Hey Binance Square fam! Ready to catch the next big ETH wave? Let’s explore how Elliott Wave Theory is painting a bullish roadmap for Ethereum – and how you can potentially ride it to glory!

---

1. 🌊 What’s Elliott Wave Theory All About?

Elliott Wave Theory zooms into investor behavior and market psychology by spotting repeating five-wave impulse patterns followed by three-wave corrections (1‑2‑3‑4‑5 → A‑B‑C) .

👉 Waves 1, 3, and 5 are upward moves aligned with the trend, while waves 2 and 4 are retracements.

This structure helps traders forecast potential highs and pullbacks.

---

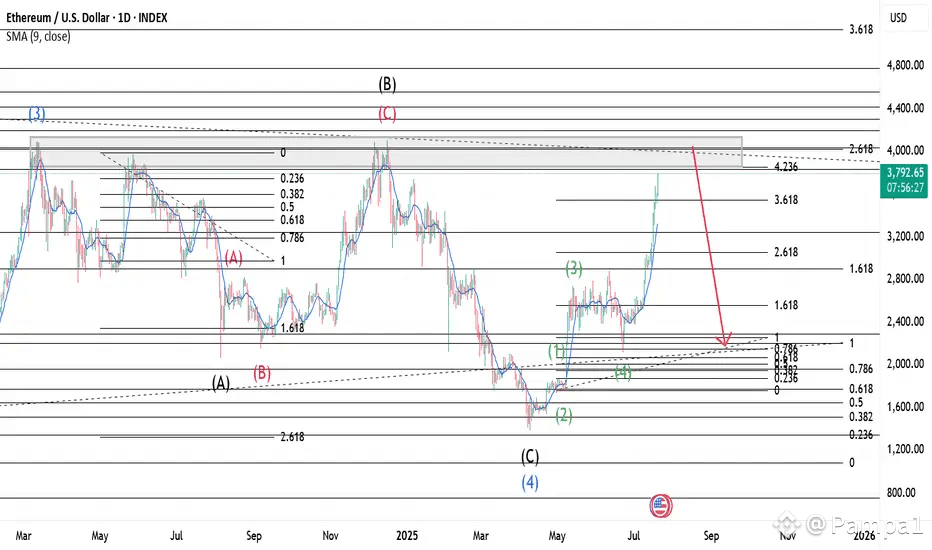

2. 🧭 ETH’s Current Wave Count: Big Bullish Move Incoming?

Several market analysts, including Gert Van Lagen, have spotted that ETH might be in the fifth wave of a long-term bull cycle that began in 2022. Here's how it breaks down :

Wave I: The initial rally that broke new ground.

Wave II: A corrective dip in 2022–23.

Wave III: A massive push to new highs.

Wave IV: The consolidation phase.

Wave V: The current final run, forming an expanding diagonal—a classic late-cycle signature .

🎯 The exciting part? After a brief wave‑b pullback, ETH could sprint toward $10,000 in wave‑c!

---

3. 🔢 Micro View & Key Levels

On shorter timeframes, we’re seeing valid structures too:

Wave 1 peaked near $2,615, followed by wave 2 down to ~$2,454

Wave 3 surged to ~$2,739

Wave 4 double‑corrected around $2,405

Wave 5 is unfolding—with dips above $2,405 likely to attract buyers

This micro perspective supports the bullish bias: as long as ETH holds above $2,405, upward momentum remains intact.

---

4. 💡 Why This Matters to YOU

Timing is key: Elliott Wave lets you anticipate reversal points—great for strategic entries and exits.

Plan your trades: A pullback toward the wave‑4 low gives a potential low-risk entry.

Stay alert: No wave is guaranteed—rules like “wave 2 never retraces wave 1 past 100%” and context matter .

---

5. 🤝 Integrate With Binance Square Strategy

Binance Square encourages combining Elliott Wave with tools like RSI, on-chain metrics, and trend analysis:

Confirm with momentum (e.g. MACD, RSI)

Watch support/resistance around key Fibonacci levels

Keep risk in check: Use stop-loss orders near wave invalidation points (e.g., below $2,405 or wave‑2 lows)

---

🎯 Final Takeaway

ETH seems to be in the final crescendo of a major Elliott Wave cycle. A small pullback could set the stage for a powerful push toward $10K—just in time for the wave‑5 finish line! With Binance Square’s smart integration of analysis tools, you're fully equipped to ride the next ETH wave smoothly and strategically.

---

🌈 Wrapping It Up

Insight Highlight

Wave Position ETH is in wave 5 of a 5-wave impulse (major bullish cycle)

Near-Term Risk Watch for a wave‑b pullback—buy strength afterward

Upside Target Potential blow-off in wave‑c toward $10K

Key Warning Invalidation if ETH dips below wave‑4 support (~$2,405)

---