sleep, and with Canopy, it doesn't.

🏗️ Why TreehouseFi Matters

Transparency First: Every data point comes with audit trails, letting users verify sources and avoid manipulated data feeds.

Institutional Grade: Designed with hedge funds and DeFi-native protocols in mind, Treehouse’s analytics rival Bloomberg-tier solutions.

Decentralized Yet Unified: One dashboard to monitor all positions across Ethereum, Arbitrum, Optimism, BSC, Avalanche, and more.

Treehouse is helping DeFi evolve from a Wild West into a well-mapped city, where data flows as freely as assets.

🌱 What Powers Treehouse? $TREE

The $TREE token enables:

Access to premium features (like AI analytics, forecast models)

Governance rights (vote on roadmap, feature additions, chain integrations)

Community curation (analysts and researchers earn by contributing insight)

This isn't just a tool—it's a community-powered ecosystem, where traders, researchers, and protocols align around data-driven transparency.

📊 Treehouse in the Bigger Picture

In a DeFi world where liquidity can vanish in seconds and yield changes by the minute, understanding your exposure is the difference between profit and liquidation.

As crypto adoption accelerates, institutional capital is entering, and with it comes the need for robust, verifiable, and intelligent infrastructure. Treehouse is that infrastructure—built for risk, made for opportunity.

🏁 Final Thought

@Treehouse Official is the compass that helps you navigate the DeFi jungle with confidence.

With powerful tools like Hyperion, Otto, and Canopy, and backed by the utility of $TREE , TreehouseFi is leading the charge into the next evolution of decentralized asset intelligence.

Join the movement. Trade smarter.

Grow with #Treehouse 🌿 $TREE