1. Bot-Based Trading (Sniper, Arbitrage, Market‑Making)

Sniper bots target new token listings or liquidity pools by monitoring on-chain events and executing ultra-fast swaps—within under 10 milliseconds. They rely on private RPC endpoints, pre-signed txns, priority fees, and co-location near validators .

Arbitrage bots identify price mismatches (e.g., SOL/USDC on Orca vs. Raydium), simulate trades first to estimate slippage, then execute across platforms .

Market-making bots maintain buy & sell orders near the current mid-price, updating continually to capture bid-ask spread. Fast cancellation is crucial .

✅ Tip: Infrastructure (speed, reliability) matters more than strategy complexity—dedicated nodes beat public ones every time .

---

2. Trend-Following Strategy

Buy SOL upon confirming an uptrend via indicators like SMA crossovers (e.g., 50‑day over 100‑day); exit when trend reverses .

Money & risk management are essential: limit per-trade risk, use volatility-adjusted position sizing, and strict stop-losses .

---

3. Grid Trading / Dynamic Grid

Ideal for volatile sideways markets—set a price range (e.g., $150–$160), define grid levels, and auto buy low / sell high .

Dynamic Grid enhances this by resetting based on recent volatility, shown to outperform static grids in backtesting .

---

4. Futures & Hedging

Trade cash-settled SOL futures on platforms like CME or Bybit/Binance.

Use futures to:

Hedge: Lock in prices by shorting futures while holding SOL .

Leverage/speculate: Trend-following, grid, or scalping strategies can be applied in futures markets .

---

5. AI-Powered Agents

Advanced AI bots (e.g., Tickeron’s agents) operate on 5–15 min timeframes, boasting >85% accuracy and return rates up to 270% annualized by analyzing price, volume, macro news .

They cater to both bullish and bearish scenarios and include risk constraints to manage exposure .

---

📈 Real-Time & Fundamental Context

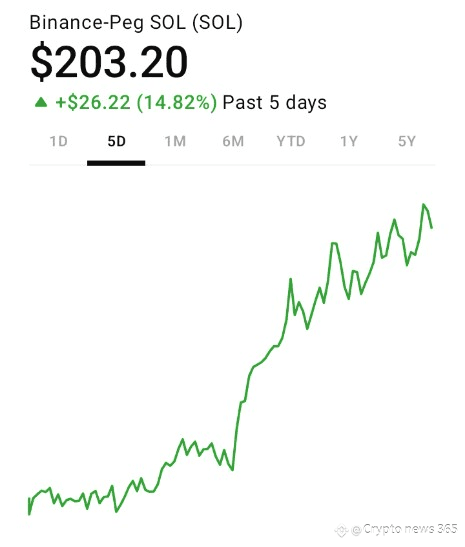

SOL is currently trading around $203, with a range today between $195–$206.

It’s up ~43% YTD, supported by strong ecosystem activity, staking ETFs, and institutional flows .

Recent catalysts:

The U.S. Solana + Staking ETF debut (July 2, 2025).

On-chain partnership upticks: stablecoin integrations, tokenized traditional assets .

---

💡 Suggested Trading Workflow

1. Define your strategy: Trend-following, grid trading, bot, futures, or AI-assisted.

2. Set up infrastructure:

For bots: use private RPCs, low-latency nodes, pre-signed transactions.

For futures: choose top exchanges (Binance, Bybit, CME).

3. Risk management:

Cap trades to a small % of capital.

Use stop-loss and take-profit levels consistently.

Perform walk-forward/backtesting to avoid over-optimization .

4. Monitor live data:

On-chain (bot triggers)

Price charts (trends/grids)

Futures positions & funding rates

ETF inflows & macro news (affects sentiment).

---

📝 Summary Table

Strategy Best For Key Requirements

Sniper / Arbitrage Bot High-frequency gains Fast infra, private RPC, on-chain events

Trend-Following Riding sustained moves SMA crossovers, disciplined risk management

Grid / Dynamic Grid Volatile sideways markets Price bands, automated rebalancing

Futures Hedge/Speculate Leverage or downside protection Margin accounts, futures contract access

AI Agents Data-driven execution Trading signals via AI, risk controls

---

🚀 Final Takeaway

Solana's ecosystem is moving fast—tools, strategies, and infrastructure must move faster. Match your strategy to the current market regime, execut

e with speed, and always prioritize risk control.