The White House, via its Digital Asset Markets Working Group, is set to drop its first-ever comprehensive crypto policy report on July 22, 2025, as required by Executive Order 14178 .

This landmark report aims to:

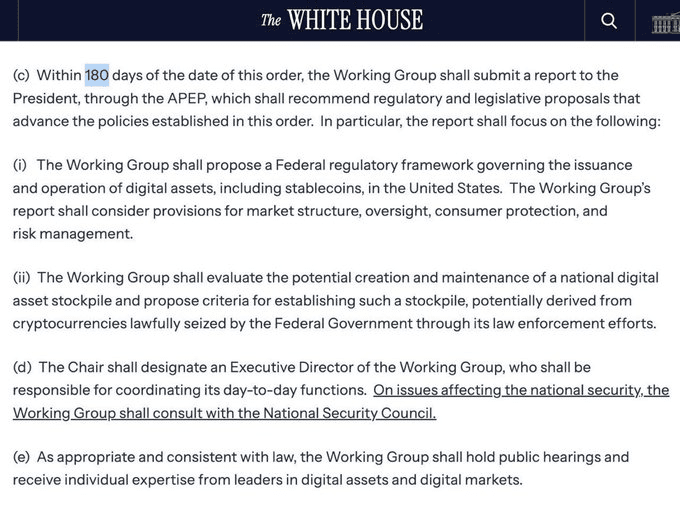

Provide a unified regulatory framework for digital assets

Assign stablecoin oversight to banking regulators under the GENIUS Act

Clarify roles for the Treasury, Fed, FDIC, OCC, SEC, and CFTC

⚠️ A massive shift is coming: stablecoins will fall under banking authorities, not just securities regulators.

---

🧠 Why It Matters

Regulatory clarity: Markets have been waiting for a clear U.S. stance on DeFi, stablecoins, and crypto securities

Institutional lift: New guardrails could bring in big money—trust and transparency are key

Banking landscape shake-up: Banks may now be able to partner or hold digital assets in better-defined ways

---

🔮 Predictions & Analysis

1. **Short-Term (Next Few Days):**

Expect a spike in market sentiment, especially for stablecoins (USDC, USDT) and Layer‑1 tokens. It may also lead to a crypto FOMO rally into the weekend .

2. Mid-Term (Months Ahead):

If regulators follow through, we could see:

Stablecoin issuance boom, with full audits and reserves

Bank-token integrations (crypto custody, lending, payment rails)

Renewed DeFi & blockchain innovation in the U.S.

3. Long-Term (6–12 Months):

U.S. could reclaim its role as a global crypto innovation hub

Institutional flows will likely increase—think crypto ETFs, tokenized assets, and crypto bonds

The groundwork may be laid to explore a U.S. CBDC, though pushback remains strong

---

⚠️ Risks to Watch

Over-regulation fears: Too many guardrails could stifle innovation

Regulatory fragmentation: Multiple agencies (banks, SEC, CFTC) could complicate compliance

Whale moves: Market reactions may be heavy; expect volatility once details leak

---

💬 Bottom Line

The July 22 report is more than just bureaucracy—it’s a watershed moment. If done smartly, it can be the foundation that finally turns crypto into a regulated, mainstream financial ecosystem while protecting consumers.

📝 My take: This marks a real turning point. Yes, it’ll mean more rules—but that transparency can lead to bigger, safer, and more stable growth. The next wave of U.S.-based crypto innovation may very well ride on these pages 📈

---

Stay tuned—for the full breakdown as the White House drops this report. And let me know what you’ll be watching most!

#ETHBreaks3700 #StablecoinLaw #NFTMarketWatch #StrategyBTCPurchase