Technical Analysis:

1. Market Structure:

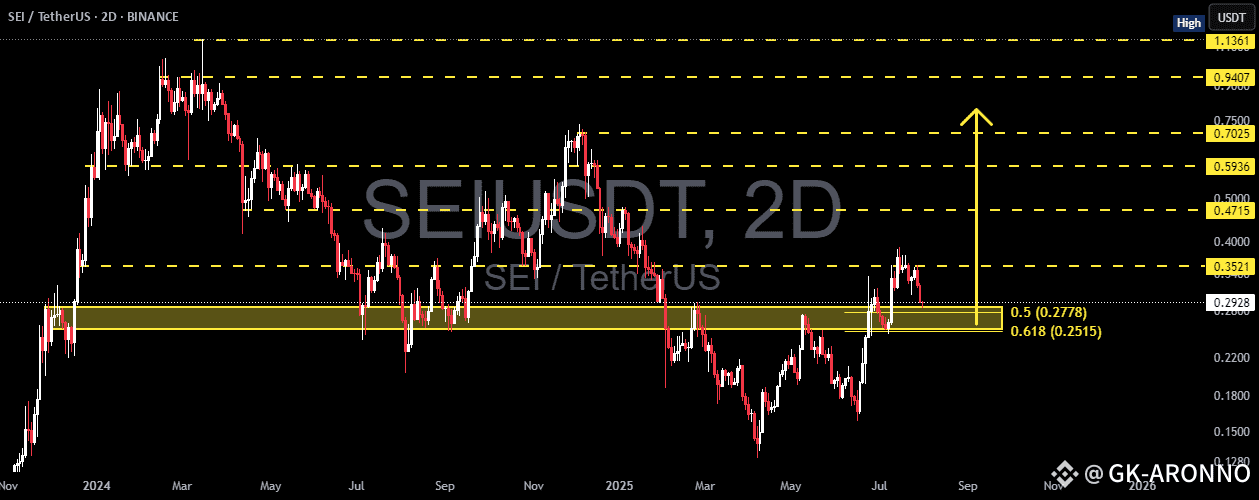

SEI/USDT is in a recovery phase after a significant downtrend.

Price is currently testing a crucial area between the Fibonacci retracement levels of 0.5 (0.2778) and 0.618 (0.2515) — known as the Golden Pocket Zone.

2. Key Support & Resistance Levels:

Strong support lies within the highlighted yellow zone (0.2515 – 0.2778), a historical support-resistance flip level.

Key resistance levels to watch:

🔸 0.3521

🔸 0.4715

🔸 0.5936

🔸 0.7025

🔸 0.9407

🔸 1.1361

---

📈 Bullish Scenario:

If price holds above the golden pocket:

A strong rebound is likely, forming a higher low structure.

Bullish confirmation occurs if price breaks and closes above 0.3521 with strong volume.

Upside targets: 0.4715 → 0.5936 → 0.7025 in sequence.

🔹 Additional Confirmation: Bullish reversal patterns (e.g., bullish engulfing or pinbar) around 0.25–0.28 would strengthen the bullish outlook.

---

📉 Bearish Scenario:

If the price breaks below the 0.2515 level:

It could trigger a deeper move toward 0.22 – 0.18 support area.

Further breakdown may bring price below the psychological level of 0.15.

🔻 Bearish confirmation if the price gets rejected from the 0.30–0.35 region with strong bearish candles.

---

📊 Pattern Insight:

Potential Double Bottom formation near the golden pocket zone.

A break above the 0.3521 neckline would validate this bullish reversal pattern.

---

🔖 Conclusion:

This zone (0.25–0.28) is a make-or-break area for SEI. A strong reaction from this golden pocket will determine whether SEI is ready to rally further or fall to new lows.