Michael Saylor Bitcoin Buying Dominates Headlines Again—What’s Next?

Strategy’s growing Bitcoin Portfolio

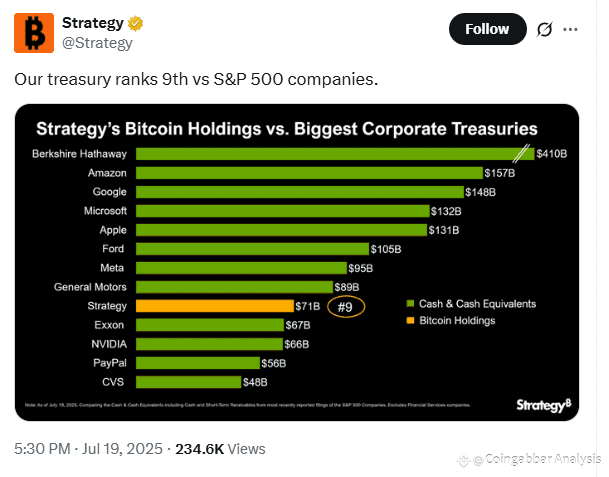

Recently, Michael Saylor’s firm Strategy has made headlines by surpassing great tech giant NVIDIA by securing 9th position among S&P 500 companies with the biggest reserves, and mentioned its name in the top 10 list of the largest U.S treasuries.

In this rat race of Michael Saylor Bitcoin buying and securing their treasury for the future, the firm Strategy is taking it seriously. It is aiming to buy more and more Bitcoins as soon as it can purchase them.

Currently, the company holds $71 billion in their fund reserves and if it focuses on its treasury by buying more BTC’s, it will soon (5-6 months) surpass General Motors whose current holding is $89B.

Consistent Strategy: ‘Stack Sats’ philosophy

Following that, the firm is showing its consistent Michael Saylor Bitcoin buying without seeing the price of it. As it is at an all time high, Michael says if you see the future price of Bitcoin it will reach up to $21M by 2046.

In a recent tweet the company’s CEO, shared a graph of the Michael Saylor Bitcoin buying Company’s purchases by mentioning in its caption “Stay Humble, Stack Sats”.

Source: X

Through this he is giving a reminder to the users to stay grounded regardless of their success or profit. He is advising the users to not be arrogant as the Michael Saylor Bitcoin buying is massively profitable.

And Stack Sats signals at regularly Michael Saylor Bitcoin buying and accumulating it as the future is orange. Sats is the short form of Satoshis that is the smallest unit of BTC (1BTC= 100,000,000 satoshis). His only message is, if you are buying small units now, you will get a huge profit in your future through it.

As the golden asset prices will rise only like gold.

Potential market impact of new BTC purchases

Seeing big firms trust over asset buyings, it gives confidence and trust to the small companies, startups, investors and most importantly the one who is stepping in the world of crypto.

Big firms like BlackRock, Metaplanet, Coinbase etc and big personalities like Robert Kiyosaki, Elon musk and many more who are continuously trying and buying more BTC’s sets an example to all the other members of this digital world.

Bitcoin’s price performance vs. Michael Saylor Bitcoin buying strategy

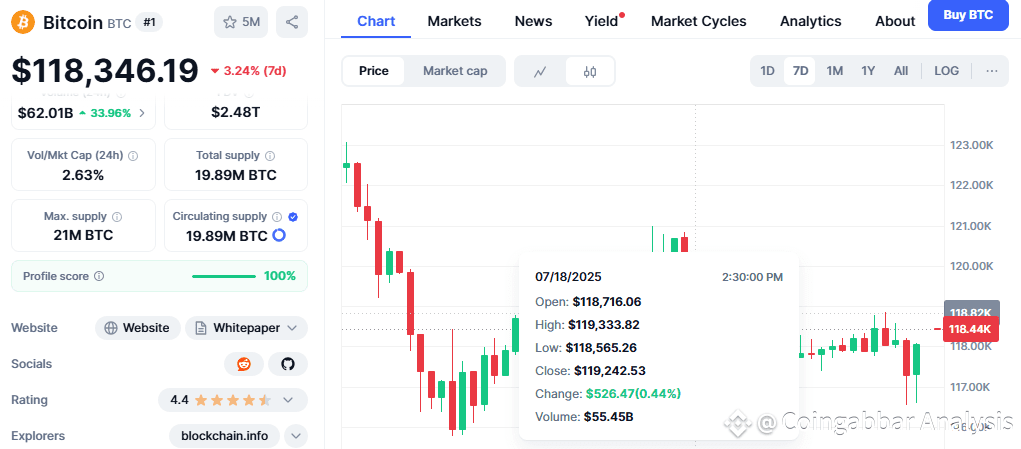

If you observe the surge in the prices of BTC closely, you will come to see in the last one month. At the beginning it was trading around $102,205 on June 22, 2025 and on July 14 its price rose to $123,091.61 and currently it is trading at $118,346.19 (at the time of writing).

Source: CoinMarketCap

This shows a huge difference in the prices, and after a little decrease in the price, the firm is planning to move as its prices are moving. Users should grab this opportunity to buy it more as it is the right time, Strategy suggests.

Long-term vision and corporate strategy

According to the firm, if you are watching the prices closely then you will better understand its importance for the long-term. Michael's recent tweet shows how he is very active towards purchasing them more and preparing to buy them again and again.

Preparing today for BTC will be beneficial in the future. As the prices will not go down, he is very confident about that.

What’s next: Eyes on Saylor’s next move

No doubt, Michael is going to strengthen his treasuries for the future and the firm is planning to further load up its asset treasuries.

Saylor is working according to his statements, he may take his firm in the top 10 list in coming years by purchasing more golden assets.

Visit:- CoinGabbar

#MichaelSaylor #BitcoinBuying #CryptoNews #StackSats #BTCStrategy